Good Day Traders,

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. Please let others know about this great webinar! You can either join live or catch the replay on YouTube.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/4740563443583192065

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Moving Average Refinements & Patterns 2

_____________________________________________________

General Market Observation: Futures are down significantly as I’m finishing off this week’s report. If this condition exist through the night tomorrow will start with a large gap down. While we each need to manage our own trades a huge spike down early tomorrow may lead to a bounce as lower levels of support are reached. Other than a partial position on the Early Warning Alerts and ongoing Strategy 3 trade I am all in cash. So I will be letting these trades initially play out as the market stabilizes. If prices on the futures market recover overnight this could be the start of a relief rally or dead cat bounce.

It appears that the Indexes have finally succumbed to the weight of all the weak stocks. The leaders have started crumbling due to the weight of the laggards. This was evident as we saw two members of the Tracking Index go into freefall this week! This week’s retreat is of a great magnitude than we have seen in over a year. It is time to become aware of how the market reacted the last time there was a significant correction in 2011 and at least glimpse at the Bear Market of 2007 & 2008. We know that each period in the market is unique but there are always similarities with past periods. Past events are what give us the clues for doing technical analysis. If prices do continue to fall then expect volatility to increase so for option traders selling premium becomes more advantageous. Due to the suspect nature of the market over the past 8 months we have maintained a very limited exposure to stocks and the ETF’s. The outlook for the next 4-8 weeks is more short term trading and hedging for more downside protection.

We have highlighted the global weakness for the last 3-4 months and that each of the tracking stocks appeared to be showing the initial signs of a rounding top. It appears that the topping process is continuing. Having the majority of our holding in cash and hedging remaining long positions is appropriate actions at this juncture.

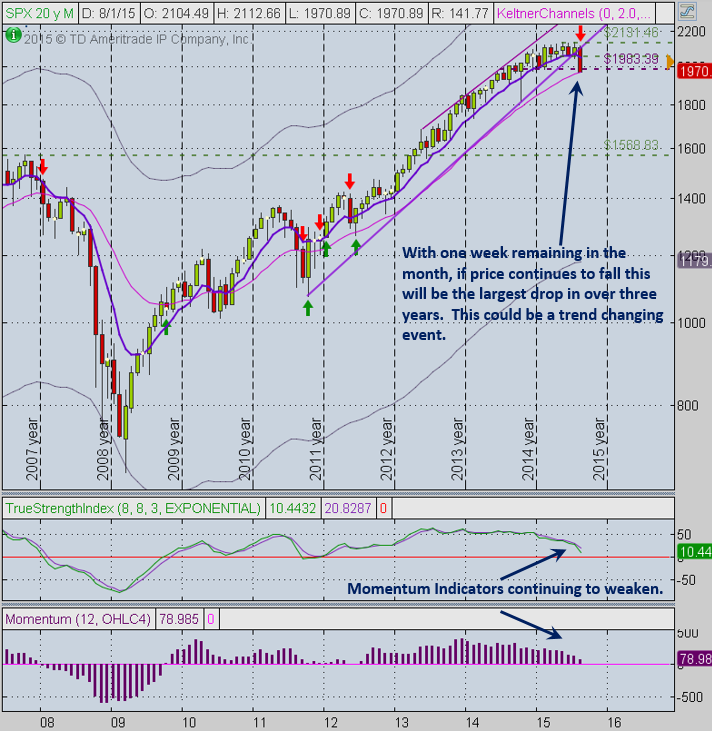

SPX: The 1700 level will be a 20% retreat from this year’s high. Currently prices are -7.7% below this level. Be aware that this week’s price action is the largest one week downside move in over a year, and often these oversized moves in a specific direction shouts at us that the past trend is now over. At this point we do not know if the sell-off continues with the same magnitude as we saw this week. The global and U.S. central banks do not have many or any silver bullets remaining to counteract more downside. A weak time of year with a weak market, hmmmm? Take a look at the monthly chart below and observe the current downturn in comparison with 2008 and 2011. Note how the correction in 2011 took about 6 months to bottom. The 2007-2008 turn down went into a full blown Bear Market lasting almost a year and a half. At this point we don’t know which we will get if either.

