Good Day Traders,

I want to thank Mike for providing an article for this weekend’s Trader’s Report. This week he shines the light on the real story concerning inflation. As you know if you have to buy anything this is not a pretty picture!

_____________________________________________________

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. Please let others know about this great webinar! You can either join live or catch the replay on YouTube.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/3239499173895952642

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Fibonacci’s—Hidden Secrets

_____________________________________________________

Mike’s Macro Market Musings: I Sure Am Glad There’s No Inflation

I know I have mentioned several times over the past several weeks and months my belief that the Federal Reserve Board, and more specifically Janet Yellen, the chairperson of the Federal Reserve, have become just about completely lacking in credibility. I also know that I am not alone in that sentiment. As always, the proof of this is in the pudding, so to speak.

One of the reasons repeatedly and consistently given by Ms. Yellen for her reluctance to begin a process of normalizing interest rates is the lack of inflation in the United States. Or, more accurately, inflation persistently below the 2% target rate the Fed has established as desirable. Never mind that they have never explained why the inflation target is 2% and why a target of, say, 1% or 1.5% wouldn’t serve the same purpose – it seems to be a “made up” number with no evidence or historical precedent to support its efficacy. The following charts are from the Federal Reserve itself. More specifically, the research department of the St. Louis Federal Reserve branch.

Officially reported CPI from the government’s BLS has increased 38% from 2000-2015:

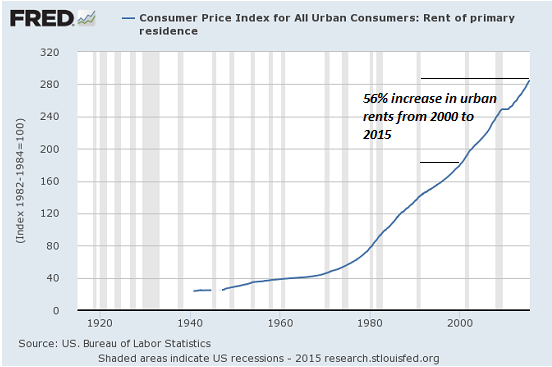

Urban-area rents are up 56% from 2000-2015:

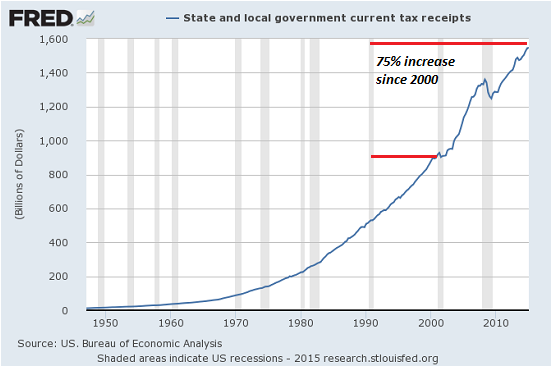

State and local government taxes are up 75% since 2000-2015:

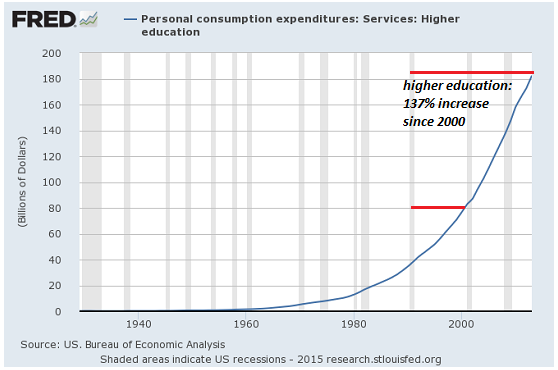

The average cost of college tuition has increased slightly more than 100% from 2000-2015:

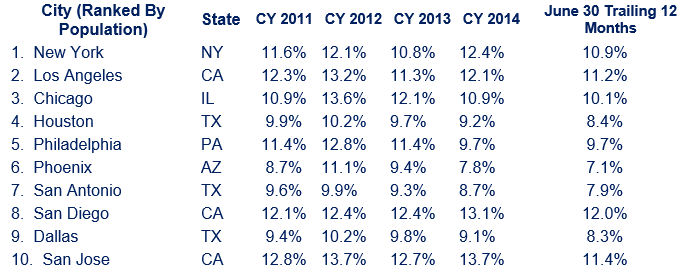

No inflation, indeed. And, again, this is data directly from the Fed itself. For other data not derived from the Fed but likely more truly indicative of the actual increases in the costs of living that we all experience on a daily basis, you can check the following website, http://www.chapwoodindex.com. The following chart from that site’s homepage will show a sampling of true inflation in a cross section of different high population cities across the U.S. over the past few years and for the trailing 12 months through June 30, 2015:

The persistence of our Federal Reserve Board in maintaining artificially repressed interest rates that were originally intended as an “emergency measure” during the financial crisis of 2008-2009, and have been kept in place long past the time when the “emergency” was deemed to have passed, has led to huge distortions in global financial markets and is at least partially based on faulty and incomplete data sourced from a government agency with a vested interest in putting out a number that is inaccurate and intentionally low. I feel it is highly likely that the repercussions of these distortions in the financial markets will ultimately prove to be quite painful to a large percentage of the global population and probably not painful enough to those relatively few individuals responsible for the policies that resulted in these distortions. And, again, I know that I am not alone in this belief. Personally, I find it baffling that anyone would choose to lend any credibility to any institution or individual in light of the type of evidence shown above.

