Good Day Traders,

Overview & Highlights: Markets could go either higher or stall this week. At this point any pullback should be considered a buy opportunity until pullbacks stop working.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Thursday, March 24th

Register Here: https://attendee.gotowebinar.com/register/7443841427983753475

Next Training Webinar: March 23rd

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Tying it all together for High Probability Entries

General Market Observation: Remember the market doesn’t have to make sense and it will do things that are surprising. This includes the rally that has been going on the last 26 trading days. With the Fed’s announcement this past week backing off their hawkish stance on interest rate hikes during 2016 perhaps will be the catalyst to move higher after current gains are digested. We shall see! At this point an orderly pullback to support would provide a good opportunity to go long from the rest of this ride. This is especially true for the SPX which is the strongest of our Tracking Indexes. The current strength pecking order is SPX, RUT and NDX.

Studying S&P may provide the best glimpse into what we may expect this week. First, Friday’s move up concluded a rally that has lasted for 26 trading days. This rally has gone up at a significantly steep angle of ascent which can often be a sign of unsustainable movement. Additionally the price action is contained in an ascending wedge which is a bearish pattern which often fails but will remain in effect until there is a close below the lower trend line. This has not happened yet. Currently the price action is respecting the 8 day EMA so pullbacks to the proximity of the 8 or 20 day EMA should be treated as a long opportunity. Trade the orderly pullbacks until they stop working!

Keep in mind that markets often move in symmetric patterns. Compare the current upswing with that of October 2015. The daily chart below shows a very similar ascending wedge in October of last year which lasted for 26 trading days followed by a pullback of over 4% in 10 trading days. This action went on to form a trading range that finally resolved to the downside at the end of 2015. There is no guarantee that this is what will happen this time but we should at least be mindful of what history reveals. Notice that the profit taking in November 2015 overshot the 50 day moving averages and bounced at the 38.2% Fib retracement of the move from the low on 9/29 and the 11/3 high. A similar move at this point would take prices down to about 1860 an established level of support. Also notice that the November 2015 pullback fell at about the same angle as the preceding uptrend. Remember symmetry!

Throw into the pot the mixed nature of the Indexes and the falling Momentum indicator on all three Indexes. Momentum is leaking out of the current move. If prices do press higher on the S&P look for strong resistance at the 2075 level. If this level is reached during the week and then indecisive or reversal patterns show up this could be a great short set up. Lastly, watch the two weaker Indexes if they start to falter this could the precursor for weakness on the S&P.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Thursday, March 24th

Register Here: https://attendee.gotowebinar.com/register/7443841427983753475

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

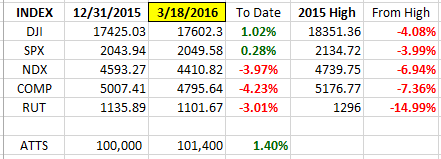

Index Returns YTD 2016

I’ve added a column to the Index YTD performance chart. The column on the far right shows the depth of the current correction with respect to the highs of the top from 2015. Note both DJI & SPX are now in positive territory for 2016.

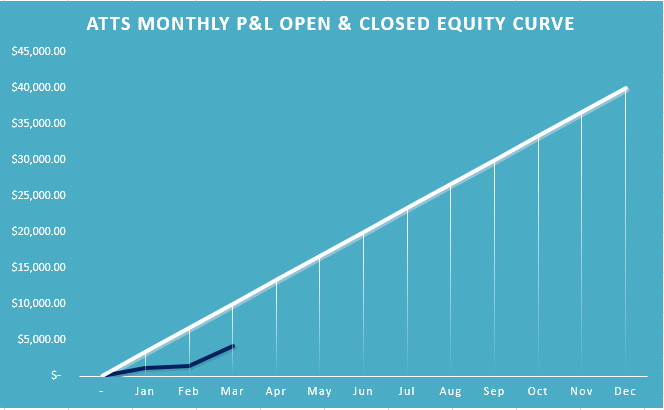

ATTS Returns for 2016 through March 18, 2016

Percent invested $100K account: Strategies I & II invested at 0%; Strategy III invested at 20%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -1054.75 or -1.5%

Strategy II: 1.65%

Strategy III: Up $4458 or +22.3%

Cumulative YTD: 3.6%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

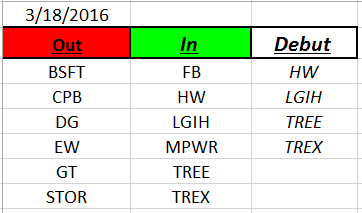

Outs & Ins: A handful of stocks make the 2016 debut on the IBD 50 list this weekend. LGIH and TREX look like they may be setting up to the upside in the near term.

One of the big challenges in having a list with over 50 stocks on it is maintaining focus. If one tries to watch all 50 stocks it increases the probability of missing the stock that moves. This leads to playing “what if “ mind games and trying to figure out how to capture everything—in other words work harder! The best way to handle a large list is to simply choose a few candidates that appear to have the best chance of triggering a buy signal that week. This can be done by utilizing reversion to the mean criteria, moving average proximity or levels of support and divergence of the oscillators. Find 2-5 stocks that appear to be at or approaching buy parameters and then focus just on those stocks that week.

Out of this week’s IBD 50 list here’s what I found LGIH, SIX, CALM, XRS and TREX. I will hole in on just these this week and see what happens.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.