Good Day Traders,

Overview & Highlights: This week’s edition of the Trader’s Report features a great article by Mike Trager about the “R” word which stands for recession. His article speaks to the history and the telltale signs of past recessions and what the charts are telling us today.

Great news for all Early Warning Alerts and Active Trend Trader Members. This year the EWA system has flashed two alerts but failed to provide a proper buy signal. We went back to work looking for an enhanced primary entry trigger that would better complement the standby alert trigger regardless of the market condition. The standby alert trigger has worked flawlessly at each of the market bottoms since 2002 but often required waiting until other signals triggered before entering. We were successful in our testing and will be using this trigger going forward as an enhancement to the EWA System. Our work also provides additional benefits by providing improved timing for “Second Chance” entries with the EWA’s and improved entry timing for each of the 3 Strategies of the Active Trend Trading System.

As always my objective is to Clarify and Simplify and this minor refinement will accomplish both so we can all multiply!

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, March 4th

Register Here: https://attendee.gotowebinar.com/register/4257703020807717123

Next Training Webinar: March 2nd

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Fibonacci Retracement Secrets

Managing Existing Trades: Only Strategy III trades open.

Strategy I Portfolio Building: No Open Trades.

Strategy II Income Generation: No Open Trades—if you trade options this is a good strategy to send up trial trades to see if the market’s direction may be changing. 1-5 contracts of one of the Index ETFs may provide less downside risk than long position in the underlying Index ETF. Trading options is not for everyone and I strongly encourage members to first become successful trading stocks and ETFs.

For members wanting to better understand this Strategy there is a very good training video at: https://activetrendtrading.com/basic-option-strategy/

Strategy III Wealth & Income Generation Trades: Two Foundational Positions are in place to sell weekly options against. The recalculated weekly revenue needed from these foundational positions was forward in an update report earning last week. My objective with this Strategy is to collect enough weekly premium during the life of the LEAPS Strangle on both SPY and TSLA to both pay for the capital invested and gain between 50% – 100%.

Tip for Experienced Option Traders: Occasionally after a weekly trade goes against me but the trend appears to be changing I will add one naked contract over and above my foundation position and close this out after it gains at least half of the premium I’ve collected. Doing naked options is not for everyone and I keep my risk small by only doing one contract above my covered limit. In other words if I can sell 4 contract covered by my long leaps I’ll sell one additional. This helps hedge the losses a bit but it this tactic is not without risk and must maintain a tighter stop than I would normally use with the regular position.

Note: We do our best to get both text alerts and email alerts out in a timely manner, occasionally there will be trades that are missed because of delay in the Text or Email alert applications. Additionally please double check with your broker to assure they allow spread trades like we do with Strategy III. Some do and some don’t.

Trade 1: Foundation Position is 4 contracts of SPY Jan17 205C and 4 contracts of SPY Jan17 200P Current Trade—Currently Up 1.61%

No Short legs will look to open this week

Trade 2: Long TSLA Jan17 250C & Long Jan17 220—Current Trade—Currently Up 32%

Sold 1 contract of TSLA Mar1 195C at 3.15 worth $315.00 per contract

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: Only a few more weeks left in the current earnings season. In an up trending market many stocks will provide upside trades with expected returns between 5% – 20%. Here are some potential stocks that may provide pre-earning moves: AVGO & ROST report earnings this week on 3/1 and 3/3 respectively. DG reports on 3/10 BMO and NKE 3/17 AMC. BITA reports on 3/10 BMO.

Potential Set Ups for this week: Long set ups continue to be in short supply, but many stocks are showing some signs of positive divergence. With the current market personality choosing one or two stocks and Index ETF’s is a good way to stay focused with potential short term trades for both Strategy I and Strategy II. I like TSLA, AMZN, NFLX and the Index ETFs for this focus currently and will look specifically for trades in each of these until the market’s personality changes.

