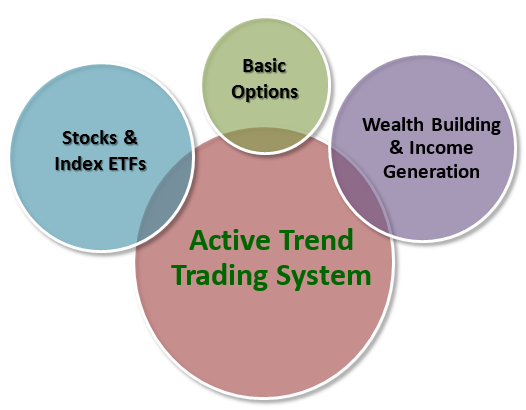

Three Focused Strategies Based on the Active Trend Trading System

The Active Trend Trading System brings together the best pieces of several trend trading systems researched over a five year period. The capabilities of the system have been proven through back testing from 2002 and live trading since 2012. The system is based on the 5 Pillars that make up all great trading systems which include:

- Define what to trade

- Objectively identify when to enter trades

- Objectively identify when to exit trades

- Define what strategies to use

- Define expectation for the system

Each of these pillars are covered in detail on the website at: https://activetrendtrading.com/five-pillars/

The following highlights Pillar 4: Strategies that Active Trend Trading will focus on. Having three focus strategies that are well defined will allow traders to keep capital working throughout the year regardless of market conditions.

Each year we start with $100K trading capital in a margin test account. This account will be divided between the three focus strategies shown on the diagram below. The division and rational for the division follows.

Stocks & Index ETF’s: Capital Allocated: $80K. This strategy is based on trading both long and short positions based on proper entry action points. With this capital we can be invested in up to 4 stocks and one Index ETF with each equally weighted depending on market conditions. The intent of this strategy is to build positions that will potentially be open for several weeks or months. With favorable market conditions we will use available margin. Performance of this strategy will be tracked separately.

Basic Options: Capital Allocated: $10K. These trades will primarily be directional option trades using either puts or calls. More information on choosing strikes prices and expiration months will soon be provided in a short training video. The basic rules for these trades is to buy the appropriate number of contracts with a $2000 maximum limit on each position. Then set a stop loss at 70% of purchase price and profit targets at T1 = 30% above purchase price and T2 = 50% above purchase price. These trades will tend to be of a shorter duration lasting from a few days to a couple of weeks. Performance of the option strategy will be tracked separately.

Wealth & Income Generation: Capital Allocated: $10K. This strategy will focus on Index ETF LEAPS (Long-Term Equity Anticipation Securities) and then selling weekly options against these positions to achieve two objectives. Each week a new weekly option will be sold as part of a simple diagonal spread. First objective: Reduce cost basis of the LEAPS to zero. Second Objective: After reducing the cost basis continue generating capital for wealth building or generate cash flow for income. These trades will last a minimum of 6 months and a maximum of 24 months. Performance of this strategy will be tracked separately.

As stated, the performance of each individual strategy will be tracked separately and cumulatively for the total system. Additional details will be provided during the month of June 2015 explaining exactly how both the Basic Option and Wealth & Income Generating strategies will be traded.