Good Day Traders,

Overview & Highlights: I look for this week to markets around the world attempting to digest and perhaps react to the Brexit vote. It remains to be seen if this will be a large enough catalyst for more severe downside pressure. We do not have to be in a hurry, just watch the charts and wait for the set ups.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, July 1st

Register Here: https://attendee.gotowebinar.com/register/2631082222793603843

New Time—11:00 a.m. PDT

Next Training Webinar: June 29th

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: The Power of Keltner & Moving Average Envelopes

General Market Observation: Ok, what next? The prognosticators will be spending a lot of time trying to figure out an answer to this question. Do we really need to or can we just trade the charts? This past week I heard a very wise statement for technical traders. “If you wait until you understand the “why” it will be too late!” How true this is, while we do wait for proper set ups we know that the setups and the follow-on move will tell us that something is up even if we don’t know the “WHY”. In the market there are no guarantees just probabilities. So trade the patterns.

If you were watching Friday’s pre-market you knew it was going to be ugly but not exactly how ugly. The BREXIT non-event turned out to be more of an event than expected. Friday’s action was set up by Thursday’s buying. The pro’s were convinced that the Brit’s would reject the notion of leaving the EU. Surprise, surprise—a vote for national sovereignty won the day. Now what? It will take time for this exit to work its way out. Some say up to two years. This could lead to a market driven by news and emotional responses which can be very volatile. Good for short term trading not so good for portfolio building.

The SPX came to rest a short distance from strong support at 2025.91 which has been tested a couple of time. If it holds this may lead to at least a reaction rebound to around the 50 day EMA. If it fails straight away, then the measured move is down to 1931. After an event like Friday maintain some perspective. A drop to this level would only be about 10% off last year’s highs and still above this year’s lows. The critical thing is to identify what to do at specific levels of support or resistance. Do we trade a bounce off of 2025 or wait for a reaction pullback into between the 2065 – 2075 levels. Right now both Momentum and TSI are overextended so no chasing to the downside at this level. Wait for a proper downside entry setup.

Both the NDX and RUT need a reaction move back towards resistance. If they then show weakness it would be time to take a downside trade or trade one of the inverse Index ETFs.

On all the Indexes we are getting close to the end of the first thrust down, now a reactive is necessary to work off the oversold conditions. The first part of this week will mostly be waiting for the start of this reaction. We must also be prepared because if the market is favoring the downside often these reactions happen quickly.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Note time change. This change will allow a full hour after the webinar to adjust trades. Free Webinar every Friday at 11:00 a.m. PDT. I’m looking for the best time to offer this webinar. I want to try closer to the close on Friday to see how that works out for potential trades going into the close. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, July 1st

Register Here: https://attendee.gotowebinar.com/register/2631082222793603843

New Time—11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

– The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

Index Returns YTD 2016

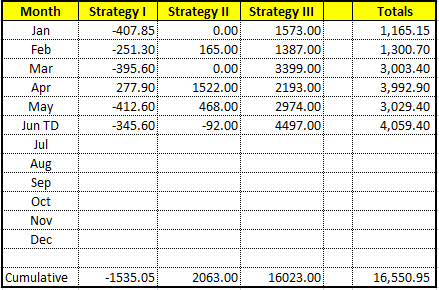

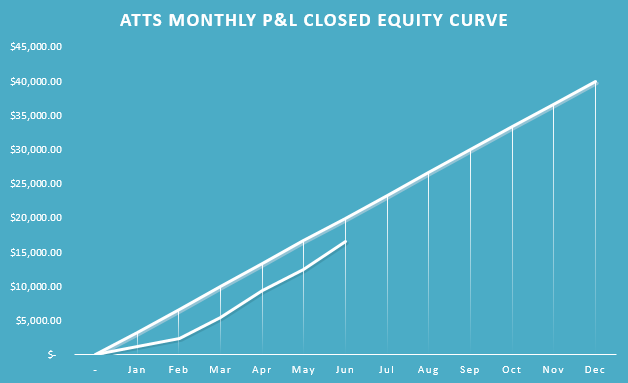

ATTS Returns for 2016 through June 24, 2016

Percent invested initial $100K account: Strategies I & II invested at 7.7%; Strategy III invested at 25.98%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -1535.05 or -2.19%

Strategy II: Up $2063 or +20.63%

Strategy III: Up $16023 or +61.6%

Cumulative YTD: 16.5%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update July.

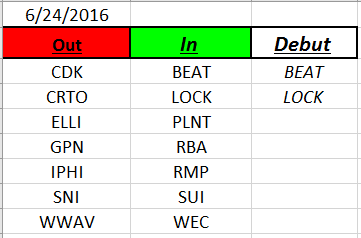

Outs & Ins: BEAT and LOCK make their debut on the IBD 50 this weekend. BEAT has recently experienced a failed breakout attempt. LOCK just reached a past swing high and may need to consolidate with a pullback to the moving averages before the next thrust attempt. Very good volume profile on LOCK.

With the second quarter quickly coming to an end, earnings will be on the agenda very soon. Given current market conditions this earnings season could be extremely volatile. Should be interesting! Stocks off the list that held up well with Friday’s debacle include both COR and LGIH. NVDA also looks to be consolidating.

Several stocks look like promising downside candidates.

These include:

DY: Potential double top

GIMO

WBMD

USCR

BSFT

EA

CTXS

HAS

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.