Good Day Traders,

I pray that all members had a wonderful Easter weekend. We just got back from visiting our youngest son Brandon his wife and our granddaughter. What a great time! This week begins the second Quarter of the 2015 Trading Campaign which looks to be fraught with mystery and excitement.

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. You can either join live of catch the replay on YouTube.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/6781365873296603905

The Mid-Week Market Sanity Check is back this Wednesday evening. Our Topic: Using Weekly & Monthly Charts to Protect Long Term Gains

It’s the beginning of the month and time for another instalment of Mike’s Macro Market Musings. Something we have been bantering around is both the over valuation of the current Indexes and the various bubbles that are cropping up around the world! We agree that the Market will correct and the correction will be significant. The big question—WHEN?

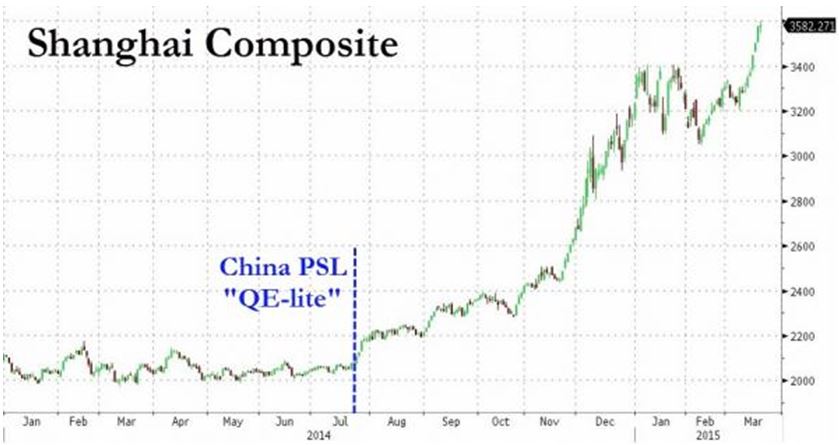

Mike’s Macro Market Musings: March Madness and Mob Mania I am writing this in March even though you may not be reading it until April, so I will defend the use of alliteration in the title and topic as justifiable in the present tense. The phrase “March Madness” in the U.S. connotes that time of year for the NCAA men’s college basketball playoffs and the seeming temporary loss of sanity among those who are too fully engaged in the process and results of that tournament. For those who aren’t paying very close attention to global markets outside the U.S., there is another type of “March Madness” currently on display, although not specifically limited to the month of March since it has been going on for quite a while – since March, 2014, actually. Specifically, I am referring to the Chinese stock market indexes and their parabolic rise over the past year or so. As of the day I am writing this (3/30/2015), the trailing twelve month (TTM) increase in nominal Chinese market index prices is approximately 90%, and close to 100% trough to peak, including an approximate 15% rise just during the month of March alone.

Shanghai Composite Index – Trailing 12 Months

There is currently an unquestionable mania amongst retail participants in the Chinese stock market, a frenzy or madness exhibited during any and every historical financial bubble one might choose to examine. Following are some excerpts I’ve taken from various readings on this topic over the past few days. Yes, I will acknowledge the following excerpts have been “cherry picked”, but only to illustrate the point, and cherry picking does not necessarily invalidate the point being made or the raw data supporting it.

“Ordinary Chinese have been piling into the market at a pace not seen since 2007, before the financial crisis, in some cases pulling money from savings deposits or cashing out of property investments as they try to win big. Investors in Shanghai and Shenzhen opened nearly 900,000 new stock trading accounts in the week that ended Dec. 12 alone-, the most in seven years”

“Some say that when the average “mom-and-pop” retail investors get back into the stock market, it could be time to get out. But what about when even teenagers start buying?

China has entered a new stock frenzy, like something out of America in the Roaring 20s or the dottiest days of the dot-com bubble, with trading volumes continuing to push to new record highs.

On Wednesday, combined trading on the Shanghai and Shenzhen markets hit 1.24 trillion yuan ($198 billion), the seventh straight session in which turnover surpassed the 1 trillion yuan mark. By comparison, the New York Stock Exchange typically saw $40 billion-$50 billion a day in trading during the first two months of this year.”

“Typically these young investors speculate with money given to them by their parents, according to a Great Wall Securities broker quoted in the Beijing Morning Post story.

Yet another report, this time by the Beijing News newspaper, relates that at the Beijing trading halls of China Securities Co., “even the cleaning lady” has opened an account to play the market.”

