Good Day Traders,

Overview & Highlights: Check out Mike’s Macro Market Musings in this edition. Mike ask the question, “Is Donald our new superhero?”. I will be staying flat the market until after the Fed decision on December 14th. While the expectations is that the Fed will raise rates at least a ¼ point, the market already knows this. Is the action already priced in

Upcoming Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Dec 16th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/2797725308331913730

Time 11:00 a.m. PDT

Next Training Webinar: Dec14th

For Premium Members, our Wednesday evening training is developing some fantastic traders!

Topic: How to Listen to the Market

Managing Current Trades: Positions open for 0 strategies.

Strategy I Portfolio Building: No Position Open

Strategy II Basic Options: No Open Positions

For members wanting to better understand this Strategy there is a very good training video at: https://activetrendtrading.com/basic-option-strategy/

Strategy III Wealth & Income: 2 Open Position

Closed the first TSLA LEAPS Strangle which was opened on 9/28/15 for a 100% profit on 9/2/16.

Strategy III Weekly Results Week ending 12/9:

SPY: Closed for a 34% Gain from January 2016

TSLA: Loss of $415

NUGT: Gain of $190.00

Trade 1: Foundation Position is 4 contracts of SPY Jan17 205C and 4 contracts of SPY Jan17 200P Current Trade—Currently Up 36.67%; Premium Collected since opening trade on 1/4/16 = $8,212

Full SPY position closed for a profit of 34.39% or $3792

Will wait until after the Fed to open the new SPY LEAPS for 2018

Trade 2: (Long TSLA Jan17 250C & Long Jan17 220—Closed on 9/2 for 100% gain since 9/29) + New Positions Jan17 210C and 220P: Current Position Total Invested $14,900. Currently Up 84.4%: Premium Collected since opening trade on 9/28/15 = $15,688.50 + New Positions at $6,451.50 = Total Collected $22,140

Waiting to open positions for the week. Will close the current long positions no later than December 28.

Trade 3: Long NUGT Jan18 18.4C + NUGT Jan18 18.4P opened 9/. 4 contracts each side of the straddle for total investment of $6,720. The required weekly premium to collect each week to achieve a 100% return by Jan 2018 is $191.43 per week.

Waiting to open positions for the week.

Tip for Experienced Option Traders: Occasionally after a weekly trade goes against me but the trend appears to be changing I will add one naked contract over and above my foundation position and close this out after it gains at least half of the premium I’ve collected. Doing naked options is not for everyone and I keep my risk small by only doing one contract above my covered limit. In other words, if I can sell 4 contract covered by my long leaps I’ll sell one additional. This helps hedge the losses a bit but it this tactic is not without risk and must maintain a tighter stop than I would normally use with the regular position.

Note: We do our best to get both text alerts and email alerts out in a timely manner, occasionally there will be trades that are missed because of delay in the Text or Email alert applications. Additionally, please double check with your broker to assure they allow spread trades like we do with Strategy III. Some do and some don’t.

Additionally, it is crucial when selling premium against the Long LEAPS position that the premium collected cover the weekly cost of holding the LEAPS plus an additional amount to over this amount as a gain. This is one of the reason I sell premium of weekly options that are close to be “At The Money”. I base my selling on the expected move during the next week. If one is not bringing enough weekly premium this trade will not work out as well and may wind up being a losing trade.

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally, some of these trades may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Early Warning Alerts for Leveraged Index ETFs: Last Trigger: 10/3. Waiting new signal or secondary trigger.

EWA Account Return to date: 10.0%

The Early Warning Alert Service alerted on all 5 market lows in 2016. A new video detailing EWA for 2016 will be out within the next 2 weeks, along with highlights on entry refinements that will provide improved entries even in environment like 2016. In 2016 the entry triggers were challenging because of the number of straight off the bottom moves. Mike and I have analyzed this and have tested adjustments in place going forward.

If simplifying your life by trading along with us using the index ETF is of interest, you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

Potential Set Ups for this week: The probability of interest rates going up at next week’s Fed meeting is very high. Between now and December 14th the Indexes may slosh around between established support and resistance without clues to long term direction. Staying mostly in cash is a great option until price action pulls back to support. If you choose to trade look to open only partial positions and take profit quickly with tight stops. In other lower expectation during this posturing environment.

Trades for Week of 12/4: NUGT is holding between 7.20 and 9.83. Price action closed above the 8 day EMA the last two trading days, which is positive. In past years’ gold, has based during this period of the year and then took off early in the year for its initial yearly run. Higher interest rates and a stronger dollar may mute a move early in 2017 but even a muted rally may result in a 20% or higher move in NUGT. NUGT is currently moving in a 30% sideways channel. After the Fed Decision I will start building a position in NUGT with a stop below 7.00. A climb back to the 20 day EMA would equate to a 14% rise from the 8 day EMA.

