Good Day Traders,

Thanks for all the great comments about having Mike Trager join the Friday webinar. Many of you picked up on the fact that Mike and I work very well together and complement each other’s trading style. Mike will join us when he can going forward. Please share the link to attend the “How to Make Money Trading Stocks” webinar show with your friends. I would love it to have a few hundred folks joining or watching the recording each week.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/1147816837603964161

Secondly, the Mid-Week Market Sanity Check will be replaced with special training for Early Warning Alert Members this Wednesday. Our Topic: Using EWA for Longer Term Holdings

General Market Observation: Each of the Indexes fell to support this past week and had a muted rebound Thursday and Friday. As I discussed on Friday, the current Bull Market is going into its seventh year depending on exactly when one believes it started. It seems that there is now a hair trigger to the downside and a heightened level of sensitivity to news or rumors. Many prognosticators have been calling for a deep correction (greater than 10%) and then a new move into a super Bull—we shall see.

SPX: I see the S&P potentially doing a couple of things next week. First is a bounce into the end of the first Quarter. This may carve out a new lower high followed by downside move to start April. The Index may not move into a full blown correction even though that would probably be then healthiest outcome. Moving back into a sideways range bound market could certainly be a strong potential like we saw during the beginning of 2015. Support rest at 2039 which is the swing low from 3/11/15. If this level is broken a visit below the 200 day moving average is a strong probability. Note that a 10% correction from this year’s high would be at the 1907 level. It seems that the downside provides the path of least resistance but at this point the uptrend is still intact!

NDX: The NASDAQ 100 established a lower low intraday last week and this is often a clue of more downside to come. A 10% correction from this year’s high corresponds to a drop of 300 points from current price levels. If the NDX and COMP are topping the process could continue to play out over several more weeks and months. Notice on the weekly chart how price action since September of last year has changed. Notice the deeper pullbacks and slowing upward momentum. The clues are not shouting get short but they are certainly showing that the upward movement is showing signs of aging. Last week’s candlestick is very close to being a Bearish Engulfing which could foretell heading for lower levels of support.

RUT: With the exception of the one day plunge on Wednesday the Russell held up best compared to the other two Indexes used for tracking. As we’ve seen over the past few weeks all news that predicts the hike in interest rates being pushed out has benefited the RUT and pushed it higher! Currently the RUT is showing more strength that either the S&P or NASDAQ 100. History has shown that the Russell typically will not support the weight of the whole market and at some point it will move with the other two indexes if they are falling. When the Russell does let go it often lets go with a lot of momentum.

From a trading perspective both the SPY and IWM are great trading vehicles for option traders to the downside and much better than the inverse index ETF for either underlying entities. In other words if the market does start to accelerate to the downside Puts on the non-leveraged ETF’s are a more solid trade.

______________________________________________

If you have not had a chance to check out the research Mike Trager and I have done to start the EWA service you can find a short 10 minute preview at: http://youtu.be/MgC9GMAWh4w

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

Remember if you are a premium or Early Warning Alert member you can receive Text Alerts and Trade Notifications if you send us your mobile phone number. Sent us your number with NO HYPHENS please and we’ll get you on the Text Notification List.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, April 3rd

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/6554999518418253825

To get notifications of the newly recorded and posted Market Stock Talk every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

______________________________________________________________

ATTS Returns for 2015 through March 27th

Margin Account = +0.7%

Early Warning Alerts = +2.70%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated at the beginning of each month.

___________________________________________________________

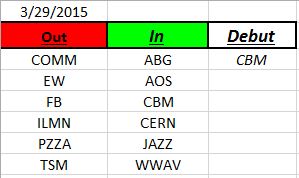

Outs & Ins: CBM makes its debut on the IBD 50 list. It is currently extended and only trades a bit over 400K average shares per day. So far this year the Running List is to 105 stocks which is well ahead of past years. The complete running list through March 2015 will be posted to both the ATTS website and BAMM Website this weekend.

Stocks that held up well last week include AMBA, SWKS, FLTX and SWI. Stocks that look like they have the potential to move into a horizontal trading range are ALK, CELG, NOAH and HZNP. Stocks that appear ready to fall if the market weakens include UA, AFSI and JAZZ.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: We had the great pleasure of taking care of our 18 month old granddaughter Elani this weekend. I find it somewhat intriguing that meal time can be a challenge because even at 18 months old she has already developed an opinion of what she likes and doesn’t like or at least thinks she doesn’t like. How does she judge what’s on her plate? By sight. She tends to like meat (takes after her Papa there), and not like the green colored foods so much. So if there are peas or yams or green beans on the plate those are typically not touched! Because she thinks she won’t like them. Thank goodness for kid’s vitamins to ensure she does get all the nutrition she needs.

What’s very interesting is that there are these squeeze tube meals that contain things like peas, yams, green beans and other assorted veggies that she absolutely loves. We give her a squeeze tube and she empties it in a few minutes and wants more. What comes from the tube smells and taste the same as the veggies on the plate so what’s the difference? May be part of the difference is the cool factor of squeezing the tube out to the last drop. All I know is that if she sees the veggies she doesn’t want them but if they are hidden in the tube it’s great!

So what does this little dining adventure tell us about human nature and how we learn to either like something or not based on what we see? I know that making judgements based solely on what we think we see can get us into a lot of trouble in life and trading. Because often times what we think we see may not be the truth. This is why traders bottom fish and take trades at improper buy points. In time my granddaughter will understand that what she loves in the tube is exactly what she is getting on her plate. The same is true for traders who stay the course and learn to discern the truth about what they are seeing on the charts!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks!