Good Day Traders,

Overview & Highlights: This week the stock candidate selection area of the Trader’s Report and Market Update will change a little. I will be honing down the over list and listing stocks that are close to action points. I will identify where I will be taking action (primarily pullbacks towards 8/20 period moving averages), and getting more text and email alerts out afterhours. This way the alerts will be ready for traders first thing in the morning on the mainland or late in the evening for those night owls on the Mainland.

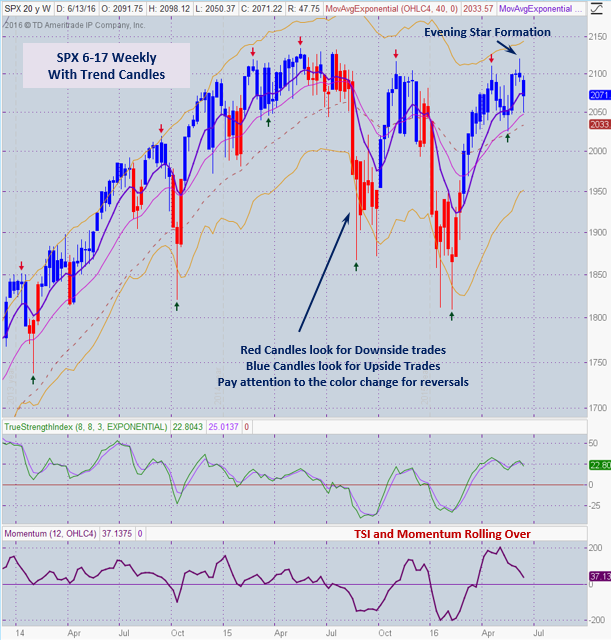

Great feedback on the Trend Candles training from last Wednesday. This week we’ll learn more about how to use these candlesticks in combination with the Active Trend Trading rules.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, June 24th

Register Here: https://attendee.gotowebinar.com/register/9221871578880388612

11:30 a.m. PDT

Next Training Webinar: June 22th

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Be Absolutely Sure About the Trend

General Market Observation: Well last week was a wild week in the market concluding with Triple Witching Day on Friday. The FANG’s were hammered Friday, with NFLX and AMZN holding up best. The last two weeks in June look like they could be “Roseanne Roseannadanna” kind of weeks. “If it’s not one thing, it’s another” was her famous line on SNL which certainly describes what to expect over the next two weeks. Numerous things could rock the boat this week including Janet talking to Congress about economic policy, the Fed’s Stress Test on Banks and of course Brexit on Thursday. With the volatility spiking up a bit as people are more apprehensive regarding the unknowns. The best trading tactic to follow when uncertainty picks up is to plan trades around levels of support and resistance. When price action is between these levels treat it like no-man’s land and don’t trade or chase.

Tonight I’m looking at the weekly SPX chart for both support and resistance and patterns. This week’s price action completed a bearish reversal Evening Star pattern which typically means the current uptrend has come to an end. This week’s drop was not severe enough to cause the weekly Trend Candles to change from blue to red, but the TSI and Momentum oscillators look like down is the path of least resistance. There is a strong level of support at the 2050 level that was tested during the week. The 2050 level corresponds with the 20 week EMA which is equivalent to the 100 day moving average. If the Evening Star confirms (it is a self-confirming signal) and price drops the 2050 level a fall similar to that in January could be holding symmetry.

I will be waiting for a pullback to the 8/20 day EMA’s on a daily chart for potential downside entries as the daily oversold condition is worked off.

The NDX is the weakest of the three Tracking Indexes and may provide the best shorting opportunity on a pullback to around the 8/20 day EMA’s. If price do break loose to the downside, then also watch the Russell to potentially drop faster than the other two Indexes.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:30 a.m. PDT. I’m looking for the best time to offer this webinar. I want to try closer to the close on Friday to see how that works out for potential trades going into the close. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, June 24th

Register Here: https://attendee.gotowebinar.com/register/9221871578880388612

11:30 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

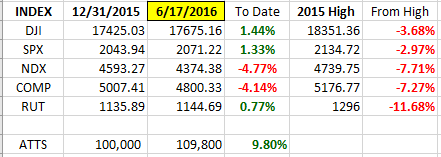

Index Returns YTD 2016

ATTS Returns for 2016 through June 17, 2016

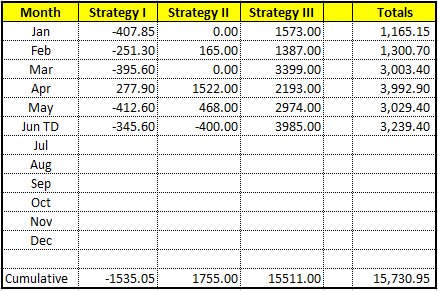

Percent invested initial $100K account: Strategies I & II invested at 19%; Strategy III invested at 25.98%.

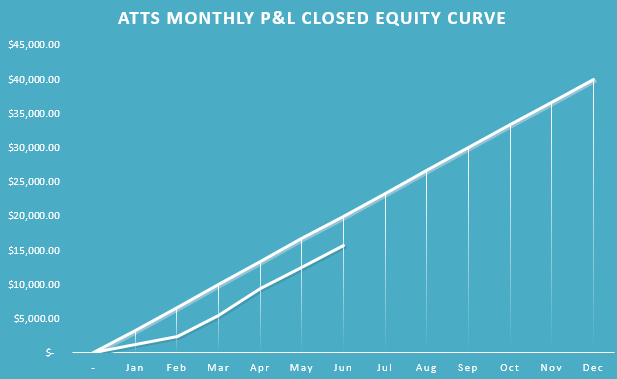

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -1535.05 or -2.19%

Strategy II: Up $1734 or +17.55%

Strategy III: Up $15511 or +59.7%

Cumulative YTD: 15.7%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

- Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update July.

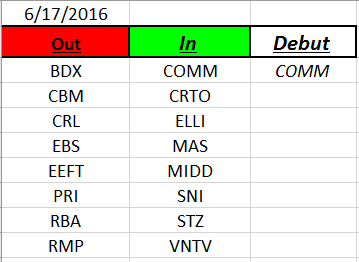

Outs & Ins: COMM makes it 2016 debut to the IBD 50 list. COMM has made several appearances on the List over the years. The stock enters this week’s list after recovering from a 40%+ selloff that started last September. Of course it is close to overhead resistance at last September’s highs.

Upside potential for the list include: GIMO, BSFT & HAS. Downside candidates include USCR, EW, NTES & CTXS. On the Radar candidates include: PAYC & ELLI.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.