I will post potential trades on December 13th to take effect after the Fed Decision. Until then I’ll keep my powder dry.

Mike’s Macro Market Musings: Donald and the CAPE

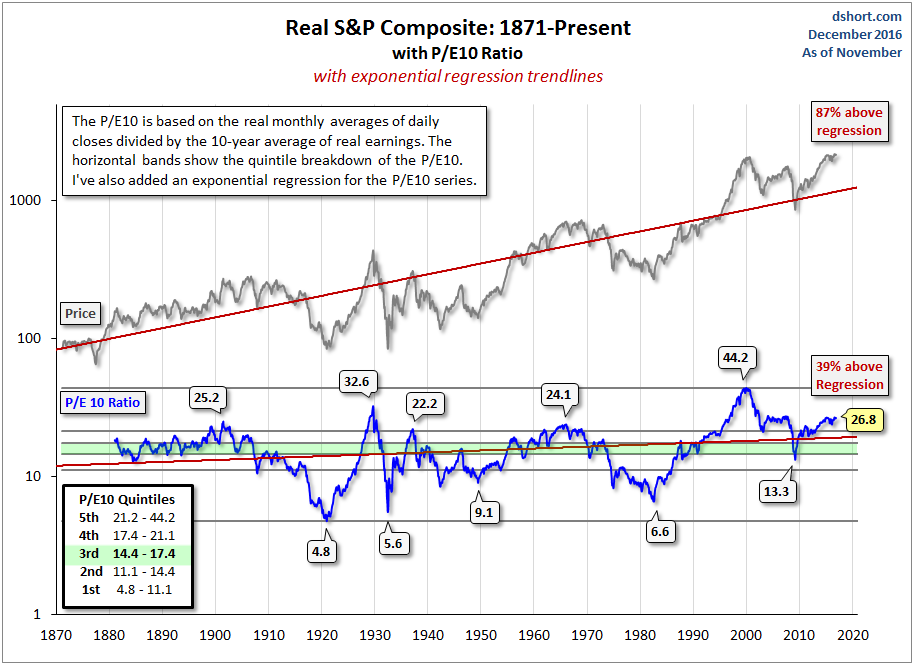

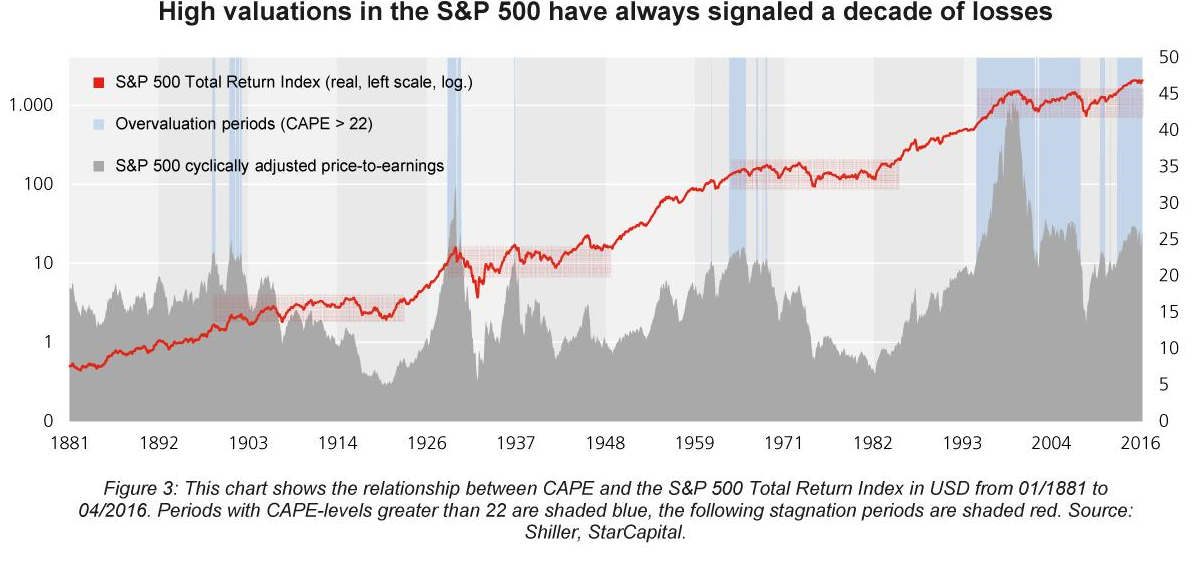

Is the Donald our new superhero? Will he and his proposed fiscal policies save our economy from the evil doings of his nefarious predecessor? Should he be wearing a cape for his public appearances? The U.S. equity markets certainly seem to think so. He apparently can do no wrong. Before the recent presidential election, it was commonly accepted wisdom that if Trump were to win, Armageddon would ensue shortly thereafter with a market crash of biblical proportions. Needless to say, quite the opposite has happened as the markets have put on a historical rally in complete defiance of the pre-election projections of the so called “experts”, despite the fact that his economic proposals were well known before the election as part of his campaign platform and have not changed since the election. The exuberance exhibited by the markets these past few weeks, which some may label as “irrational”, is not without historical precedent, though. Markets can get and stay “irrational”, both to the upside and downside, for far longer and to much greater extremes than even the so called experts might expect. In order to maintain some perspective and not get carried away with recent equity index price action, some historical perspective is helpful, mainly in the form of another CAPE, the acronym for the cyclically adjusted price earnings ratio, also known as the Shiller P/E ratio, named for the economist who developed it. CAPE is an index p/e ratio utilizing the past 10 years worth of earnings data which is utilized by some as an overall valuation metric for U.S. equity indexes meant to smooth out the potential volatility of just using one year’s (or trailing 12 months) data. Consider the following chart and its’ implications:

Depending on the source, the current CAPE after this recent extreme rally is in the ballpark of 27 – 28, historically considered to be nosebleed territory and surpassed only twice in over 100 years, at market peaks immediately preceding historic crashes in 1929 and 2000 – 2002. For more and very current information on this, click on the following link: http://www.marketwatch.com/story/the-stock-markets-oldest-indicator-just-flashed-red-2016-12-08 (this is a short and quick read and I highly recommend this article to anyone interested in this topic). The historical average for CAPE is 16.7; by this metric the current U.S. equity markets are overvalued by approximately 65% and would require a correction of approximately 40% just to get back to average. Additionally, by some valuation metrics, the median U.S. stock is currently more expensive than it has ever been. E-V-E-R. Currently, most market participants just cannot fathom a 40% pullback, although historically valuations inevitably revert to their mean as illustrated above – they always have and they will do so again.

