Good Day Traders,

Overview & Highlights: We are set up for a great trainings session on Wednesday this week and will be back on schedule with the Friday webinar. Mike has written a short but very timely article discussing other factors that have influenced SPX movement in the past. Currently the number of shares outstanding on the SPY is at extremes and in the past this has provided a heads up before the market corrected.

It’s a Fed week also, so will be holding off until Wednesday prior to going heavy in any direction.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, July 29th—Friday week after next.

Register Here: https://attendee.gotowebinar.com/register/1191963339500657924

11:00 a.m. PDT

Next Training Webinar: July 27th

For Premium Members our Wednesday evening training is developing some fantastic traders!

Topic: Time and Price Symmetry

Mike’s Macro Market Musings: What is this chart telling us?

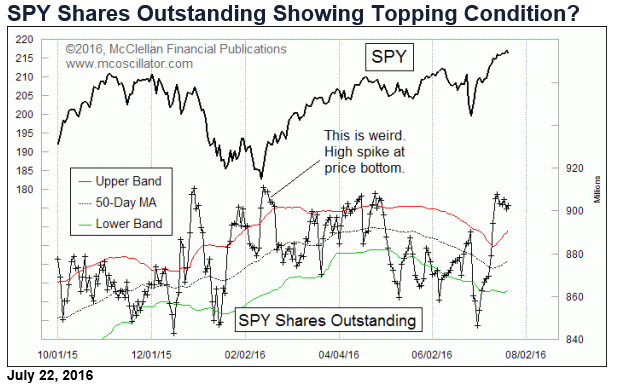

Keeping an eye on the number of shares outstanding in the equity index etf’s can provide useful information, especially at upper and lower extremes, and one of the best for this purpose is the biggest one, SPY. It tracks the SP500, and it currently has $196 billion invested in it. So it is a big deal.

The number of shares outstanding fluctuates with investor interest in the stock market. As more people start buying shares, the share price can start moving ahead of the net asset value (NAV), and so the sponsoring firm issues more shares, thereby keeping the share price and NAV as close as possible and increasing the number of shares outstanding. Likewise, when investors start selling, shares get redeemed and the number of shares outstanding declines. And in the process, we can get insights about investor sentiment when this data on shares outstanding gets to an extreme value.

But what is extreme? The numbers can trend higher and lower over time so using 50-1 Bollinger Bands can be helpful. That notation means setting up the Bollinger Bands on a chart displaying the number of outstanding SPY shares by using a 50-day moving average and 50-day standard deviation, and then the upper and lower bands are each set 1 standard deviation away from that moving average. The chart above shows how, at important short term peaks and valleys in the share price of SPY, the number of outstanding shares of SPY can move to extremes outside this Bollinger Band configuration in either direction.

The current reading is way up above the upper band. In fact, it is 3 standard deviations above that moving average right now. It is reminiscent of the sudden surge we saw back in December 2015, just before the sharp drop in early January 2016. This big rush into SPY says investors have suddenly become exceedingly interested in being invested in SPY lately, and whenever the crowd rushes in like this, it is a sign of excessive bullish sentiment.

If you want to track these data yourself, Interactive Data Corp. (parent company of eSignal and QCharts) has it under the symbol $SPY.SO. Yahoo! Finance also has it as SPY-SO although they do not seem to be able to chart it. SPY’s sponsoring firm makes it available on its web site, although not in historical form. Other services may have it as well; check with your data provider.

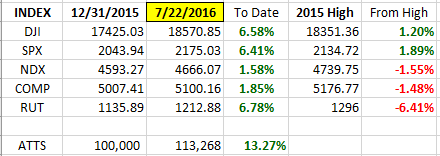

General Market Observation: Each of the 3 Tracking Indexes have provided a variation of a sideways move over the last couple of weeks. The strong uptrend has slowed or stopped but sellers have not showed up to drive price into even a good pullback. In Mike’s article above it speaks how over extended the SPY is with regard to shares outstanding. Oh the chart of the SPX price also remain extended above the Keltner Channel and the moving averages. The 8 day moving average is pushing up hard to catch price action but is not yet providing a clue as to whether the current uptrend will continue or a more significant pullback will take place. Resistance rest at the 2175 level and support at 2150. There are no active reversal signals.

The same scenario is working itself out in the other two Indexes as well. Along with some big name stocks reporting earnings this week, the Fed meets and reports out on Wednesday. Those in the know indicate that the chances of an interest rate hike are very slim for this meeting the verbiage in the report may provide stimulus to move the market one way or another. As typical I prefer to be lightly invested during up until Wednesday on Fed week, I’m also keeping in mind that over the past 5 years this point of the year tend to be weak. How weak? We shall see and of course it could be different this election year.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Note time change. This change will allow a full hour after the webinar to adjust trades. Free Webinar every Friday at 11:00 a.m. PDT. I’m looking for the best time to offer this webinar. I want to try closer to the close on Friday to see how that works out for potential trades going into the close. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, July 29th—Friday, week after next.

Register Here: https://attendee.gotowebinar.com/register/1191963339500657924

11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

Index Returns YTD 2016

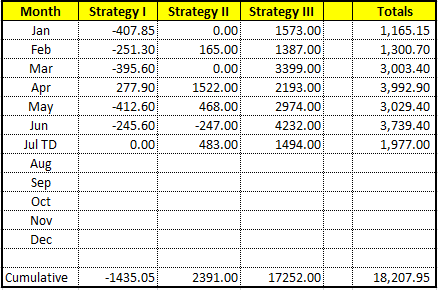

ATTS Returns for 2016 through July 22, 2016

Percent invested initial $100K account: Strategies I & II invested at 7.7%; Strategy III invested at 25.98%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -1435.05 or -2.05%

Strategy II: Up $2391.00 or +23.91%

Strategy III: Up $17252 or +63.6%

Cumulative YTD: 18.2%

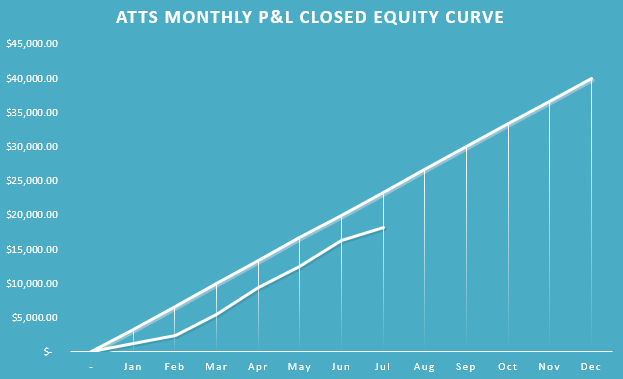

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update August.

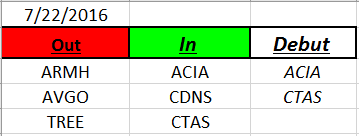

Outs & Ins: Two new stocks make an appearance on the IBD 50 list this weekend. ACIA and CTAS neither of which are in a buy position. ACIA just ran 94% in the last 24 days and CTAS broke out nicely after earnings last week. Both look like solid candidates but need a pullback to a proper action point.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.