Upside: NTES & CALM. NTES may only be a pre-earnings trade.

Downside: SBUX, NTES, . Waiting for bounce downs near the 8 week EMA for short entries.

On the Radar: Stocks & ETFs that could go either way include: UPRO, SPXU, TQQQ, SQQQ, TNA, TZA, TSLA (180 resistance/140 support), NFLX, AMZN, FB, HA, NKE, XRS, ELLI, ANET & NOW

Stocks identified by ** are holding up well and may be upside movers if the market strengthens.

Early Warning Alerts for Leveraged Index ETFs: Waiting for Second Chance Entry trigger.

The Early Warning Alert Service hit all eight major market trading points in 2015. See this brief update video for more details: Early Warning Alerts Update Video or at https://youtu.be/GJwXCL4Sjl4

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

Mike’s Macro Market Musings: The “R” Word and the 10/20 Cross

Over the past several weeks, starting with and likely due to the market sell off since the first of the year, there seems to be much hand wringing (figuratively if not literally) about the possibility of an imminent recession in the U.S. economy. As a reminder to those who may have forgotten exactly what a recession is, the technical definition of a recession is two consecutive quarters of negative GDP growth. While completely arbitrary and somewhat problematic, this definition has been in place for so long that it has become commonly recognized and accepted. Why is this definition problematic? For one thing, it is highly lagging. By the time two consecutive quarters of negative GDP growth (as reported by the BLS) have occurred, recessionary economic conditions have already prevailed and exerted their effects for several months and the recession itself may be closer to ending than to beginning. Secondly, as I have noted previously, government statistics such as inflation and GDP have a built in bias to the upside and are so heavily manipulated and frequently revised after the fact that it is almost unimaginable in the current environment that the publication of a negative GDP quarter would even be allowed, let alone two consecutive negative quarters. For that to occur, the economy would have to be in far worse shape than the reported statistics would ever indicate. The BLS has gone to great lengths in recent years to avoid putting out negative numbers.

Just as night follows day, and vice versa, and bull markets are followed by bear markets (and vice versa), periods of economic expansion are inevitably followed by recessions. That is, unless you believe that the global central banks have finally discovered a way to repeal the business and economic cycles that have unfailingly repeated for many, many centuries (I, for one, have no such faith in the abilities of those running the central banks). In the mainstream media and the financial press there seems to me to be a certain amount of fear associated with the word “recession”. I believe such fear to be misplaced. While unpleasant, recessions are necessary and serve the same purpose to the economy that corrections serve for the equity markets. They have the effect of addressing and correcting the excesses and mal-investments of the preceding expansion and thereby restoring some balance to the economy that helps lay the foundation for the next expansion and the overall resulting prosperity that inevitably ensues. From that perspective, when economic expansions have resulted in extremes of, for example, inventory build ups and production overcapacity, recessions should be welcomed and not feared since they lead to reductions in inventories and capacity that restore an equilibrium to the overall economy. Personally, I believe that the U.S. and overall global economy is already in a recession. Why? Many sectors of the economy are currently experiencing recessionary conditions as evidenced by metrics such as retail inventory/sales ratios, declining manufacturing indexes, declining railroad and shipping freight volumes, and the Baltic Dry Index (a metric for measuring global shipping rates that has recently gone down to all-time lows), just to mention a few.

