Good Day Traders,

Overview & Highlights: I will be flying to our old home in Hawaii this week, so this weekend’s report will be shorter than usual. I am interested in opening two positions on Monday. The TSLA trade below and a small position in SIX. The mid-week training and Friday webinars will resume this week for our members. As you know Strategy III is doing very well for the year and with the potential of volatility increasing through the remainder of the year, I will add an additional long TSLA 17Jan Call & Put Strangle thus increasing the amount of weekly premium I will collect. For premium members the details of the expected trade are provided at the bottom of the Strategy III section. The TSLA trade is up over 57% since it was opened at the end of September last year.

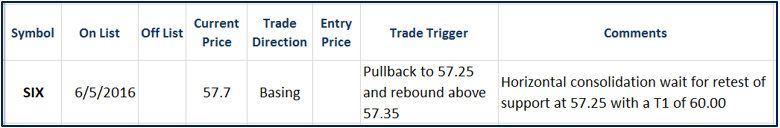

Here is a sample of the weekly stock update I’m working on which will list the stock or ETF along with detail about where to execute a trade. This sample is not a recommendation just a sample of the format I’ll use. My intention is to post a simple table like this providing the basics so members can be better prepared for the week. Member’s feedback would be appreciated.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, June 10th

Register Here: https://attendee.gotowebinar.com/register/6740381586676275713

11:30 a.m. PDT

Next Training Webinar: June 8th

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Is it Me? Trading Psychology

Managing Existing Trades: Positions open for 3 strategies.

Strategy I Portfolio Building: Long 100 shares of TZA

Bought 200 shares of TZA at 41.60

T1 = 5% -10% to close 100 Shares

T2 = Attempt to hold remaining shares up to earnings and then close

Stop Loss = Will hold and sell weekly covered calls on remaining position to reduce cost basis while waiting for the Market downturn. Will hold for 8-10 weeks

Hit T1 sold 100 shares at 43.79 for a gain of 5.26% or Profit of $219.00

Strategy II Income Generation:

TZA Trade: Sold 1 contracts of TZA 10Jun 37.5C at 0.44—Potential Profit $44

Thus far $66 has been cleared to reduce cost basis of the TZA position. If we get a pullback in the market this week will keep a very tight stop on the contract sold for this week.

Speculative Trade going on VXX – This position will be closed this week for a loss due to volatility staying low!

Opened speculative trade with the expectation that volatility will pick up between now and June. Bought 5 contracts of VXX Jun 19C at 1.42

Will let this trade play out over the next 4-5 weeks. I will close out 3 contracts at 2.84.

I will monitor volatility for a potential trade when VIX turns around. Right now there is very little fear in the market place!

Strategy II stocks of interest for this week: TSLA, SPX & Index ETFs.

For members wanting to better understand this Strategy there is a very good training video at: https://activetrendtrading.com/basic-option-strategy/

Strategy III Wealth & Income Generation Trades: Two Foundational Positions are in place to sell weekly options against. The recalculated weekly revenue needed from these foundational positions was forward in an update report earning last week. My objective with this Strategy is to collect enough weekly premium during the life of the LEAPS Strangle on both SPY and TSLA to both pay for the capital invested and gain between 50% – 100%.

Tip for Experienced Option Traders: Occasionally after a weekly trade goes against me but the trend appears to be changing I will add one naked contract over and above my foundation position and close this out after it gains at least half of the premium I’ve collected. Doing naked options is not for everyone and I keep my risk small by only doing one contract above my covered limit. In other words, if I can sell 4 contract covered by my long leaps I’ll sell one additional. This helps hedge the losses a bit but it this tactic is not without risk and must maintain a tighter stop than I would normally use with the regular position.

Note: We do our best to get both text alerts and email alerts out in a timely manner, occasionally there will be trades that are missed because of delay in the Text or Email alert applications. Additionally, please double check with your broker to assure they allow spread trades like we do with Strategy III. Some do and some don’t.

Strategy III Weekly Results Week ending 5/27:

SPY: Profit + $164

TSLA: Profit + $366

Trade 1: Foundation Position is 4 contracts of SPY Jan17 205C and 4 contracts of SPY Jan17 200P Current Trade—Currently Up 12.82%; Premium Collected since opening trade on 1/4/16 = $4418.

Sold 4 contracts of SPY 10Jun 210C at 1.08—Potential Profit $432

Trade 2: Long TSLA Jan17 250C & Long Jan17 220—Current Trade—Currently Up 57.59%; Premium Collected since opening trade on 9/28/15 = $11,515

Sold 1 contracts of TSLA 10Jun 217.5C at 4.20—Potential Profit $420

With Strategy III continuing to do well for this year, I will add to the TSLA long positions. I will buy one contract each of the 20Jan17 220P and 210C for at a cost of approximately 60.33 or $6033 for the two contracts. I will then sell 2 contracts per week on either side of the long Strangle. Note that the one of the long options for this new position will finish in the money and thus add to the return on January 17th. I’ll start a new table to track this trade.

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: Retail stocks will start to report earnings soon to close out the current earnings season.

Pre-earnings trades can be a great supplement to the portfolio building portion of Strategy I. Depending on the stock and technical analysis they tend to be predictable and repeatable. For busy traders focusing on pre-earning opportunities can free one up from the necessity of constantly chasing stocks during other periods of the year. The process repeats four times a year and capturing a 5%-15% return four times a year can compound very nicely!

Potential Set Ups for this week: The June Fed meeting is on the horizon so stocks may maintain a holding pattern waiting to see if the Fed raises rates. What kind of a catalyst might that be? One observation over the past few weeks is that many stocks are showing ‘V’ bottoms. This type of bottom tends to be weak and can provide some violent correction once the momentum starts running out. Because of this we need to adjust expectations for returns on individual trades to smaller profit targets and tight stops. 5% – 15% are great objectives for initial targets and if hit setting breakeven stop losses is prudent.

