Good Day Traders,

Overview & Highlights: For those who have been following ATTS for a while you know that the monthly performance has improved significantly since we got back to trading our rules based on the 8 day EMA. This happened in September and for the past 2.5 months we have been on a clip that compounds out to about 40% per year. Closed trades for the past 2.5 months have averaged over $3000 per month. With a focus on Portfolio Management in Strategy I going forward I look forward to further clarification and simplification as we hone in on Wealth Building moving into 2016.

Beat the fee increase in January 2016. Lock-in and save 40% or more as a Premium Member or Early Warning Alert Member or both. In January 2016 membership fees will increase on both Active Trend Trading and the Early Warning Alerts. You can lock-in at a reduced rate and save 40% or more off the current membership amount. This reduced monthly or yearly memberships will never go up as long as you maintain an up to date membership. This offer expires on January 1, 2016.

Lock-in your membership here: https://activetrendtrading.com/monthly-membership-intro1/

The Website performance page was updated and shows current information. Additionally a new video updating the performance to date of the Early Warning Alert System was recorded and is available at: https://activetrendtrading.com/early-warning-alerts-2/

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on December 4th

Register Here: https://attendee.gotowebinar.com/register/4081905403179957506

Next Training Webinar: Dec 2nd

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Your Plan—Why isn’t it working?

_____________________________________________________

Managing Existing Trades:

Strategy I: Currently 3 open trades. Strategy I is where we will do our portfolio building using mechanics using the Active Trend Trading System and guidelines learned from some excellent portfolio builders. Moving into 2016 Active Trend Trading will use Strategy I as a Wealth Building strategy to go along with the Income Generating aspects of Strategies II & III.

YY Trade Closed: Bought 300 shares of YY for a pre-earnings run at 57.85. Adjusted T1 this week to 59.50 to sell 150 shares which was hit this week. Closed for a profit of $247.50

Closed final shares of YY on the day of earnings for a profit of $274.50. Total Profit for this overall trade was: $522.00

Trade 1: Bought 500 shares of NOAH at 30.20 with a 10% T1. Sold 250 shares on Friday when for a profit of $755.

Will hold the remaining 250 shares with a trailing stop based on a close below the 8 week EMA. Hard stop at Breakeven. Additionally I will be looking to add to this position on proper pullbacks. Remaining position up 3.94% or $297.50

Trade 2: Bought 350 shares of CBM at 49.40 with a 10% T1. Current Hard Stop at 4% below entry price. Price action on Friday came within 3 cents of the 10% target. Current position up 8.56% or $1480.50

Trade 3: Bought 30 shares of FB at 106.30. T1 = 10% above entry price. Hard Stop at 4% below entry price. Current position is down 0.80%

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/ .

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

The Early Warning Alert Service has hit all seven major market trading points this year. See this brief update video for more details: Early Warning Alerts Update Video or at https://youtu.be/aVE9zqbG4MQ

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

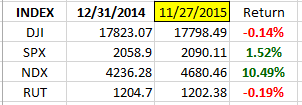

General Market Observation: The markets moved into the holiday trading season this past week with the Small Cap Russell Index performing better than the other two members of the Tracking Index. Both the S&P and NDX rested much of the week and look to be getting ready to move. The direction of the move is yet to be determined but the series of small bodied candles either spinning tops or doji’s show a level of indecision on these two Indexes.

There is just over 4 weeks of trading remaining in 2015 so we want to guard profits and look for opportunities to increase the value of the trading account before resetting to begin 2016. Remember that the Fed reports out on December 14th and the probability of a rate increase are currently high. The impact of this rate increase will be interesting to observe. Will it boost the market into the end of the year and then cause it to tank in 2016? We shall see! The prudent approach is to continue trading the charts and let price action dictate direction.

SPX: Price action on the S&P for the week was a series of small bodied candles that shows that the index is either resting to move forward or posturing to retreat. One subtle personality change has been how price action again seems to be respecting the shorter term moving averages (the 8 & 20 day EMAs). There is a resistance zone that starts just below the 2100 level and runs up to 2134.72. This equates to about a $3 move on the SPY ETF.

Bounces off the 8 or 20 day EMAs can be treated as opportunities to go long the Index ETF’s either non-leveraged or leveraged. Watch for weakness around the defined levels of resistance.

Preferred ETF’s: SPY, UPRO and SPXL

NDX: The NASDAQ 100 is following a similar track as the S&P. Slowing down and resting at a well-defined level of resistance. Watch for the bounces from the 8 or 20 day EMAs.

Preferred ETF’s: QQQ and TQQQ

RUT: The Russell has moved up 7 of the last 9 days. It made headway by closing above the resistance at the 1200 level and may still have some upside. Price is starting to get extended from the 8, 20 & 50 day EMA’s so prices may pullback or rest while the moving averages catch up. A pullback and bounce from around the 1190 zone could provide an entry opportunity. This would equate to the middle third of the positive weekly candle stick shown below. Next resistance is at the 1214 level which coincides with the 200 day moving average.

