This page is updated on Sunday’s if stocks or ETFs on our Private Watch List are approaching proper buy points.

March 12, 2017

Good Day Traders,

Overview & Highlights for On the Radar: The big news for the week will be how hawkish will the Fed be at its meeting this week. The Indexes may be tenuous waiting to see what the Fed reports on Wednesday. The jobs report Friday was above expectations so the higher rates at this meeting may result. Last rate hike resulted in very little negative pressure on the Trump Rally. Will the same thing happen this time?

Starting the week of March 19th, the format of the How to Make Money Trading Stocks webinar will change to a shorter webinar twice a week. Because your time is important, I want to pack a quicker paced and shorter webinar in to approximately 10-15 minutes. It will include brief market update and a highlight of at least one trading opportunity. The first webinar would be on Monday’s shortly after the market closes to help prep for the week. The second webinar will be on Friday with a quick rehash of how the weekly plan turned out. If you have any comments or suggestions, please email me at: dww@activetrendtrading.com

Upcoming Webinars: At Active Trend Trading we offer three webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, March 17th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/2182251686462488834

Time 11:00 a.m. PDT

Next Training Webinar: March 15th

For Premium Members, our Wednesday evening training is developing some fantastic traders

Topic: Two “Go-No Go” Indicators

** Friday’s “Final Hour”: March 17th **

Time 12:00 p.m. PDT

For Premium Members, provides trades and set ups during the final hour of weekly trading.

On the Radar: I’m long ESNT in Strategy I: Portfolio Building. This week the Fed may raise interest rates again so the market may be wishy-washy through Wednesday. Not in a hurry to entry anything long but if signals appear taking the trade is appropriate.

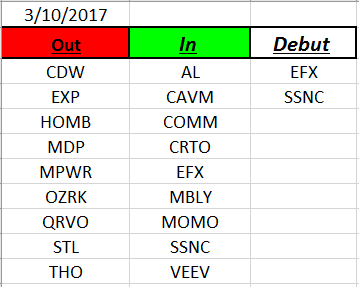

Outs & Ins on the IBD 50: EFX & SSNC make their debut the IBD 50 this week. Both stocks are coming out of a consolidation pattern. Neither ranked in the top 10 stocks from the weekly Fundamental Sort.

The top three stocks from the week’s sort were: AVGO, AMAT & ESNT. Others just out of the top of the sort include: PAYC, AEIS, CGNX, BEAT, NTES & NVDA. I’m long ESNT waiting for momentum propel prices. AMAT and AVGO have already made their moves. BEAT & NTES look promising. NVDA is looking for a bottom, but needs to retake the 50 day EMA.