Although I have been concerned about equity valuations for quite a while now, a reasonable reaction to these concerns could be, so what? Valuations don’t seem to matter, the market just keeps going up. In the short and even intermediate term this is quite true. Valuation metrics are not, nor are they meant to be, short term timing indicators. I am not suggesting an imminent market crash is likely – in fact, I believe it is quite unlikely. What valuation metrics like CAPE are good for, however, is helping project longer term future equity investment returns. Consider the following:

It should be a given that expected future equity returns from this point in time at these valuation extremes are extraordinarily poor over a time frame of anywhere from 8 – 12 years. That doesn’t mean the market indexes won’t print a new high tomorrow or next week or even next month. They certainly can and may very well do so. What it does mean is that it would be unrealistic to expect, going forward from today and from these market price and valuation levels, that the next 8 years are going to look anything like the past 8 years. Quite simply, they won’t. At least not if history repeats, or even remotely rhymes with, itself. Negligible, poor, or even mildly negative overall returns during the coming several years on equity investments going forward from current price and valuation levels are simply “baked into the cake”, so to speak. Committing new money to equity investments at these valuation levels and expecting returns over the coming 8 years comparable to the past 8 years, or even historically average equity index returns, is a notion that should perhaps be reconsidered.

Unless, of course, it’s different this time and our new superhero ultimately proves to be deserving of his CAPE.

General Market Observation: Waiting on the Fed. A full analysis of the 3 Tracking Indexes will be provided tomorrow evening.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Dec 16th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/2797725308331913730

Time 11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

– The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

Index Returns YTD 2016

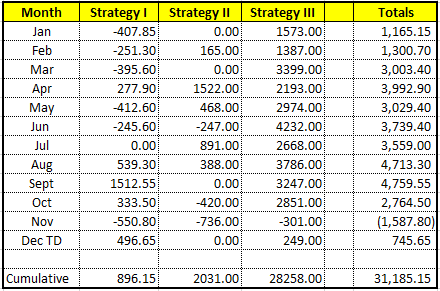

ATTS Returns for 2016 through Dec 12, 2016

Percent invested initial $100K account: Strategies I & II invested at 3.00%; Strategy III invested at 20%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Up $896.15 or +1.28%

Strategy II: Up $2,031.00 or +20.3%

Strategy III: Up $28,647.00

Cumulative YTD: 31.5%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update after first week in January.

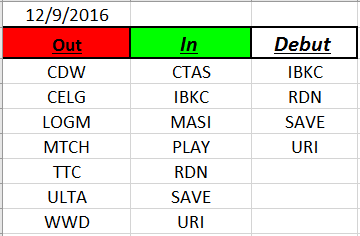

Outs & Ins: IBKC, RDN, SAVE and URI made their debut on this weekend’s IBD 50. A sort for the strongest fundamental stocks resulted in the following stocks floating to the top: THO, CPE, NVDA, UBNT and ESNT. They all are currently extended and not near a proper buy point.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.