Upside: COR (a slow but steady mover), V, MA & SIX** (Alert out on SIX).

Downside: Short term downside trades on SPY, QQQ, or IWM. The inverse Index ETF’s may provide some short term trades if the market pulls back this week.

On the Radar: Stocks & ETFs that could go either way include: UPRO, SPXU, TQQQ, SQQQ, TNA, TZA, TSLA (270 resistance/140 support), NFLX, BIDU, MA, V (Visa may provide some upside opportunities because several companies like Costco are transitioning from American Express to Visa), LNKD, BABA, OLLI, NOAH, CRM, AMZN, FB and AOS.

Stocks identified by ** that are close to a potential entry point.

Early Warning Alerts for Leveraged Index ETFs: Waiting for Second Chance Entry trigger and Alert reset.

A downside trade for TZA triggered on 5/17 and a courtesy alert was sent to all EWA members. I plan on holding this position until July 1st or until price hits $55. During this time rather than a stop loss I will sell weekly covered calls. A major reason of choosing TZA is that it has weekly options which provides the opportunity to collect premium while price oscillate. Going forward Mike will trigger the long EWA alerts and I will trigger the short side triggers as courtesy alerts to members.

The Early Warning Alert Service hit all eight major market trading points in 2015. See this brief update video for more details: Early Warning Alerts Update Video or at https://youtu.be/GJwXCL4Sjl4

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

General Market Observation: Two weeks ago the Tracking Index bounced and ran up hard for a week and then the SPX and NDX spent last week moving sideways just below strong resistance. The RUT pushed higher until finally slowing down on Friday. Both the NDX and SPX look like a pullback is in the offing and may take place this week. With the extremely poor Jobs Report Friday the odds of the Fed raising rates at the next meeting have dramatically diminished despite the saber rattling over the last few weeks by the Fed Presidents!

The Fed meeting is a wild card because now the potential of negative interest rates may come into play. Is it even legal for the Fed to go to a negative interest rate? Regardless the minor rise in rates last December provides at least one silver bullet and there is a potential of more QE. Either of these action would potentially provide a path for easy money that could continue propping up the market. At present the Fear Index as measured by the VIX is remaining low so the bias for the market remains up even if we get a 2-5% pullback between now and the Fed meeting.

At this point the Indexes and several stocks have had a great two week run, which may start coming under pressure requiring a reversion to the mean of the moving averages.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:30 a.m. PDT. I’m looking for the best time to offer this webinar. I want to try closer to the close on Friday to see how that works out for potential trades going into the close. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, June 10th

Register Here: https://attendee.gotowebinar.com/register/6740381586676275713

11:30 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

– The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

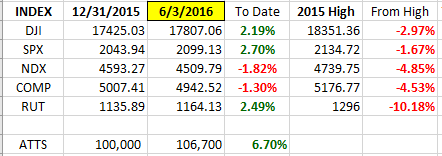

Index Returns YTD 2016

If the Indexes are slipping off the ledge we could see a retracement to yearly lows in the short term of a few weeks. DJI, SPX and RUT have pushed into positive territory for the year. NDX and COMP made progress for the week but are still negative for the year.

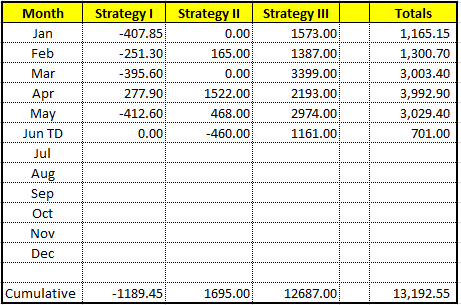

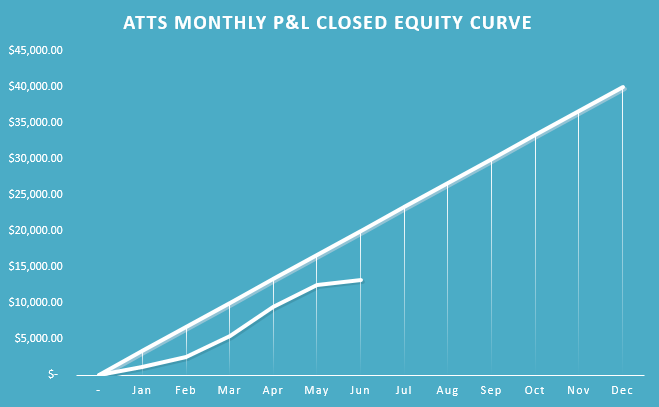

ATTS Returns for 2016 through May 27, 2016

I’m pleased how the ATTS system has shown growth every month of the year thus far. We are managing Strategy I which encompasses portfolio building well because thus far this year it has not been a great portfolio building year. The quick hitting option trades of Strategy II are working along with the steady Income & Wealth objective of Strategy III.

Percent invested $100K account: Strategies I & II invested at 3%; Strategy III invested at 20%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -1189.45 or -1.6%

Strategy II: Up $1695 or 16.95%

Strategy III: Up $11526 or +63.4%

Cumulative YTD: 13.2%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

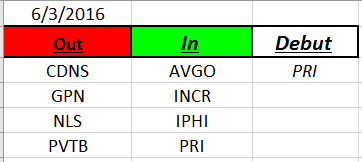

Outs & Ins: PRI was added to the IBD 50 this weekend.

Most of the stocks on the list look ready for a pullback or consolidation. Potential candidates this week. Downside: SWHC. Upside: EW, FB & AVGO. Pre-Earnings: INCR

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.