Good Day Traders,

Overview & Highlights: We’ve made the turn and are now heading west on our road trip. I like TSLA to the downside and WOR to the upside. Each of the Indexes are still posturing for a move either up or down. The historic expectation for September is a solid pullback in preparation for the end of year rally.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, Sept 2nd—Video from the Grand Canyon!

Register now for the next live webinar on Sept 9th at the link below:

Register Here: https://attendee.gotowebinar.com/register/3109323602625198340

11:00 a.m. PDT

Next Training Webinar: Recorded for Aug 31st

For Premium Members our Wednesday evening training is developing some fantastic traders!

Topic: Fixing Trades Gone Wrong!

General Market Observation: Today’s price action on all three Tracking Indexes was up but contained within last week’s range. This week last week’s highs and lows are the boundaries I’m watching. If we go with the typical downside bias of September, then look for potential downside trades if price move towards last week’s highs. The SPX looks weaker than the other two Indexes. A move up between 2186 and 2193 could be a retest and opportunity to the downside. On the other side of this plan would be a drop to the 8 week EMA or 2134 as a potential long side trigger. Each of the other Indexes provide similar levels for planning. If the highs are taken out after opening a downside trade close the position. If a long trade sets up and the lows are taken out, then close the long position.

The chart below is a weekly chart including today’s price action. Both oscillators look weak. The TSI has rolled over and crossed, but depending on this week could rebound. This is where we will watch for negative divergence on a weekly timeframe. This would be positive for a stronger pullback which would potentially provide a better set up to the upside in October. At this point the Indexes are posturing and trying to figure out which way to break.

The other scenario would be a continuation of the current sideways move up until the Fed report on September 21st.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Sept 2nd—Video from the Grand Canyon!

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/3109323602625198340

11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

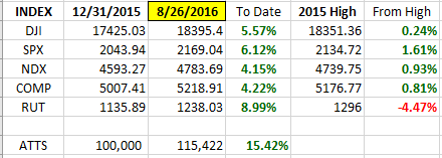

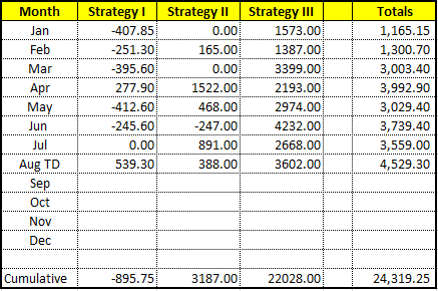

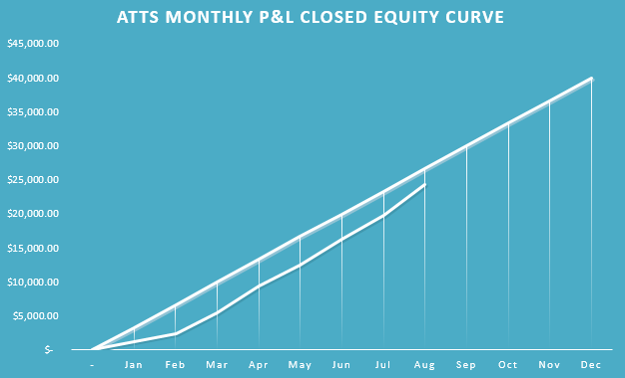

Index Returns YTD 2016

ATTS Returns for 2016 through Aug 26, 2016

Percent invested initial $100K account: Strategies I & II invested at 0.0%; Strategy III invested at 25.98%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -895.75 or -1.27%

Strategy II: Up $3187.00 or +3.18%

Strategy III: Up $22028 or +84.9%

Cumulative YTD: 24.3%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update August.

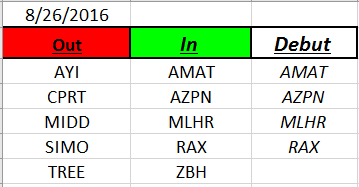

Outs & Ins: Four stocks make their debut on this week’s IBD 50. RAX is early in its basing pattern but needs a pullback into the daily moving averages for a buy opportunity.

Upside candidates from the IBD 50 are, GIMO, SSTK, LGIH, STOR and BABA. The downside candidate is PYPL.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.