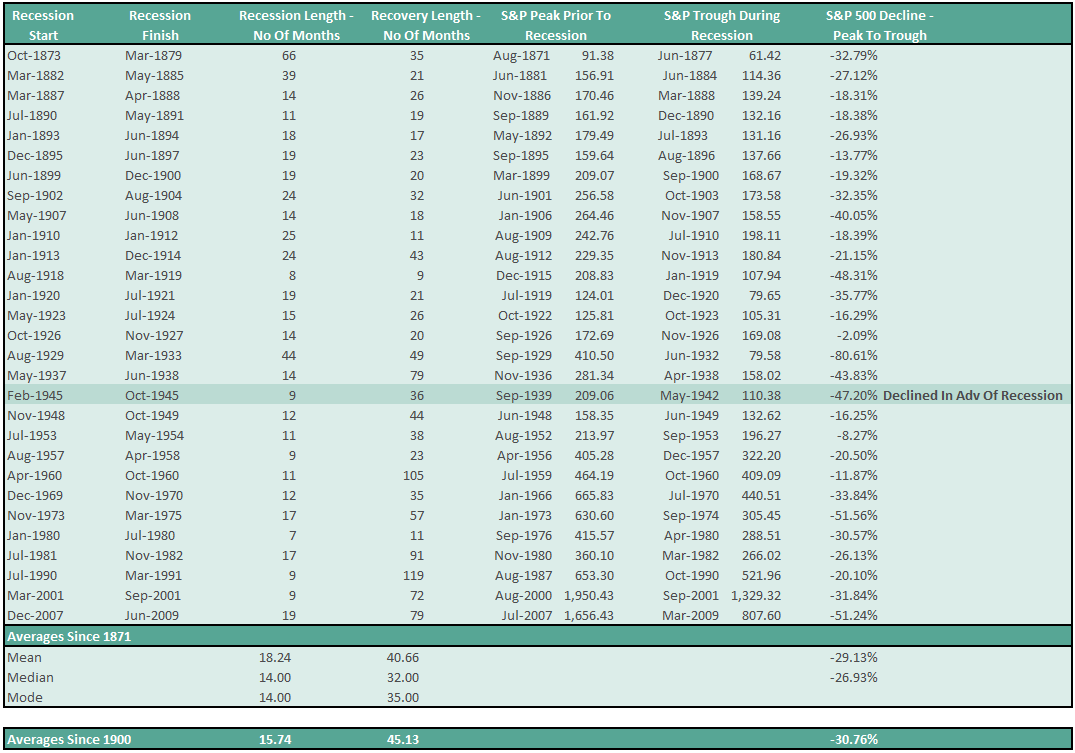

One might then say, well, OK, what does this all mean for investors and traders? How can I benefit from this information? Good questions which can be answered by the historical evidence that serious equity market corrections and even bear markets usually accompany recessions. They cannot be avoided and will serve to correct the extreme valuations and excesses that have resulted from the prior bull market and will ultimately present extraordinary opportunities for longer term investing by allowing you to exercise the “buy low” component of the “buy low, sell high” market axiom. For some perspective on this, consider the information in the following charts and graphs, much of which is self-explanatory and doesn’t require much comment.

Bottom line for the above data derived from recessions over the past 140 years – there have been 29 recessions in the past 140+ years, about one every 5 years or so on average. Again, on average, recessions can last for roughly 16-18 months with an approximate 41-45 month recovery period required and a corresponding peak to trough decline in equity indexes during the recession of approximately 30%.

