Good Day Traders,

Overview & Highlights: I’ll be back to my regular schedule this week when I return to Northern California for the remainder of September. If September behaves like most Septembers, then we can expect weak markets and consolidation going into October. A significant sell-off does not appear to be shaping up but a healthy pullback could provide excellent set-ups for an end of year rally. I’m pleased to have closed out ½ of the Long TSLA LEAPS used in Strategy III with a 100% gain. I’ll be evaluating whether a 2018 TSLA LEAPS position should be open moving forward or replacing it with another entity.

In this issue Mike Trager has provided an excellent article about what he learned about trading from his dog. This article is a perfect example of the trading lessons we can learn from just being observant!

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, Sept 9th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/3109323602625198340

11:00 a.m. PDT

Next Training Webinar: Sept 7

For Premium Members our Wednesday evening training is developing some fantastic traders!

Topic: ATTS Rules Review and Adjustments

Managing Existing Trades: Positions open for 1 strategies.

Strategy I Portfolio Building: No Open Position

Strategy II Income Generation: No Open Position

For members wanting to better understand this Strategy there is a very good training video at: https://activetrendtrading.com/basic-option-strategy/

Strategy III Wealth & Income Generation Trades: Two Foundational Positions are in place to sell weekly options against. The recalculated weekly revenue needed from these foundational positions was forward in an update report earning last week. My objective with this Strategy is to collect enough weekly premium during the life of the LEAPS Strangle on both SPY and TSLA to both pay for the capital invested and gain between 50% – 100%. Closed the first TSLA LEAPS Strangle which was opened on 9/28/15 for a 100% profit on 9/2/16.

Tip for Experienced Option Traders: Occasionally after a weekly trade goes against me but the trend appears to be changing I will add one naked contract over and above my foundation position and close this out after it gains at least half of the premium I’ve collected. Doing naked options is not for everyone and I keep my risk small by only doing one contract above my covered limit. In other words, if I can sell 4 contract covered by my long leaps I’ll sell one additional. This helps hedge the losses a bit but it this tactic is not without risk and must maintain a tighter stop than I would normally use with the regular position.

Note: We do our best to get both text alerts and email alerts out in a timely manner, occasionally there will be trades that are missed because of delay in the Text or Email alert applications. Additionally, please double check with your broker to assure they allow spread trades like we do with Strategy III. Some do and some don’t.

Additionally, it is crucial when selling premium against the Long LEAPS position that the premium collected cover the weekly cost of holding the LEAPS plus an additional amount to over this amount as a gain. This is one of the reason I sell premium of weekly options that are close to be “At The Money”. I base my selling on the expected move during the next week. If one is not bringing enough weekly premium this trade will not work out as well and may wind up being a losing trade.

Strategy III Weekly Results Week ending 8/26:

SPY: Profit of $184.00

TSLA: Closed ½ of TSLA LEAPS for 100% gain since 9/29/15 –Profit for week $1381

Trade 1: Foundation Position is 4 contracts of SPY Jan17 205C and 4 contracts of SPY Jan17 200P Current Trade—Currently Up 22.13%; Premium Collected since opening trade on 1/4/16 = $5,944.00

Sold 4 contract of SPY 9Sept 218.5C at 1.15 potential profit $460

Trade 2: (Long TSLA Jan17 250C & Long Jan17 220—Closed on 9/2 for 100% gain since 9/29) + New Positions Jan17 210C and 220P: Current Position Total Invested $14,900. Currently Up 84.5%: Premium Collected since opening trade on 9/28/15 = $15,688.50 + New Positions at $3,800.50 = Total Collected $18,108

Sold 1 contract of TSLA 9Sept 202.5C at 1.45 potential profit $145

Sold 1 contract of TSLA 9Sept 190P at 1.78 potential Profit of $178

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally, some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Potential Set Ups for this week: If traditional September weakness prevails this year then the next few weeks will be a period of consolidation in preparation for a rally during the last 3 months of the year. Some of the stocks of interest are highlighted here.

TSLA is weakening and may provide a significant downside opportunity. The spring on WOR is tightening and may provide a buy opportunity soon. I’m adding NUGT to the “On the Radar” list. Currently NUGT is selling off with gold, but it just went through a 5:1 stock split and may provide some potential set ups if gold strengthens into September on market weakness. It also has weekly options with rich premiums! NUGT may also be a good candidate for Strategy III. Currently it has weekly options but the ride it would go on is not for the faint of heart.

Pre-Earnings Trade: None.

Pre-earnings trades can be a great supplement to the portfolio building portion of Strategy I. Depending on the stock and technical analysis they tend to be predictable and repeatable. For busy traders focusing on pre-earning opportunities can free one up from the necessity of constantly chasing stocks during other periods of the year. The process repeats four times a year and capturing a 5%-15% return four times a year can compound very nicely!