A drop below 1200 followed by a rebound back through this level may provide a secondary trigger to the upside.

Preferred ETF’s: IWM and TNA

The Early Warning Alert Service has hit all seven major market trading point this year. See the updated video at: https://activetrendtrading.com/early-warning-alerts-2/

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show Dec 4th

Register Here: https://attendee.gotowebinar.com/register/4081905403179957506

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

_______________________________________________________________

Index Returns YTD 2015

ATTS Returns for 2015 through Nov 27, 2015

52% Invested

Margin Account = +12.4% (Includes profit in open positions)

Early Warning Alerts = 10.8% Partial Positions; 19.4% Full Positions

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

- Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

___________________________________________________________

For our all Active Trend Trading Members here’s how we utilize our trading capital

Trading Capital Setup and Position Sizing: Every year we start the year off trading a $100K margin account split up into the three strategies used with the Active Trend Trading System.

- Each trader must define their own trading capital in order to properly size trade positions to meet their own risk tolerance level

- Strategy I: Capital Growth—70% of capital which equates to $140K at full margin. This strategy trades IBD Quality Growth Stocks and Index ETFs. Growth Target 40% per year.

- Strategy II: Short Term Income or Cash Flow—10% of capital or $10K. This strategy focuses on trading options on stocks and ETF’s identified in Strategy I. The $10K will be divided into $2K units per trade.

- Strategy III: Combination of Growth and Income—20% of capital or $20K. This strategy will use LEAPS options as a foundation to sell weekly option positions with the intent of covering cost of long LEAPS plus growth and income.

- The $70K Strategy I portion of the trade account is split between up to 4 stocks and potentially a leveraged Index ETF. Actual number of shares will vary of course depending on price of the entity traded and amount of margin available. We have found that limiting open positions to only 5 entities greatly reduces the trade management time requirements for members.

- Naked Puts or short term options strategies will be used occasionally for Income Generating Positions

- None of the trade setups are a recommendation to trade only notification of planned trades from set ups using the Active Trend Trading System. Each trader is responsible for establishing their own appropriate risk level on every trade.

- The Active Trend Trading System objective is to provide a clear and simple system designed for members who work full time.

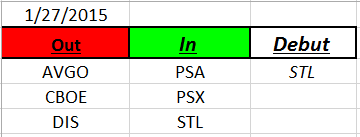

Outs & Ins: STL makes its debut on this week’s IBD 50 list and it’s extended. The Running List has now grown to 204 stocks for the year.

I have begun analyzing the first IBD 50 list of 2015 and as I have each list since 2007. Again the first IBD 50 list of the years was where the “big fish” could be found with ample trading opportunities. One thing I measure every year is the price range from the low to the high of the year for the IBD 50 stocks compared to the S&P. This year from low to high the S&P demonstrated a range of 13.36%. This is a good move but of the 50 stocks on the IBD list, 46 of the stocks moved more. The average move of 92% of the IBD 50 stocks was over 46%.

After analyzing the list for the past 9 years with similar results it continues to confirm that trading stocks on the IBD 50 with the right system will significantly outperform the Indexes!

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: Insanity seems to be running rampant on many university campuses in the U.S. Perhaps insanity may be too strong of a description but it sure seems like the inmates are in charge. With all the talk about various types of “privilege” the people either have or don’t have I wonder if the vocal ones really are speaking for the majority or are the loud splinter groups just the ones who just happen to have the mic? I may be missing the point but it seems like there are some very loud voices who want an excuse to be victims and want people to feel guilt or shame over something they had absolutely no control over—like how they were born.

There just seems to be something off-center about trying to shame another person into feeling guilty about something they have no control over. It’s like saying, “I’m the way I am because of how somebody else was born!” Really? Of course by accepting this mindset they don’t have to be responsible for any of their decisions or actions. Their mantra can be, “I’m the way I am because someone else happened to be more fortunate that me!” Wat a crock! Where’s the personal responsibility in that mindset?

Personally, I had no choice in how I was born. My mom who was the daughter of a share cropper who came from the wrong side of the tracks. She chopped and picked cotton to contribute to feeding her brothers and sister. But she knew there was something better in life that would require her personal hard work and focus. She and my dad worked hard to end the cycle they grew up in and provided an example to me that success demands hard work. My dad refused unemployment benefits because he thought it was welfare and he didn’t want to be beholding to the Government. So these were some of the beliefs that shaped my world growing up. The other thing they taught me was that success achieved by hard work is always sweeter than success given as an entitlement. Of course I’m sure the enlightened will say I was just privileged. I can say that, the privilege sure seemed like a lot of Hard Work!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.