Good Day Traders,

Overview & Highlights: This week may be very interesting and volatile week. Several of the big names like AAPL, FB and AMZN. Add to this the uncertainty of the Fed and we could see support and resistance tested several times. Note that the “How to Make Money Trading Stocks” Webinar is back on Friday at 11:30 a.m. PDT this week.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, April 29th

Register Here: https://attendee.gotowebinar.com/register/6304738586288150019

Note this session will be at: 11:30 a.m. PDT

Next Training Webinar: April 27th

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Symmetry of Time and Price—How to be Patient

General Market Observation: Several events this week may provide a catalyst for higher volatility and price moves between levels of support and resistance. The Fed reports out on Wednesday so often waiting for the Fed dampens daily movement. Add to this some of the big name stocks like APPL, FB and AMZN reporting earnings between Tuesday and Thursday the Indexes could end up either pushing higher or breaking the current uptrend and finishing the week lower. I like to keep most of my powder dry going into the Fed meeting because of the unpredictability of both the Fed decision and then the follow on report. I will wait for price action on the Tracking Indexes to either test support or resistance for potential trade opportunities but will most likely be flat any Index ETFs while the Fed reports.

Since all three of the big names reporting this week are members of the NDX and SPX price action on both Indexes could potentially gyrate wildly. The NDX was showing the weakest technical pattern of the Tracking Indexes finishing the week with a weekly Bearish Spinning Top below the down trend resistance line that’s been in place since December of last year. There is plenty of support at the 50, 100 & 200 day moving averages and other price level supports so if price continue to fall look for bounces from one of these areas. A healthy 38.2% retracement would bring prices to the 4309 level. Of course there is a potential head & shoulders pattern shaping up on the daily chart with the left shoulder and head formed. AMZN, FB and AAPL will be the drivers for what happens next.

The RUT provided the most strength last week finishing Friday with a positive gain. If the Fed does not raise rate and puts out a dovish statement the RUT may run to the upside some more. Technical resistance comes in at the 1160 and 1200 levels.

The weekly chart of SPX finished with a Shooting Star like pattern. This is a bearish reversal signal. Additionally the weekly Momentum showed its first pullback in about 10 weeks. Prices for the week tested up in to a strong level of resistance formed from last year’s highs but sellers or profit takers came from Wednesday to Friday to take a bit of the shine off the current uptrend. On the weekly chart below the negative divergence on the Momentum if visible. When negative divergence shows up it does not mean prices will not push higher it is simply a clue that the internals are starting to shift which might lead to a stronger pullback in the future. When? We shall see. The weekly chart also shows that price is extended from the moving averages so a reversion to the mean would not be a surprise. A retest at last week’s high or break below last week’s low may be the triggers for short term downside trades. A retest at the 2050 level or bouncing off the weekly moving averages would potentially be a set up to the long side.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:30 a.m. PDT. I’m looking for the best time to offer this webinar. I want to try closer to the close on Friday to see how that works out for potential trades going into the close. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, April 29th

Register Here: https://attendee.gotowebinar.com/register/6304738586288150019

Note this session will be at: 11:30 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

– The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

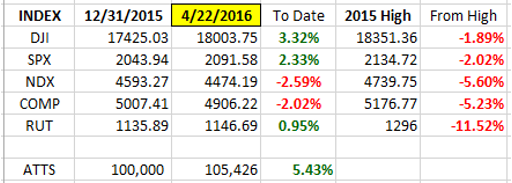

Index Returns YTD 2016

I’ve added a column to the Index YTD performance chart. The column on the far right shows the depth of the current correction with respect to the highs of the top from 2015. Note both DJI & SPX are now in positive territory for 2016.

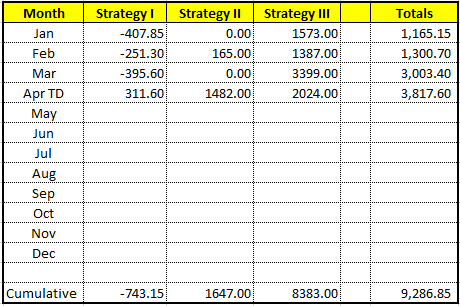

ATTS Returns for 2016 through April 22, 2016

Percent invested $100K account: Strategies I & II invested at 12.7%; Strategy III invested at 20%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -743.15 or -1.06%

Strategy II: Up $1647 or 16.47%

Strategy III: Up $8383.00 or +41.9%

Cumulative YTD: 9.28%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

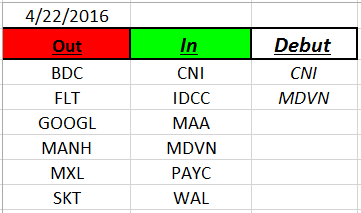

Outs & Ins: CNI & MDVN make their debut on this weekend’s IBD 50 list. Neither inductees are at a proper buy point as both are extended from both daily and weekly moving averages. About 90% of the stocks on the list have yet to report earnings this season so unless a traders is already long in one of these positions some may set up well for pre-earnings trades only.

Like the Indexes prices on most of the IBD 50 are pushing up against overhead supply which forms a resistance zone that must be breached before an uptrend can continue. Stocks of interest for this week include: TTC, FIVE & NVDA. Watch THO for a downside opportunity.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at mailto:dww@activetrendtrading.comor leave a post on the website. Thanks.