General Market Observation: Last week was very weak for the tracking indexes with each visiting lower levels of support on the current down move that started two weeks ago. A positive for each index was how Friday’s selling was met with buying into the closing couple of hours. Each of the indexes put in a hammer or a hammer wannabe. I would rate the NDX as the strongest index, SPX the second strongest and the RUT as the weakest. Remember that August can be a very slow month with lots of movement with little progress. Of course that sound like the market for much of this year. Each Index lost ground for the past week. It seems that a relief rally would be appropriate but we will see.

For those who joined Friday’s “How to Make Money Trading Stocks” webinar or have seen the recording the charts I shared of how many stocks are below their 200 day moving averages was an eye opener! The current charts look a lot like 2007. Like we say, “It could be Déjà vu all over again!”

SPX: Twelve days ago the S&P visited the 200 day moving average and did so again on Friday. Price action sold off in the first part of the day and rebounded into the close forming a hammer like pattern at the 200 day. If one takes a look at the current chart on Thursday and Friday buyers came in toward the end of both days to push prices up. Look at the longer tails for each of these days. This shows that while overall sellers are in control, buyers are trying to stage a defense. At this point we do not know which support level will be 100% protected and lead to at least a relief rally. Watch for a retest into Friday’s wick or to 2070 for a potential rebound zone.

Preferred ETF’s: SPY and SPXL

NDX: Price action Friday fell and bounced just before the 100 day moving average. Friday’s candlestick pattern is a dragon fly doji or hammer reversal signal. Remember that all along the wick of this candle is a zone of support so if some strength comes back into this index we may see a rebound from a retest in this support zone. Note that the NDX is also in a short term downtrend having broken through the swing low of 7/28. The first level of resistance will around the 4550 level.

Preferred ETF’s: QQQ and TQQQ

RUT: The Russell is in a downtrend and the last two closes were below the 200 day moving average. Friday’s candle while lower did provide a bullish hammer reversal signal. It appears buyers came in to support the 1200 level. The 1200 level was resistance earlier in the year and was tested the first four weeks of 2015. If price stabilize here and goes no lower, then a relief rally may be forthcoming. A 38.2% retracement of the last leg down would yield an upside target of 1217. We will be covering Fibonacci Retracements on this Wednesday’s training session you don’t want to miss it.

One thing that has been a challenge with the RUT is its weakness not providing rebounds of the same magnitude as the other two indexes. Right now trade the downtrend which means any long trade should only be entered from sound support or support that has had multiple test. Secondly, any bounce should also be viewed as leading to a set up to the downside.

Preferred ETF’s: IWM and TNA

_____________________________________________

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, August 14th

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/3239499173895952642

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

Index Returns YTD 2015

ATTS Returns for 2015 through Aug 7, 2015

Less than 3.0% Invested

Margin Account = +3.8% (Includes profit in open positions)

Early Warning Alerts = +4.08%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated at the beginning of each month.

Managing Existing Trades: With market volatility taking us out of all long stock trades I’m standing by for new entry signals in either direction.

Special Trades: I have one CYBR Aug 15 60C contract open that was purchased at 4.20. I closed one contract at 5.20 for a $100 gain. CYBR reports earnings on 8-11 AMC so the last contract will be closed prior to this. My next target is 6.40 or higher as Implied Volatility grows into earnings.

Wealth & Income Generation Strategy 3 Trades: Currently waiting for a new entry signal on the two IWM Jan 16 127 Call and Put position. Later this week I will post spread sheet with exactly how this trade is doing since opening it in June. I will also highlight on what refinements need to be made in the current market environment.

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: Earnings Season is almost over. No picks for this week.

_________________________________________________

Potential Set Ups for this week: The market is due a relief rally that will take many stocks up. Currently it is target rich environment in both direction.

Upside: I really like both AMBA and GPRO to the upside. Other include: FB, HAWK, HAR and CELG

Downside: There a slew of downside candidates including: NOAH, EPAM, ABG, BIIB, GILD, CGNX, VDSI and TMH. AAPL is also now in a downtrend. As AAPL goes so goes the market for right now so it’s worth a daily look.

Toss Ups: The following stocks could go either way: FEYE, CNC, NKTR, CAVM, JAH, CALM, EBIX, MEI and MYL.

Leveraged Index ETFs: On the Early Warning Alerts we are waiting for either a reset alert or second chance entry.

Outs & Ins: Mass rebalancing in the IBD 50 this weekend. Debuting are CTSH, EBIX and HA. Of these EBIX just recently came out of a downtrend and CTSH broke out. Both are worth watching for future setups. Only a few of the IBD 50 report earnings this week and those should be avoided for any new buys until after earnings. Reporting this week include: CYBR, ZBRA, and ENDP.

AMBA is consolidating at support so a go signal could happen this week.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: One of the things I liked about living in the Southwest was the huge number of just good ole, downhome folks that resided there. Seems like things haven’t changed much as I’m here in Arkansas visiting my mom. People seem to have few pretenses and the weather is the most important thing to talk about. Certainly there are fewer distraction and even Facebook seems little less combative when viewed from Arkansas. Now don’t get me wrong I love living where I do in California but I miss the qualities that seem to be more common here. Little things like manners, how neighbors actually know each other and people driving by on the little country roads wave at you as you pass them going the other way. They actually wave with all fingers here! There is an easy unhurried approach to almost everything. Like I said don’t know if I could live in the Southwest again, but it sure is good to visit and get a little taste of southern heritage and hospitality!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.