Upside: Waiting for pullbacks on the Index ETF’s, WOR, COR, XRS, BABA, SSTK, RAX & WOR.

Downside: SIX, TSLA & NFLX. TSLA has broken down and will wait for a pull-up for a downside trade.

On the Radar: Stocks & ETFs that could go either way include: UPRO, SPXU, TQQQ, SQQQ, TNA, TZA & their associated non-leveraged Index ETFs. NVDA, WYNN, NUGT, GLD, PYP, COR, TEAM, MTCH and EDU.

Stocks identified by ** that are close to a potential entry point.

Early Warning Alerts for Leveraged Index ETFs: Waiting for either an initial or a second chance entry. Last Trigger: 6/27

EWA Account Return to date: 5.5%

The Early Warning Alert Service hit all eight major market trading points in 2015. See this brief update video for more details: Early Warning Alerts Update Video or at https://youtu.be/GJwXCL4Sjl4

If simplifying your life by trading along with us using the index ETF is of interest, you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

Mike’s Macro Market Musings: What My Dog Has Taught Me About Investing and Trading

For anyone who tunes in regularly to the weekly webcasts conducted by Dennis in which I often participate, I’m sure you’re aware that I will often check out of the presentations a bit early in order to attend to the elimination needs of my dog, Misha, a nearly four-year-old female goldendoodle. Those of us with canine companions can attest to the strong bonds that can exist with our pets and the varied ways we learn to communicate with them and vice versa. We pay very close attention to each other and learn to anticipate our needs and desires via an established daily routine.

We don’t have a backyard at our home so I will walk Misha around our neighborhood and take her to a couple of different local parks where I can allow her to roam around off-leash and get her daily exercise and “go potty”. Misha loves chasing squirrels and is always on the lookout for them while completely ignoring birds, ducks, and geese. Despite the fact that she is as domesticated and spoiled as can be, when she spots a squirrel, her innate biological instincts take over and it is very fun for me to observe her as she goes into her stalking and hunting mode. When it is apparent that she thinks she has a chance of scoring a “kill”, her attention becomes completely riveted and she becomes very quiet and still without so much as stepping on a twig or doing anything else that might alert the squirrel to her presence. At the moment that she perceives her best opportunity, she then pounces into action, accelerating rapidly and proceeding with the chase, inevitably to be frustrated as the squirrel scurries away up the nearest tree. Then there are other times when she might see a squirrel off in the distance or in very close proximity to a tree and, when she doesn’t perceive a high probability opportunity to score a “kill”, she just ignores it and goes on with her walk. She seems to innately know what her best opportunities are and pursues them as they present themselves while ignoring the lower probability opportunities.

I have witnessed this process countless times over the past few years but it has only recently occurred to me that certain analogies and lessons can be learned from this act of nature and applied to the process of trading and investing. Some of these that come to my mind are as follows:

1) Limit your focus – Misha only looks for squirrels and ignores everything else. For most of us, our trading and investing revolves around stocks and, if that applies to you, then forget about everything else. Don’t bother tracking precious metals, agricultural commodities, currencies, bonds, etc. Very few of us can master all markets and you cannot possibly watch everything. Choose which market you want to trade and limit yourself to that. And, with equities, one might do well to limit oneself to which type of equities upon which to focus. For example, one might choose to only monitor and trade/invest in IBD 50 stocks. There is nothing wrong with that, and there is no question that there will be many opportunities to take action within that limited list of stocks over time; there is really no need to look elsewhere and you cannot watch every stock on the U.S. stock exchanges.

2) Patience – Misha waits for a high probability “set-up” before taking action while ignoring lower probability opportunities and does absolutely nothing until a favorable opportunity comes along. When trading and investing, there are valuable lessons to be learned from this. Learn to be patient. Wait for the higher probability set ups that you know are likely to pay off with favorable risk/return dynamics. Do not try to force things or impose your will upon the market – this never, or seldom, works out favorably. It is perfectly OK to do nothing if you cannot find a low risk/high return opportunity in the stocks or markets upon which you are focused.

3) Discipline – this goes along with being patient. Misha has the innate discipline to wait for her best opportunities and then to take action accordingly while ignoring the lower probability opportunities. Not only does this require patience, it also requires the commitment to take action without hesitation when those opportunities present themselves. Know what your set ups are and do not hesitate to strike and take action when they present themselves. Limit those set ups to those that you know have a high probability of following through successfully with a low risk/high return scenario. This means limiting your focus (see number 1 above) not only to the markets or stocks you monitor, but also to the technical set ups upon which you choose to act.