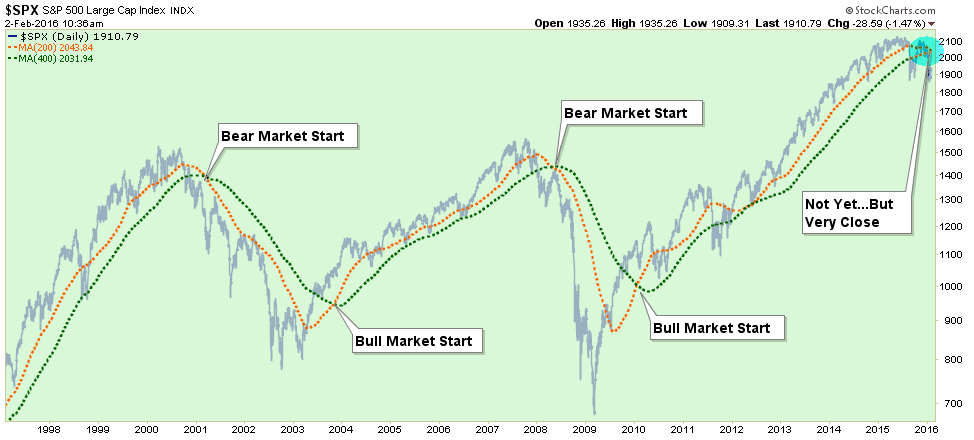

Many major market moves associated with recessions and their eventual recoveries can be telegraphed by a crossover of the 200 and 400 day moving averages on a daily chart of the major equity indexes, as follows:

The two moving averages in the chart above are the 200-day and 400-day. As you will notice they are about to cross. Because these two moving averages are so long in nature, THEY WILL CROSS. It is now inevitable.

“Most identify the death cross as when the 50-day moving average breaks below the 200-day moving average on the S&P 500. However, the real death cross takes place when the 200-day moving average crosses below the 400. In 13 of the last 18 major correction episodes going back to 1920 (i.e. 72%) this crossover marked the onset of a major Bear market.

In the five exceptions, which were 1953, 1990, 1984, 1987, and 1996, the same crossover actually ended the correction at that time. Importantly, these five episodes were during strongly trending SECULAR bull market cycles. Given we are not currently in one of those periods, it is likely a cross-over now would be more related to each of the market failures since the turn of the century.”

While the long term nature of these moving averages ensures a certain lag and guarantees that they will never capture an absolute top or bottom, the chart shows that following this crossover will protect longer term investment accounts from major damage during bear markets and allow participation in a good portion of the gains to be realized in the eventual bull markets that follow. On a monthly chart, these moving averages can be closely approximated by the 10 and 20 period monthly moving averages (I know Dennis likes to use the 8 period moving average instead of the 10, they are close enough to almost be interchangeable, the 10 period sma on a monthly chart more closely approximates the 200 sma on a daily chart):

The 10 month sma is crossing below the 20 month sma right now in real time on a monthly chart of the S&P 500; the 8 month sma crossed below the 20 month sma as of the close of the January, 2016, candlestick. As of today, Feb. 24, 2016, the day I am writing this, the 200 day sma is crossing below the 400 day sma on the daily chart of the S&P 500 (this daily crossover to the downside happened at the end of January, 2016, for the Dow and the first week of February for the Russell 2000). History may not always exactly repeat itself but it does tend to rhyme. We’re going to find out relatively soon if these crossovers are as predictive as they have historically been. Caveat emptor!

General Market Observation: I want to tie Mike’s article into this week’s observation. I’ve included the month chart to see what it may be telling us. As Mike highlighted I use the 8 period moving average on my charts so one can see that the cross of the 8 below the 20 period moving averages has not yet taken place on my charts. With the current long term trend being down the path of least resistance still appears to be down. I’ve drawn a circle around the current market and a similar period just before the plunge in 2008. The major similarities between then and now are that the moving averages were turning down and just about to provide the negative crossover. Secondly price was ranging between an established floor and the moving averages were acting as the roof. This is very similar to current price action in 2016. The current floor on the SPX is at the 1800 level and the downward slanting roof sits at the 2000 level. In 2008 price action stayed in a 13% range until the Shooting Star in May, then total failure in June. From the highs of June 2008 to the lows of March 2009 the S&P dove over 50%. Of course how the next several months work out in 2016 is not currently known but the support and resistance levels are identified. Part of the puzzle is in place. Patience is a must to navigate what could be some great short term swings in both directions.

From a longer term perspective the weekly and monthly charts are not in synch. The monthly charts show weakness for both TSI & Momentum while the weekly charts show that these two oscillators are trying to turn around—hence the current relief rally. The longer term charts tend to carry more weight from an analysis stand point. The mixed action on Friday of the three Tracking Indexes may have been signaling that the current relief rally has run its course and price action may start stalling out at current resistance. For the S&P the main clue is how price closed back below the 1950 level which was a strong level of resistance and the 50% Fib Retracement.

