Register Here: https://attendee.gotowebinar.com/register/5137505840659157251

11:00 a.m. PDT

For Premium Members our Wednesday evening training is developing some fantastic traders!

Topic: Fixing Bad Trades

Strategy I Portfolio Building: Bought 150 shares of WOR at 44.50 on 7/28

Bought 200 shares of IPHI at 34.70 on 8/2 – Close on earnings day 8/8 before market closes

Bought 340 shares of PLNT at 20.25 on 8/2 – Close on earnings day 8/11 before market closes

Bought 110 shares of WBMD at 60.70 on 8/2 – Close on earnings day 8/8 before market closes

Weekly Profit = $903

GLD closed all 12 contract position: Profit Total of $2097 on full position

Sold ¼ of 12 positions at $250 for a profit of $303

Sold second ¼ of 12 contract position on 7/1 at 3.10 profit = $483

Sold ¼ position of 12 contracts on 7/25 at 2.85 profit = $408

Sold last ¼ of 12 contracts on 8/2 at 4.50 profit = $903

SPY: Profit = $234

TSLA: Profit = $752

Currently Up 82.50%: Premium Collected since opening trade on 9/28/15 = $14,513.50 + New Positions at $2,763.50 = Total Collected $17,277

Will wait until later in the week to establish other positions

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally, some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Other pre-earnings candidates include: Existing positions are good for this week. PLNT reports earnings on 8/11 AMC.

Stocks identified by ** that are close to a potential entry point.

Early Warning Alerts for Leveraged Index ETFs: Waiting second chance entry from alert on 6/27

New Video Update will be posted in July.

The Early Warning Alert Service hit all eight major market trading points in 2015. See this brief update video for more details: Early Warning Alerts Update Video or at https://youtu.be/GJwXCL4Sjl4

General Market Observation: Last week each of the three Tracking Indexes provided a quick pullback to either the 8 or 20 day EMA’s then a bounce. There were no reversal candlestick patterns or even uniform pullbacks to plan off of. Just a quick intraday move that reversed the next day. Friday was strong for each of the Indexes with SPX moving to a new high and the NDX closing above last year’s high. The Russell still has more room to the upside before reaching last year’s high but is close the entering the resistance zone including last year’s high.

Currently there is some mild divergence but no signs of weakness in the price action on any of the Indexes. Right not we wait for a pullback entry to the long side. One of the members mentioned that the long trigger may have to come off an intraday hourly chart. While this is a potential currently we must wait even on the intraday to provide a potential signal.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Aug 19th—Friday! Will be on the road during market hours this Friday. Will record and post a session for the weekend

Register Here: https://attendee.gotowebinar.com/register/5137505840659157251

11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

– The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

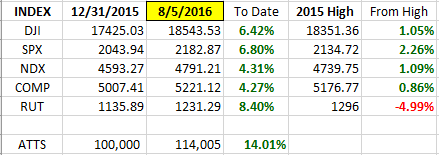

Index Returns YTD 2016

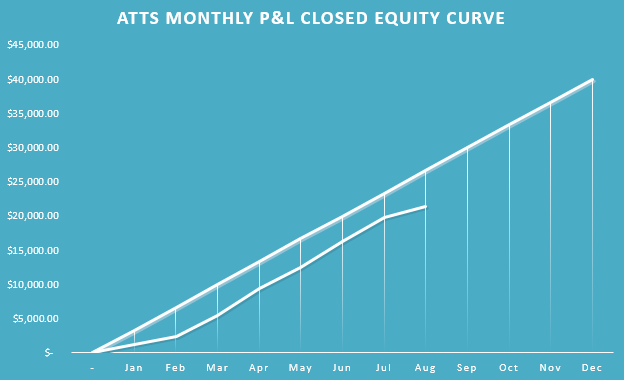

ATTS Returns for 2016 through Aug 5, 2016

Percent invested initial $100K account: Strategies I & II invested at 8.6%; Strategy III invested at 25.98%.

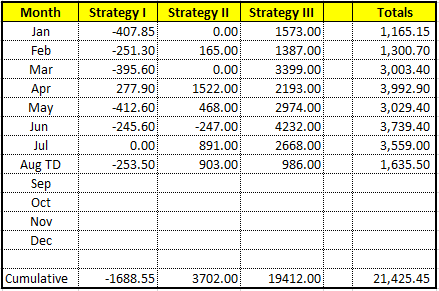

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -1688.55 or -2.4%

Strategy II: Up $3702.00 or +37.02%

Strategy III: Up $19412 or +70.8%

Cumulative YTD: 21.45%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update August.

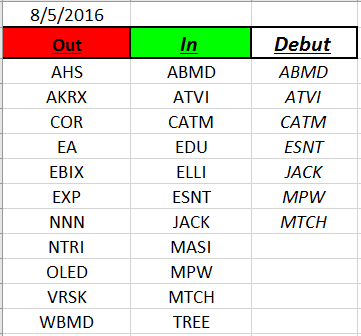

Outs & Ins: ABMD, ATVI, CATM, ESNT, JACK, MPW and MTCH make their debut on the IBD 50 this weekend. ABMD, ATVI and CATM have been on the list in past years. Only MPW and MTCH are in the process of pulling back to the moving averages and support.

To date the Running List is up to 222 stocks which is high for this time of year.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at mailto:dww@activetrendtrading.comor leave a post on the website. Thanks.