Good Day Traders,

Overview & Highlights: It’s good to be home in Hawaii again! The first part of any move is always a challenge waiting for the furniture to arrive and getting set up in the house. Right now we’re sleeping on a blowup bed (BLUB) and working off a folding table. It great moving back into our old house that was rented for the 12 years we were in California. I’ve just about adjusted to the time difference and got up Friday prior to the 3:30 a.m. market open. I will hit the open between 2-3 times a week leaning towards Wednesday through Friday when more of the market action takes place. I will be doing my homework and getting out the trade alerts and updates earlier in the day after the market closes so they will get to members so they can also plan their trades for the following day.

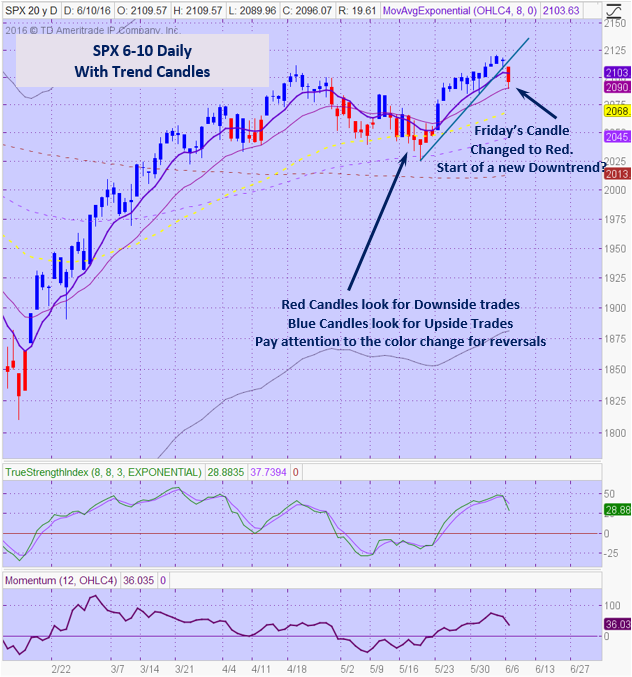

I was fortunate to attend a training conference webinar on Saturday on Trend Trading and tools other traders are using. I’m very excited about one tool I’ll be training on this Wednesday evening. The tool is called Trend Candles and I believe introducing these will help members be more patient and have a better understanding about direction to trade visually. I’ve provided an example in the Market Review section. So instead of Trading Psychology I’ll be demonstrating how to use this tool, plus talking about understanding the ebbs and flows of the markets and stocks over the next few weeks! I believe this training will provide all members stepping stones to aid in moving to a higher level of trading success.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, June 17th

Register Here: https://attendee.gotowebinar.com/register/6740381586676275713

11:30 a.m. PDT

Next Training Webinar: June 15th

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Ebbs & Flows—Riding the Trends

General Market Observation: Friday ended last week with a gasp and it appears there are too many variables heading into the final weeks of June! First of course is the Fed meeting this week. While it appears that the Fed will again be accommodating by not raising rates, there has to be concern about poor job reports and other economic news showing that the current faux recovery may come under additional strain. Add to this the upcoming vote on Britain staying in the EU and the uncertainty grows. Are we witnessing the last gasp prior to a downside capitulation? We shall see! On the other side of this debate are some who are calling for a big rally into the end of the year. What would be the catalyst for that? The US going negative on interest rates or spinning up some hybrid of Quantitative Easing? If this happens it may result in a rally, but into what—a steeper ledge when the house of cards finally falls? As traders do we care? In fact, we should not be concerned and focus purely on the setups that stocks and market provide and trade accordingly.

The beginning of this week may be soft as everyone waits for the Fed. Clearly sellers showed up on both Thursday and Friday taking profits from the latest run up. On the SPX Friday’s sell off only took prices back down to the 20 day EMA. This level is slightly above a stronger level of support at 2085. Both TSI and Momentum have rolled over so is this a hint of things to come as we move deeper into the dull summer months? The weekly chart finished last week with an ominous Shooting Star Bearish reversal candle after price action poked it’s nose into the strong resistance zone which is topped by last year’s high. Negative divergence has commenced on the weekly chart and we will see if price action turns negative shortly. At this point I’ll wait until after the Fed meeting to make any large commitments.