Both the Nasdaq 100 and Russell are lagging the S&P technically. Both are participating in relief rally but not with the same vigor as the S&P. Both closed Friday below the 50 day EMA but without additional bearish candlestick patterns. Until we get a solid reversal, watch for the 8 and 20 day EMA’s to provide support. Current action is also causing the 8, 20 & 50 day EMA’s squeeze together. Short term this may be a positive clue and support additional limited upside movement.

For those who attended last Wednesday’s training on Reversions to the Mean. Take a look at the 3 times Leveraged Index ETF’s for the SPX, NDX and RUT. Each is very close to the upper moving average envelope which often is telltale that the current move is approaching a point to pause or reverse.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, March 4th

Register Here: https://attendee.gotowebinar.com/register/4257703020807717123

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

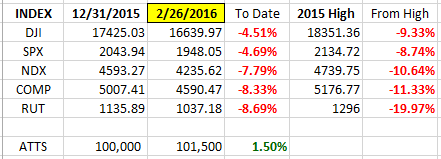

Index Returns YTD 2016

I’ve added a column to the Index YTD performance chart. The column on the far right shows the depth of the current correction with respect to the highs of the top from 2015. Currently RUT is just out of Bear Market Territory.

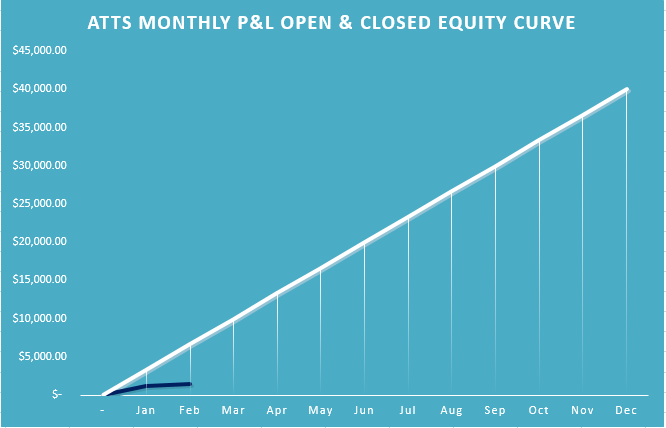

ATTS Returns for 2016 through Feb 26, 2016

Percent invested $100K account: Strategies I & II invested at 0%; Strategy III invested at 20%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -407.85 or -0.94%

Strategy II: 1.65%

Strategy III: Up $2960 or +14.8%

Cumulative YTD: 2.47%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

- Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

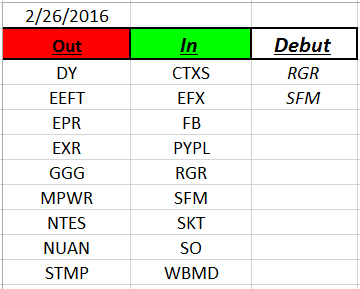

Outs & Ins: RGR and SFM make their debut on the IBD 50 this week. RGR has made a strong move over the last six weeks and is now extended and in need of a pullback after breaking out above 66.95. For Sprouts Farms we can say the same thing. Both stocks have earnings behind them for this quarter.

A deeper look in to the IBD 50 for this week showed several stocks showing that a negative reversal may be in the offing. CALM, ORLY, XRS & AHS all finished Friday with Bearish Engulfing patterns. Most of the IBD 50 has reported earnings but pay attention to both ROST and AVGO as the report AMC on 3/1 and 3/3 respectively.

To the upside keep an eye on CTXS which is working on an IBD Double Bottom.

Because there was such a wholesale swap out of stocks on the IBD 50 early in the year paying attention to Running List is in order as 2016 proceeds for both upside and downside trades. The Running List will be posted to the website this week.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.