4) Self-knowledge – Misha knows innately what she is capable of and acts accordingly within those capabilities; she can’t fly so she doesn’t chase birds. Know yourself and your capabilities and personality and act accordingly. If you are a longer term investor, monitor weekly or monthly charts and pay no attention to intraday charts. If you are inpatient and prefer to scalp quick small profits, utilize intraday charts and a time frame that suits you and forget about the longer term charts that don’t fit your personality and goals. Know why you are trading and investing and what your goals are and then act accordingly and forget about anything and everything else that will not help you achieve those goals.

Misha has taught me so much, and I love her all the more for doing so. I know it’s just nature, but it’s amazing what we can learn from nature if we just pay attention.

General Market Observation: The Indexes last week provided a “move along, nothing to see here” kind of week. One commentator called the action “dull”. At some point the market must react to both the upcoming FED meeting on September 20-21 and the presidential election. At this point it is not clear what the reaction will be. Add to this mix the historical softness of September markets and one could expect a potential downside bias but at this point there has been no strong telltale signs of overwhelming weakness.

Of the three Tracking Indexes the Russell continues to look strongest. This week’s price action on the RUT pushed to a new high in the current rally. The NDX and SPX moved sideways with no apparent impetus to move either up or down. The SPX as shown on the daily chart below is stuck in a trading range as is the NDX. There is divergence between indicators on daily and weekly charts with weekly charts looking prime for a pullback. Daily indicators are showing the current directionless daily price action of the Indexes. Currently I’m falling back to seasonality of the indexes and will prepare for the yearend rally. I will keep in mind that this year’s rally may be muted depending on the outcome of the election. The current SPX trading range has a ceiling at 2192 and a floor at the 2160 level. I’ll plan trades at these limit using options or the leveraged index ETF’s.

We are still researching which candidate will benefit traders. At this point it appears that Clinton’s tax plan aimed at discouraging short term trading with potential additional transaction fees would be the biggest negative. If any of the Active Trend Trading members read anything regarding this topic, please share.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Sept 2nd—Video from the Grand Canyon!

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/3109323602625198340

11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

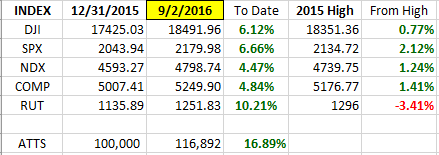

Index Returns YTD 2016

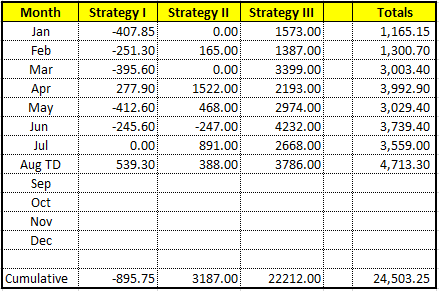

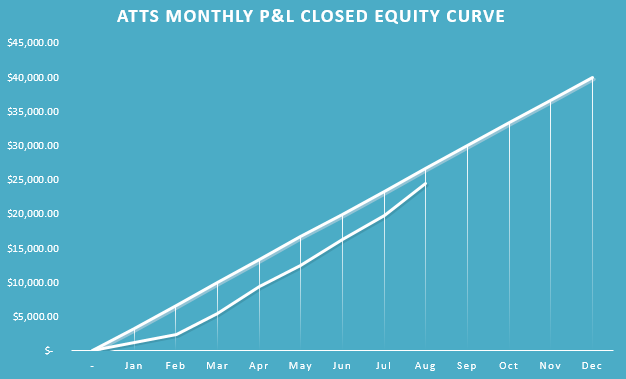

ATTS Returns for 2016 through Sept 2, 2016

Percent invested initial $100K account: Strategies I & II invested at 0.0%; Strategy III invested at 25.98%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -895.75 or -1.27%

Strategy II: Up $3187.00 or +3.18%

Strategy III: Up $22028 or +85.6%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update first week in September.

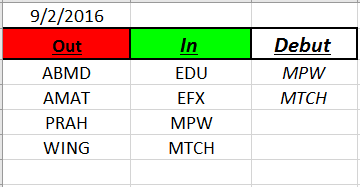

Outs & Ins: MPW and MTCH make their debut on the IBD 50 this weekend. MTCH has a better looking chart than MPW both are consolidating. I expect many stocks on the IBD 50 and 2016 Running List to base through the remainder of September and then set up for a run during the last quarter of the year.

GIMO, SSTK, LGIH, STOR, BABA, PAYC, COR, WOR, IGT, TEAM and EDU deserve to be on a long watch list moving. ULTA appears to be breaking downs and may provide a short opportunity on market weakness.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.