The other two members of the Tracking Index team showed similar action to the SPX last week with the NDX showing greater weakness. Friday’s gap down and close below the 20 day EMA by the NDX was enough to roll the shorter term moving averages over. There is support at the 4400 level that may provide a bounce or resting point over the next few days. If this level fails watch for the next stop to be at 4300. Because NDX failed to make a new high on the resent thrust it may be more susceptible to a harder fall. The RUT was not immune to Friday’s selloff, but it held up better than the other Tracking Indexes. Price action found support at 1160 but the fall lasted most of the day. A Tombstone Doji reversal signal on the weekly chart may be indicating that the latest up thrust has ended. I am long TZA the 3x leveraged inverse ETF on the Russell and have been selling covered calls against it over the past few weeks. My time stop on this position is July 1st unless price dramatically fails over the next few weeks!

In the introduction I mentioned a new charting tool I was introduced to on Saturday. It is included on the chart below my regular daily SPX chart. On the second chart note how the candles change color from blue (for uptrend) and red (for downtrend). I will be going into depth on these new candles on Wednesday evening. A hint on what they will help us do is plan potential long trades, short trades and improvement timing exits. If the color of the candle is blue, we wait for pullbacks to enter trades and the opposite when the candles are red. The candles work on all time frames and provide instantaneous feedback on direction to trade. As the second chart show Friday’s candle turned to Red on the SPX. The other Active Trend Trading Rules still apply but these candles should provide additional clarity when planning trades! Secondly, I’ve converted the Momentum oscillator to a line chart rather than the histogram. The line chart clarifies direction and pattern a better than the histogram.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:30 a.m. PDT. I’m looking for the best time to offer this webinar. I want to try closer to the close on Friday to see how that works out for potential trades going into the close. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, June 17th

Register Here: https://attendee.gotowebinar.com/register/6740381586676275713

11:30 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

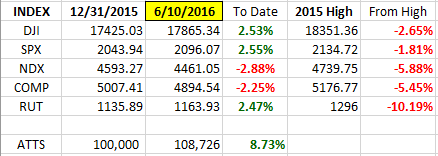

Index Returns YTD 2016

ATTS Returns for 2016 through June 10, 2016

Percent invested initial $100K account: Strategies I & II invested at 25%; Strategy III invested at 25.9%.

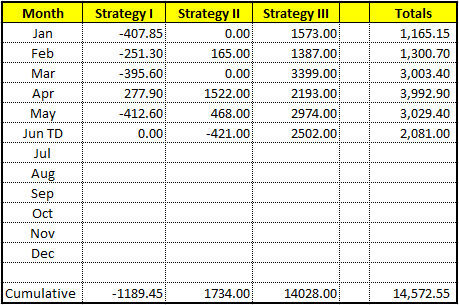

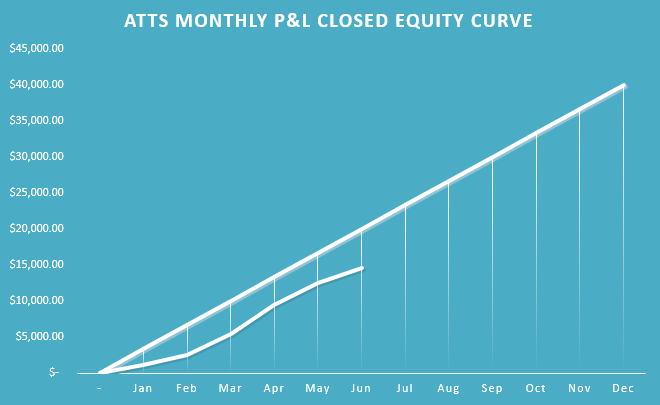

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -1189.45 or -1.69%

Strategy II: Up $1734 or 17.34%

Strategy III: Up $14028 or +54.10%

Cumulative YTD: 14.57%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. (Next week for June)

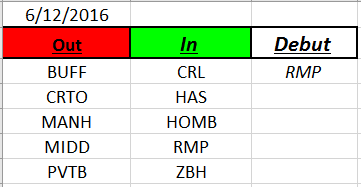

Outs & Ins: RMP makes its debut on the IBD 50 this weekend. The IBD 50 Indexes took a bigger hit than the Tracking Index on Friday so this list may provide excellent downside candidates if the market falls apart.

A review of the list shows many members of the list are extended and primed to pullback with the Indexes. Downside candidates include USCR, EW, EDU, PRAH & NTES.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.