Preferred ETF’s: SPY and SPXL

NDX: Price action last week pierced and closed below the long term uptrend channel that has been in place since 2010. A 20% retracement from this year’s highs would take prices to about the 3730 level which corresponds to a past breakout area. At this point price is down -10.6% from this year’s high mark. Checking out the weekly and monthly charts shows that momentum has accelerated to the downside and may be foretelling more downside. The daily charts show that prices are highly oversold and price is rapidly approaching solid support tested during the January at 4078.

A relief rally on any of the indexes could happen at any time, and such an event may provide an excellent opportunity for bearish trades.

Preferred ETF’s: QQQ and TQQQ

RUT: The Russell has reached a level of strong support which may have slowed the price correction momentarily. Since this index often leads the other indexes in both directions I’ll be looking for early signs of strength to show up here first. A 20% correction from this year’s highs would take price to the 1036 level. Price have already fallen -10.9% from this high over the past 8 weeks. The trend is down currently so any upside may be short lived. The question right now is, will this correction be a 2011 or a 2008 correction?

Preferred ETF’s: IWM and TNA

_____________________________________________

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, August 28th

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/4740563443583192065

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

_________________________

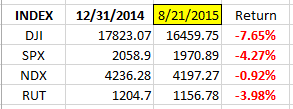

Index Returns YTD 2015

ATTS Returns for 2015 through Aug 21, 2015

1.0% Invested

Margin Account = +3.0% (Includes profit in open positions)

Early Warning Alerts = -0.78%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated at the beginning of each month.

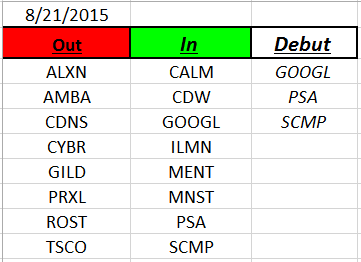

Outs & Ins: GOOGL, PSA and SCMP make their debut on the IBD 50 this weekend. GOOGL and PSA look to be following the Indexes but SCMP may be one of those that chooses its own way and may provide some long opportunities on its own merits.

If one is looking for stocks with potential strength on any market rally look to list members currently above their 20 day EMA’s. This weekend this only includes four stocks, SCMP, PAYC, AHS and CDW. This means that 90% of this week’s IBD 50 stocks are below their 20 day EMA which is not a sign of strength! If the 50 day EMA is the filter then a 16 stocks are currently above this mark. During the current market correction using either one of these sorts is a great way to cut through the clutter down to the few that are holding better than the Indexes.

The IBD 50 stocks and Running List stocks that have penetrated their 50 day EMA on huge volume are great potential short candidates with proper set ups!

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: Prudence is the better part of valor. I use to hear that often when I was on active duty. The underlying meaning was that sometimes it’s do nothing in a wise way than barge forward with unwise false bravado. We traders like to trade and often we look for signals to trade and then think we see signals to trade when the signal really isn’t there. One of the toughest things for us to do is sit on our hands and do nothing! If a trader is challenged with the urge to trade when the market is saying stay out then stay out. But if the trader really can’t resist then they must take precautions. These precautions include trading real small! Some call this playing small ball. Use smaller trading sizes and take profits more quickly with lower expectations. Keep stops really tight or learn how to hedge a positon. These are skills one can develop if they recognize they are challenged with trading when the market says stay out.

Another way to beat this urge is to paper trade. Some trading platforms allow a trader to still trade but with paper money, thus meeting the need to trade without the downside risk. It’s a great way to practice and see how topping market works. This way the next time there is a topping market the trader will have memories to draw on and trade successfully.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.