Good Day Traders,

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. Please let others know about this great webinar! You can either join live or catch the replay on YouTube.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/7312888487568287746

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Market Neutral Wealth and Income Generation

_____________________________________________________

General Market Observation: Since the Fed’s non-decisive action last Wednesday the indexes have rallied. Everything is turning up roses and the skies the limit. Well maybe! While one of the tracking indexes has broken to new highs the other two are testing at resistance formed by earlier yearly highs. Today’s rally was primarily due to the IMF working out a deal on Greek debt which pushes things out to the end of the year. Amazing to see the market swing so much based on such a small thing as Greek debt. It does appear that the indexes continue to ignore negative news and work higher. We will not argue with the current upward bias.

SPX: The rebound from the 100 day EMA continues and is faltering at resistance in the 2130 zone. The yearly high is at 2134ish and if this level is breached more upside may be in order in the short term. If the resistance holds then prices may again find support at either the 50 day or 100 day EMAs.

Preferred ETF’s: SPY and SPXL

NDX: Similar story as the S&P. A bounce after the Fed meeting reaches resistance at 4550. What happens over the next few days will provide the clues to short term moves and longer term trend considerations. Today’s candle is a Shooting Star that qualifies as a candlestick reversal candle. If current resistance holds then a retreat to the 50 or 100 day EMAs may happen over the next few days. Of late it seems like both this and the S&P’s daily direction all depends on which side of the bed it gets up on.

Preferred ETF’s: QQQ and TQQQ

RUT: The Russell continues to be the index with the juice! Breaking to new highs last Thursday and adding more gains today. From the lows of last Monday the index has moved almost 4% up to today’s high. All the moving averages are showing acceleration in their slope as price action extends from the moving average. At some point there will be a reversion to the mean but the when is yet to be determined. When the reversal does happen the power of the reversal may provide some clues in to the internals of this index. Remember the Russell will be most susceptible to interest rate increases. If the perceived certainty of a Fed rate increase grows we may see considerable profit taking in this index. But for now the chart is strong.

Preferred ETF’s: IWM and TNA

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, June 26th

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/7312888487568287746

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

ATTS Returns for 2015 through June 22, 2015

Strategy 1 = 0.0 % Invested

Margin Account = +3.0 % (Includes profit in open positions)

Early Warning Alerts = +5.32

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated at the beginning of each month.

___________________________________________________________

For our all Active Trend Trading Members here’s how we utilize our trading capital

Trading Capital Setup and Position Sizing: Every year we start the year off trading a $100K margin account make the math really easy for yearly returns.

- Each trader must define their own trading capital in order to properly size trade positions to their own risk tolerance level!

- The $100K account is split between up to 4 stocks and a leveraged Index ETF. Actual number of shares will vary of course depending on price of the entity traded. We have found that limiting open positions to only 5 entities greatly reduces the trade management time requirements for members. This goes back to our goals of providing a system designed for members who work full time.

- Regardless of market conditions no more than 50% of available margin is used at any time.

- Each Trade is split 50-50 between Income Generating & Capital Growth Objectives unless specified in the Order Alert

- Naked Puts or short term options strategies will be used occasionally for Income Generating Positions

- None of the trade setups are a recommendation to trade only notification of planned trades from set ups using the Active Trend Trading System. Each trader is responsible for establishing their own appropriate risk level on every trade.

Managing Existing Trades: Currently no open positions.

Special Trades: A Strategy 3 trade is in place on IWM with a Jan 2016 straddle. Will place a page on the website to track this trade this week.

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: None.

Potential Set Ups for this week: Many stocks moved with the indexes last week, but there several candidates look good in both directions.

Upside: YY, JUNO and CYBR look good to the upside. I like YY because it also has very good weekly and monthly option chains. Add to this list: QIHU, TSEM, NKTR and CRUS.

Downside: AMBA was hit on Friday and today with a significant downgrade. Price fell over 20%. Watch for sympathy selling in GPRO.

Toss Ups: Toss up candidates could go either way and are currently consolidating. These include: BIDU, VIPS, HABT, BABA, ALK, AKAM and CALM

Leveraged Index ETFs: Currently waiting for a new signal or secondary entry.

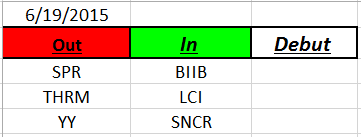

Outs & Ins: No new debuts in the IBD 50 this weekend, just a reshuffle from within.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: There is a saying that “Perception is reality”. As I was driving down and back from Southern California this weekend I spent some time thinking about this statement, mentally challenging the validity of perception truly being reality. Perhaps my train of thought was due to some of the interesting news stories recently about people pretending to be something that they were not and claiming their current life to be “their” reality. While there is some truth that how we view things could be called “our” reality it might do us all some good to have a healthy skepticism of what we think is real. Maybe it’s the engineer in me that wants more concreteness to reality other than just my thoughts or perception of any matter. Perception is so dependent on biases of belief, can they ever really be 100% trustworthy? How we interpret perceptions is based on what we know or what we experience which can sometimes be corrupted. So perception may or may not be real—it’s based on my subjective experience!

Reality per Merriam-Webster means the true situation that exist or a real event or entity. Now I can get behind that definition because it seems to have some objectivity to it. If something is truly real it would seem that it would be true for everyone. Maybe there are some things in life that are more real than other or there are different levels of realness! If this is the case then “Perception is reality” makes total sense. However if there is a limit on what’s really real, then the statement would not be true because perception is often based on biased perspective and how we might feel about what we perceive. Feelings and emotions are often based on what we believe to be true which is often deeply influenced by what we’ve learned from other people’s perceived reality.

When it comes to reality for traders being aware and cautious of what we perceive to be true is critical in avoiding fatal errors. When we look at a chart the only true reality is what has happened and what is happening. We may think we know what’s going to happen but that is merely a “perception of reality”!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.