Good Day Traders,

Overview & Highlights: This week I will keep things very condensed due to being away from the home office on a family vacation with our youngest son’s family. The time difference is 3 hours to California so pre-market starts at 3 a.m.

On Saturday, Oct 24th I’ll be presenting at TAA-SF on Patterns for Profits. I’ll send out location and time later this week.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks will return on October 30, 2015. I’ll be on an airplane high above the Pacific the next 2 Fridays.

Next Training Webinar: October 28, 2015

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Trading the ATTS with Enhancements

_____________________________________________________

Managing Existing Trades:

Strategy I: Short 100 shares of IWM. Profit Target T1 = 110.50 and Stop Loss at 116.40.

Strategy II: No Open Trades

Wealth & Income Generation Strategy III Trades:

Trade 1: Long IWM Jan16 127C & 127P – Waiting for Entry Signal for weekly call and put.

Trade 2: Long TSLA Jan17 250C & Long Jan17 220P – Booked $132 in profits on this position. Currently the Put leg of this trade is complete having sold the Oct4 207.5 Put for 2.53. I will close this weekly at between 0.25 and 0.50 and look for an entry to sell a Weekly Call against the long LEAPS call.

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/ .

I posted a video about how to choose the weekly options to short for this strategy. can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: Stocks of interest that report this week include MANH, HA and AOS. APPL and AVGO may provide pre-earnings run set ups.

Potential Set Ups for this week: Many stocks rallied with the Market Thursday and Friday after a quick pullback reaction. Stocks are also entering the midpoint of Q3 earnings season over the next 3 weeks. As we saw with Walmart last week, many of the reporting companies are providing lackluster results and disappointing guidance. With the poor performance why are the Indexes rallying? It’s a case of bad news being good news. Poor economic results provides greater pressure for the Fed to leave rates alone until next year. A low interest environment will continue to be a positive for the market until it isn’t! From a macro view this is not a sign of a healthy market, but short term don’t argue with the tape.

Upside: Several stocks are holding up well and are early in their move up from consolidation. Interesting stocks include: VIPS, CBM, CALM and PANW.

Downside: MBLY, NFLX and CRUS may provide downside opportunities.

Toss Ups: Several stocks could go either way or provide short-term opportunities in both direction because the entity stuck in a tradable range. TSLA provides short-term directional trades and shows a hammer like candle on the weekly timeframe. CYBR, FL and PNK are still in the early stages of consolidation.

Leveraged Index ETFs: Waiting for New or Second Chance signal.

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

General Market Observation: Has the psychology of the markets really changed or is the current upswing just a faint? Each of the Tracking Indexes show a higher bottom in place with only the S&P also showing a higher high on a daily chart. If the market sentiment becomes more positive, a break thorough on the other two indexes could happen soon. Each of the Tracking Indexes are showing the 8 day EMA crossing above the 20 day EMA which is another positive clue. Additionally prices have now closed above the 8 week EMA two weeks in a row. Closing above the 8 week EMA could be considered positive signal of more upside. However, if the two lagging indexes weaken and start to fall hard the S&P breakout could be foiled and voided.

A major economic report out of China on Sunday could set the tone for next week’s market. Follow this up with the Fed’s meeting at the end of month and October could still provide a great deal of fireworks over the next two weeks. Add to this that the current rally has taken place on below average volume and a stance of cautious expectations is appropriate.

SPX: Friday’s price action added to gains from Thursday pushing closer to resistance at the 200 day moving average. Before price reach that level significant resistance is present at the 2043 level. The recent positive action on this Index has started to pull both the 50 and 100 day moving averages into a positive trajectory. Take a look at the Fibonacci Retracement from the low on 9/29 to the high of 10/13. The very short reactive move on Tuesday and Wednesday didn’t quite fall to the 23.6% retracement. Price actually stopped at the 50 day EMA, so until proven different the 50 day can be considered a supporting moving average. Additionally there has been a positive cross of the 20 day EMA by the 8 day EMA. For shorter term trend traders pull backs to the 8 day could potentially offer entries for Swing Trades.

Preferred: SPY, UPRO and SPXL

NDX: The NASDAQ 100 is moving up to resistance at the 4450 level. The short two day pullback reaction provided a bounce off the 8 and 50 day EMAs on Wednesday. The test now is will Momentum ramp up and drive price back above the swing high. We will look for pullback reactions to the 8 day EMA for potential entries on each of the Tracking Indexes.

Preferred ETF’s: QQQ and TQQQ

RUT: Comments on the Russell are a ditto to those made for the NDX from a technical standpoint. The RUT still has more damage to repair than the other Indexes which means more upside resistance must be overcome, but also a greater potential gain if strength and momentum increases.

Preferred ETF’s: IWM and TNA

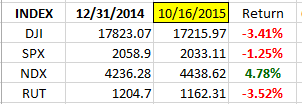

Index Returns YTD 2015

ATTS Returns for 2015 through Sept Oct 16, 2015

20.0% Invested

Margin Account = +8.5% (Includes profit in open positions)

Early Warning Alerts = 10.2%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

- Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

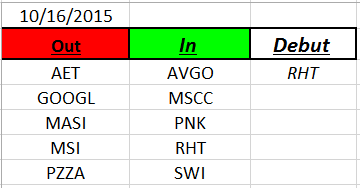

Outs & Ins: RHT makes its debut to the IBD 50 this weekend. If you are long any of the IBD 50 stocks double check exact earnings dates. If you are not up 10% consider taking some profits off the table prior the earnings date.

AVGO may be a good pre-earnings run candidate.

Off the Wall: No Off the Wall this weekend.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.