Good Day Traders,

I hope all had a good Independence Day on July 4th, celebrating with friends and family. Despite its flaws the USA is still a beacon and example of Freedom and Liberty throughout the world. I encourage all to cherish these privileges that come from living free and guard against giving up liberty just for supposed security!

If there is ever a question about a potential set-up email me at dww@activetrendtrading.com or call me at 808-366-0397 and get clarification!

Remember every Friday at 1:30 p.m. PDT, the Active Trend Traders co-host the free “Market Stock Talk” Webinar. I want to invite you to attend register here:

https://attendee.gotowebinar.com/register/2457356071125569282

General Market Observation: The Markets continued to move higher during this holiday shortened week. I highlighted last week that the Markets were extended, and now they are even more extended! Is it time for a drop or even a move into the summer doldrums? We shall see. But, we will not argue with a bull market heading higher and will plan our trades around what the market is doing and not what we think it should be doing!

The Confirmed Uptrend with the same number of distribution days we had at the end of last week—3 distribution days for S&P and 2 for the Nasdaq, is how the Market ended up after the shorten trading week prior to the Independence Day Holiday. This latest rally that started on May 15th, has seen controlled profit taking and consolidation before taking off for higher ground three times. SPX broke out, Nasdaq broke out & the Russell is sitting right at resistance of the early high achieved back in February. Other than some negative divergence in the Momentum Indicator, significant extensions from the 50 day moving averages and the Russell bumping its head on resistance, there are no signs that this rally is over except for the expectation that we are due for some pullback or consolidation. Yet when this pullback or consolidation will happen remains to be seen.

SPX: The S&P continues to move closer to the upper channel line which serves as an up trending line of resistance. Note how the trend within the trend channel remains intact and how the price action since the May 15th rebound has respected the 8 and 20 day moving averages. This is indicative of a strong uptrend. We will soon find out if the upward move slows at the upper channel line which may take place this week.

Nasdaq: Where to from here? The Nasdaq just broke out of a weekly cup pattern a couple of weeks ago. If we do the math on what the expected move is subtracting the low of the cup from the high of the cup that provides us with a range to expect from this break out. In this case the math looks like this: 4344.39 – 3946.03 = 398.36. Moving up this many point from 4344.39 provides a target of 4742.75 and as this weekly chart shows that would be above the 4732.82 shown.

If you’re wondering what the 4732.82 represents it reflects the resistance zone put in place back in 2000 just before the Dot Com Burst. The Monthly Chart of the Nasdaq, the second chart below shows how we’re getting in to territory not seen in fourteen years. Now some technicians believe that lines of support and resistance that far back are weaker than more recent events, but this resistance zone may prove to be a significant resistance zone for psychological reason more than economic ones. A few more weeks of this upward momentum and we will find out just how strong or weak this zone turns out to be.

Summary of Closed Trades: Only one trade was closed this past week. The Income Generating position on QIHU was closed with the following details: 100 shares purchased on 6/11 at 86.75 were closed on 7/1 at 95.13 for a gain of 9.66% and cash flow of $838.

Profit/Loss from June Trades Closed as of June 30th

Income Generating Trades Closed = + $ 5,029.50

Capital Growth Trades Closed = + $ 1,869.00

Total Profit/Loss Month to Date = + $ 6,898.50

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

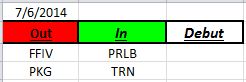

Outs & Ins: No new stocks made a debut on the IBD 50 this weekend. With the Market’s extended we’re waiting for pullbacks to alternative entry Action Points. It appears that AFOP may be working on a C&H pattern. This may turn out to be a wait for set ups week.

Several stocks have listed buy points including UBNT and ALXN. Of these ALXN may provide an alternative entry earlier than 172.60. UBNT is working on a C&H. Other stocks worth watching this week include AFOP & EPAM.

I’ll highlight again that earnings start in earnest this week, so a rule of thumb I use going into earnings to protect profits is the following. Most earnings gaps either up or down tend to be no more than 10% (there can be ugly exceptions!), if my profit cushion is less than 10% I close out the positions or at least ½ of the position prior to earnings. If it’s 10%-15% or more I will make closing out ½ is typically a prudent decision. If the profit cushion is greater than 15% then one can one can typically weather the earnings storm. Again, if in doubt take some of the profits off the table.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: When we simply say we celebrated the 4th of July it does a disservice to what that day in the history of America really means. The 4th represents our Independence Day, and that’s a big deal. Now there some decrepit citizens and government leaders who would have us forget the roots from which this Great Nation came. The ties to the past that made this country a marvel of democracy and a beacon of freedom, will hopefully survive these misdirected souls.

Yet as long as there are patriots who will speak out and even fight against a tyranny of beliefs that seeks to suck the liberty and freedom from our veins in exchange for all encompassing government control, we as a nation will continue to be the land of the free and home of the brave.

Now I know that some are uncomfortable with patriotic rhetoric so much that in order to squelch it they call everyone in the US who breathes a patriot, but this is just not a truthful statement. This cheapens the meaning of the word and corrupts the fabric of our history. This practice actually feeds the strength of the enemy within our borders. I remember when I first joined the Navy back in 1973 and took the oath. The oath was to protect this Country from all enemies both foreign and domestic, perhaps our biggest threat we face as we celebrate Independence Day 2014 is from the latter as President Lincoln warned over 100 years ago!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks!