Good Day Traders,

Overview & Highlights: Our thoughts and prayers go out to the people of France as they mourn the deaths from the cowardly terrorist attack by Islamic radicals on Friday evening. Attacks on sovereign soil is an act of war, I hope the US government acts appropriately in the face of this escalation!

The Website performance page was updated and shows current information. Additionally a new video updating the performance to date of the Early Warning Alert System was recorded and is available at: https://activetrendtrading.com/early-warning-alerts-2/

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Nov 20, 2015.

Register Here: https://attendee.gotowebinar.com/register/8432551967706053890

Next Training Webinar: Nov 18, 2015

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Finish 2015 Strong—Prep for 2016

_____________________________________________________

Managing Existing Trades:

Strategy I: Currently 1 open trades.

Trade 1: Bought 300 shares of YY for a pre-earnings run at 57.85. T1 = 62.18 and T2 = 66.52

Hard Stop at 55.50 and this trade will be closed prior to the close on 11/11 the day of earnings. The confirmed earnings date is Nov 23 AMC. If the market continues to weaken I will tighten my stop to just below Break Even.

Strategy II: No Open Trades

Wealth & Income Generation Strategy III Trades: If the value of the underlying Long Options plus the premium profit from selling weekly options approaches 100% on any trade I will close the position and open a new position. With the IWM trade below because there is only 9 weeks until the long positions expire, I will look to close the total position if return approaches between 30-50% profit.

Trade 1: Long IWM Jan16 127C & 127P – With the market Falling I will look for Weekly Call Premium to sell. There is only 9 more weeks to trade this Option pair. If the market drops significantly the value of the long Put option will increase. If the combination of value in the long position plus value of premium collected hits between 30-50% I will close this position and open a new position using 2017 LEAPS. Finished this week with $523 in premium cleared.

Trade 2: Long TSLA Jan17 250C & Long Jan17 220P – Finished the week with $180 cleared.

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/ .

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: Watching the following stocks for Pre-Earning Runs: AMBA, YY, AVGO and QIHU.

_________________________________________________

Potential Set Ups for this week: If you do not trade to the downside then if the market continues to drop start preparing a list of potential stocks you want to buy when the drop is over. With the current market weakness I will be primarily focusing on short side trades with options on the Index ETFs and Strategy III trades.

Upside: No Upside Candidates.

Downside: ALK, NKE, TSLA, NFLX, AAPL and JBLU.

Toss Ups: PAYC, AHS, XRS, FB, DATA, HAWK, INCY, TSEM and VDSI

Leveraged Index ETFs: Waiting for New or Second Chance signal. Highlight video of results YTD will be posted this week.

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: Early Warning Alerts Update Video or at https://youtu.be/aVE9zqbG4MQ

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

General Market Observation: Friday’s selloff was not connected to the terrorist attack in France. As Mike and I have been highlighting for several weeks the breadth of the market stinks and the participation rate by leading stocks is also sickly. I thought it quite interesting that there are only 8 stocks currently propping up both the Nasdaq and S&P. If these stocks start to fail standby for the downside to accelerate.

How will the terrorist attack effect the market on Monday morning? To get an idea I’ll be watching both the Asian and European markets to see how they react. Just looking at the charts and not listening to the news, technically each of the Tracking Indexes have either closed below or at their 50 day moving average. The velocity to the downside picked up last week on Thursday and Friday. The weekly charts on the indexes confirmed this acceleration.

SPX: Based on the weekly chart the S&P moved dramatically to the downside and rest at the 2020 support level. Friday’s prices closed at the 38.2% Fibonacci Retracement from the low on 9/29 to the high on 11/3. The S&P appears to be putting in a classic lower high bearish formation which often time lead to a deeper correction. At this point I will be looking for any bounce towards the mid-section of the weekly candlestick as a potential downside entry.

Preferred: SPY, UPRO and SPXL

NDX: The Nasdaq 100 finished Friday just above the 50 day EMA. Like the S&P prices dropped the 8 week Moving Average. The mid-section of the weekly candle becomes a potential trigger for downside trades. I’ll be watching the middle third of the weekly candle stick.

Preferred ETF’s: QQQ and TQQQ

RUT: The Russell finished the week with a Bearish Engulfing reversal signal on the weekly chart. I will look for a bounce to the 1169 level for a potential downside entry. Because this is the weakest of the three Tracking Indexes if price gaps below the 1140 level this would also trigger a downside trade but a move back above this 1140 level would be a stop loss on a downside trade of either IWM or an option on IWM. Traders may consider trading the inverse ETF but remember to keep inverse trades on a time stop of no more than 2-3 weeks.

Preferred ETF’s: IWM and TNA

_____________________________________________

The Early Warning Alert Service has hit all seven major market trading point this year. A new update video will be posted on this service the week of November 8th.

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show Nov 20th

Register Here: https://attendee.gotowebinar.com/register/8432551967706053890

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

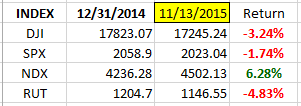

Index Returns YTD 2015

ATTS Returns for 2015 through Nov 15, 2015

12.0% Invested

Margin Account = +12.4% (Includes profit in open positions)

Early Warning Alerts = 10.8%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

- Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

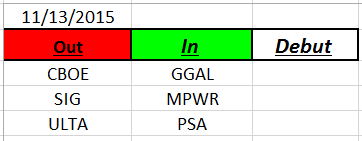

Outs & Ins: No new stocks added to the IBD 50 this weekend. If you want an updated copy of the Running List go to: https://activetrendtrading.com/atts-private-watch-list/ . This section is available to all Premium, Basic, Trial and Early Warning Alert members.

Only three stocks on the IBD 50 are left to report earnings over the next few weeks. These include: DY, MENT and NOAH. Stocks on this week’s list fall into two categories, those extended and potentially correcting and those that are already below their 8 day EMA’s. The ones below their 8 day EMA’s could yield some potential short candidates.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.