Good Day Traders,

As we move into the last half of July, summer earnings season gets into full swing this week with some big names reporting. We’ve said many times in the past, traders must be careful during earnings season. Be aware of how much profit cushion your positions have as you make the decision to either sell before earnings or hold. Typically if the profit margin is less than 10% it’s a good idea to take some profit off the table. Rolling the dice on earnings occasionally can work really well and other times it can really hurt. Err on the side of caution.

If there is ever a question about a potential set-up email me at dww@activetrendtrading.com or call me at 808-366-0397 and get clarification!

After the July 25th webinar show, Market Stock Talk Live will be off on vacation until after Labor Day. We will post recorded sessions every week during the month of August. I want to invite you to attend register here:

https://attendee.gotowebinar.com/register/1710666729860009474

To get notification of the newly recorded and posted Market Stock Talk during the month of August just subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

General Market Observation: The uptrend is still under pressure but some of the distribution days did fall off this past week. It seems that the Indexes have moved into a new market phase with more volatility and larger daily price swings. This is a significant difference from the nice controlled uptrend that started on May 15 and topped out around July 3rd. This new phase also makes trading a bit more challenging because of big down days followed by big up days with few sound trading signals other than taking trades off support which can be challenging. The SPX continues to be the strongest of the indexes we monitor. The Nasdaq held up fairly well last week but the Russell showed the weakest price action until Friday. The move up on Friday was positive, but the downside was the low volume for the bounce.

Huge sell offs in big volume followed by up moves in lower volume tend to be the precursor of further down side. If volume remains absent this move up may be simply a relief rally.

This week, AAPL, NFLX & FB report earnings and may provide a precursor to market direction at least short term.

Summary of Closed Trades:

Profit/Loss from Trades Closed in July as of July 18th

Income Generating Trades Closed = + $ 1138.00

Capital Growth Trades Closed = + $ 1028.00

Total Profit/Loss Month to Date = + $ 2,166.00

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

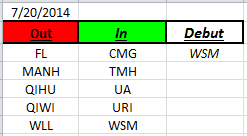

Outs & Ins: WSM was added to the IBD 50 list this week and is actually close to a pullback entry point. This is a rare occurrence. Over the past couple of weeks stocks on the IBD 50 have been playing musical chairs without any new stocks making a debut to the list for the year. Over the next two week the majority of stocks on the list will report earnings so caution is in order if you own any of these stocks.

FB, UA, LAD, ALXN, ILMN, CELG, BIIB, & FFIV all report this week.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: We never know where we’ll find inspiration! This past week after taking a walk with my wife, we stopped at a coffee shop before heading home. One of our friends came in and for whatever reason he wanted to talk about some of the new things he was doing in the area of inspirational training. A lot of what he said was good stuff, but he was really scattered in how he discussed his ideas. He would bounce from one story to another without really getting to the point on any of them. It was challenging to keep track of where he was going but it was clear that he was excited about what he was sharing! After listening for about an hour it was time to go so we looked for an opportunity to escape.

As we were leaving our friend said here take one of my new business cards. I looked over the card and there was his email address, gwNOV8@gmail.net. What caught my eye was the Nov 8 on his card and I asked him if his birthday November 8th? This caught my attention because that’s my birthday. My friend said no, that’s not a date, and I said yes it is. On his card Nov 8 actually meant INNOVATE. After adjusting my filter, I saw that he was correct.

How we see things is often the result of our conditioning, and while I saw the abbreviation for November 8th, my friend saw Innovate. Of course now that he shared that with me every time I now think about my birthday, I’ll also think about Innovate which is a good thing!

Often trading is about adjusting the filter of our beliefs and learning new realities that are tested against a model. If we do not allow our past conditioning to be tested and refined we may keep ourselves from maximizing our results!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks!