Good Day Traders,

Overview & Highlights: I came back from the vacation nursing a very bad cold. Aches, pains, fever, the whole nine yards. I was able to muster enough strength to present at TSAA-SF on “Patterns for Profits” yesterday. I’ll be presenting on this topic on a future Mid-Week Training session. The concepts fit the ATTS very well.

I was pleased to receive several emails from members saying how using the 8 day EMA trigger for entries has provide them with some follow on great gains on both stocks on their watch list and Index ETF’s. Well done!

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on October 30, 2015.

Register Here: https://attendee.gotowebinar.com/register/5471915698827683329

Next Training Webinar: October 28, 2015

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Trading the ATTS with Enhancements

_____________________________________________________

Managing Existing Trades:

Strategy I: Short 100 shares of IWM. Profit Target T1 = 110.50 and Stop Loss at 116.40.

Strategy II: No Open Trades

Wealth & Income Generation Strategy III Trades:

Trade 1: Long IWM Jan16 127C & 127P – Waiting for Entry Signal for weekly call and put. Closed out 7 contracts of the Oct4 116.50C clearing $378 for the week.

Trade 2: Long TSLA Jan17 250C & Long Jan17 220P – Booked $327 in cash flow for the week by double dipping against the 250C positions. This meets our objective of $305 on the total long position. Waiting for the next set up.

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/ .

I posted a video about how to choose the weekly options to short for this strategy. can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: Earnings over the next 3 weeks will remain heavy. AAPL reports this week on Tuesday so that could move the indexes prior to the Fed! EPAM, JUNO, and FIT may provide setups for a pre-earnings runs. Earnings are 11/4 AMC for EPAM, 11/10 AMC for JUNO and 11/2 AMC for FIT so exiting prior to this would be the objective with a 5%-10% gain.

_________________________________________________

Potential Set Ups for this week: With the SPX and NDX powering up this week several stock are extended from proper buy action points at the 8 day EMA. The trend is short term up so look for stocks that are breaking from good patterns with prices around the 8 day EMA.

Upside: FB rallied in concert with GOOGL Friday. Watch for a pullback to around $100 earnings are 11/4 AMC.

Downside: NFLX and CUDA look weak.

Toss Ups: PANW, HAWKS and VIPS.

Leveraged Index ETFs: Waiting for New or Second Chance signal.

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

General Market Observation: Last week I asked if the psychology in the market had changed to a more positive outlook. It seem with last week’s action on both the S&P and NDX this may be the case. The Russell is still “tail-end” Charlie so should we be concern that the non-weighted indexes is not rumbling back to the highs of the year? We shall see.

The Fed reports out on Wednesday. With Europe and China putting stimulus into their economy could the Fed dare to raise rates this time around? The first two days of the week should be quite and then the announcement. Many of the Fed hawks are still pushing for a rate rise this year so getting past Wednesday allows the markets to go through this again in December.

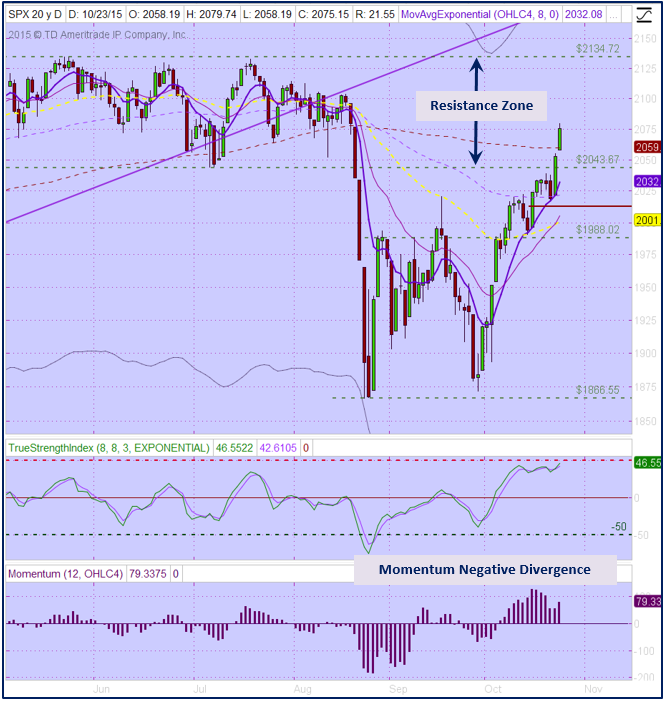

SPX: The S&P has now completed 4 strong up weeks and is back in the resistance zone from mid-year. From March through August price action bounced around from 2043 to 2134 often making the run either up or down every other week. We will see if this action repeats itself now that prices have entered the zone.

Preferred: SPY, UPRO and SPXL

NDX: Big gap up on NDX going along with GOOGL reporting last Thursday after market. The NDX gapped but then stalled forming a spinning top Doji by the end of the day. This is not a reversal signal but it is an indecision signal. GOOGL gapped to its high on Friday and then spend the rest of the day giving back the gains. Still counts as a breakout but the selloff could be telling. I guess with GOOGL’s name change to Alphabet it will now referred to as “Alphabet the company formerly known as Google>”

Preferred ETF’s: QQQ and TQQQ

RUT: The Russell is the index that is not breaking past resistance like the other Tracking Indexes. Perhaps the RUT and the NYSE are more reflective of the actual internal health of the markets! Because neither are weighted like the SPX or NDX, a few stock cannot hold these indexes up or make them surge higher. While we will not argue with the strong uptrends currently underway on the SPX and NDX, it is worth noting that the same moves are not going on in the non-weighted Indexes.

Preferred ETF’s: IWM and TNA

_____________________________________________

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show will be back on October 30th

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

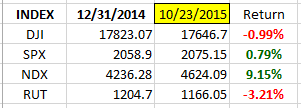

Index Returns YTD 2015

ATTS Returns for 2015 through Sept Oct 25, 2015

20.0% Invested

Margin Account = +8.5% (Includes profit in open positions)

Early Warning Alerts = 10.2%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

- Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

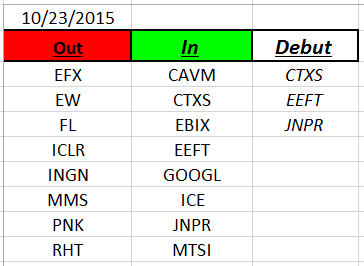

Outs & Ins: CTXS, EEFT and JNPR make their debut to this year’s IBD 50. CTXS and JNPR have been on the list in past years so there reappearing is like a blast from the past. All three have broken out so pullbacks are in needed before they would be viable candidates.

There are still 30 stocks left to report earnings on the IBD 50. EPAM looks best for a pre-earnings run.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.