“Risk-Love (equity sentiment) in China’s equity market is in euphoria territory. It is time to book some profits.” Bank of America Merrill Lynch

“Within the last week alone, 1.14 million stock accounts were opened in China, the biggest such surge since June 2007, according to China Securities Depository & Clearing Corp”

“Buying Chinese stocks on margin has increased by 900% in the past six months”

Teenagers using borrowed/gifted money to buy stocks? Janitors opening brokerage accounts? Selling property in order to invest the proceeds in equities? For those of us who have been around long enough to have witnessed a bubble or two and the eventual aftermath, these are exactly the kinds of anecdotes we have always, ALWAYS, seen during the bubble topping process. This doesn’t mean the bubble will burst next week or next month and that the Chinese market is at an absolute top, but it most definitely is an indication that a top is near and foreseeable. Given all the evidence of bubble like conditions in the U.S. equity markets currently, is it possible that an implosion in the Chinese equity markets might serve as the black swan event that triggers the inevitable U.S. major correction?

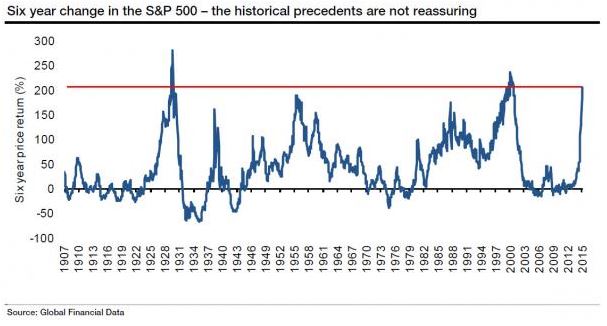

Time will tell. The most compelling piece of evidence that might support this type of scenario may be evident in the following chart:

The above chart shows that over the past 100 years or more there have only been three instances when the U.S. indices as represented by the S&P 500 have appreciated 200% or more over a six year period – 1929, 2000, and 2015. Current SPX appreciation off of the March, 2009 lows from trough to peak is approximately 220%; for the NASDAQ this is slightly over 300% and for the Russell 2000 this is around 260%. We know what happened in 1929 and 2000 and the next couple of years afterwards. Can the market of 2015 buck that history and stand up to an implosion of other major global markets? Somehow, it just doesn’t seem terribly likely. As the old saying goes, “that which can’t be sustained, won’t be”.

General Market Observation: Last week the Indexes were volatile and weak. Those of us who opened the SPY puts on Thursday would have been very happy due to the poor Jobs Report that came out on Friday! The DOW Futures were down on Friday -165 points which would have made for a very profitable trade. Now we wait until Monday to see if the negative tone survives the weekend! There are so many takes on how a slowing economy will impact the Markets! As we covered in Friday’s video, the Indexes are showing signs that its personality is changing and perhaps topping. We will watch the Futures for a clue to the what will be the tone Monday morning. If the Futures completely recovers the drop from Friday it may be a set up for a bounce. If prices fail to rebound pre-market then we may be seeing an increased probability of more downside.

______________________________________________

If you have not had a chance to check out the research Mike Trager and I have done to start the EWA service you can find a short 10 minute preview at: http://youtu.be/MgC9GMAWh4w

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

Remember if you are a premium or Early Warning Alert member you can receive Text Alerts and Trade Notifications if you send us your mobile phone number. Sent us your number with NO HYPHENS please and we’ll get you on the Text Notification List.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, April 10th

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/6781365873296603905

To get notifications of the newly recorded and posted Market Stock Talk every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

______________________________________________________________

ATTS Returns for 2015 through April 3, 2015

Margin Account = +0.7%

Early Warning Alerts = +2.70%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated at the beginning of each month.

___________________________________________________________

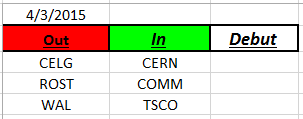

Outs & Ins: No stocks making a debut on this weekend’s IBD 50. The Running List is up to 105 stocks and has been posted on the website at: https://activetrendtrading.com/atts-private-watch-list/

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: “Invitation to the Miraculous” –The Unescapable and Undeniable Solution

At some point all people will pay attention to the Father’s invitation to the miraculous—Salvation through Son. Sadly for many it will be after they close their eyes on this brief life and they wake to discover they didn’t pay attention to the invitation! Acceptance of the Invitation must be completed on this side of life.

There will be no escape for failing to pay attention or thinking the Invitation to the Miraculous wasn’t real. The penalty of not paying attention will also be Unescapable and Undeniable!

Pay attention and accept the Invitation to the Miraculous now while you still have a choice! Just agree with our Father and the Solution and the Miracle He has provided!

Pay attention—Know Now not Later!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks!