Good Day Traders,

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. Please let others know about this great webinar! You can either join live or catch the replay on YouTube.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/3355658179818034433

For Premium Members our Wednesday evening training is developing some fantastic traders

Mid-Week Market Sanity Check Topic: Simplified Analysis of Stocks & ETFs

_____________________________________________________

General Market Observation: What are the differences and similarities between the current correction and past corrections? This is an important question technical analyst must ask in order to search for clues and then assign probabilities to potential outcomes. Over the past 4 years all corrections have had a similar characteristic. They have been short in duration and shallow in magnitude. Is the current correction different? It certainly seems this is the case. This evident when we compare current action with past corrective action. The last correction in October 2014 was larger than the previous correction but it took place with the longer term moving averages heading up. A steep 4 week dive followed by the move up from mid-October the highs of this year. This time the downside is of greater magnitude and the moving averages are no longer supportive of an uptrend. Even the 200 day moving average has a downward pointing slope. The current topping action is more reminiscent of 2011 or 2008 which both led full-blown Bear Markets. Will the same story workout currently at this point no one knows. The bulls are saying it’s time to buy and the bears are waiting for a new selling opportunity. With the huge swings profits can be made on either side of the opinion but timing is everything.

There was a lot of hoopla about the big up day on Wednesday, but as we learned on Friday 6 out of 10 of the biggest up days in history took place in the midst of a Bear Market. So how do we trade the current market? For stocks look for stocks showing strength by being above their 50 day moving averages and then wait for proper patterns. For the Index ETFs wait for bounces at support and resistance and trade up or down accordingly. As of this report Dow Futures are down about 200 points so it appears the swings are not over! With this level of volatility the safest position is to be mostly in cash and waiting for order to return. No one has to trade just because the market is open!

SPX: As with each of the Tracking Indexes the S&P finished with a gain for the week. The weekly chart below shows a huge hammer reversal candle. If price drop below last week’s body at 1965 then a test of the wick is underway and prices could fall all the way to the 1865 level. On a daily chart the 50 day has now crossed the 200 day moving averages or is close to doing so depending on the type of moving averages used. This is called a Death Cross and considered very bearish. What kind of trades should we be looking for on the SPY? Well one can use the SPX to trigger trades on the SPY by using a move below the body of the Hammer on the SPX as a trigger to enter a put of short the SPY. If one will check out the SPY weekly chart they will see that the SPY does not show a hammer but more of a large bullish candle. This is one reason I sometime use the SPX to trigger trades if there is greater detail on triggering a trade and then use the SPY if there is more definable clues there. If one wants to take clues from the SPY chart then use the low of week before to trigger a downside trade. On the SPX that level is 1969.

Preferred ETF’s: SPY and SPXL

NDX: From low to high the Nasdaq 100 moved over 14% last week. This index is the strongest of the three tracking indexes. It too was up for the week and made it back to the 61.8% Fib Retracement. If price action weakens here and a price moves below 4200 then a retest of last week’s big candle is underway. A natural level of support tends to linger around the midsection of all large magnitude candles. The midsection of last week’s candle resides at the 4063 level. For the NDX go to the daily chart and use Friday’s spinning top for potential bearish entries.

Preferred ETF’s: QQQ and TQQQ

RUT: The Russell is the weakest of the three indexes, but may have the most to gain if interest rates are left untouched at the September FED meeting on 9/17. Like the other indexes the RUT now has a strong level of support identified. Any retest between 1107 and 1133 might provide a platform to bounce from. A break below 1152 would be provide a downside trade trigger.

Preferred ETF’s: IWM and TNA

_____________________________________________

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, Sept 4th

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/3355658179818034433

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

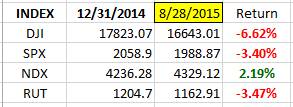

Index Returns YTD 2015

ATTS Returns for 2015 through Aug 28, 2015

7.0% Invested

Margin Account = +2.4% (Includes profit in open positions)

Early Warning Alerts = -0.78%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated at the beginning of each month.

Managing Existing Trades: No Strategy 1 or 2 trades open.

Special Trades: Wealth & Income Generation Strategy 3 Trades: Only the Call option leg of this trade is currently filled. I am short 7 contracts of the IWM Sep1 117C at 0.63 which equates to $441. A GTC order to buy back this leg at 0.10 is in place.

I’m working on the report to post for this strategy to cover lessons learned and current status. The spreadsheet is complete and the report will be complete tomorrow.

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: No Pre-Earnings Trades. AMBA reports on 9/1 AMC so movement in both AMBA and GPRO may add some fireworks for the week.

_________________________________________________

Potential Set Ups for this week: Over the past three years the indexes have started a substantial rally in October after lackluster August and September performances. With last week’s meltdown August was a bust for bulls and we shall see what is in store for September. One stock that I want to add to my holdings is TSLA. At a proper buy point I want to either buy shares or buy a 2017 LEAP on this stock and then sell rich weekly premium against the position. As this trade sets up I will post how I’m trading to both Premium and Special Trade members.

Last week’s price action left many stocks on the watch list with lower lows that have bounced to potential lower highs. The drawback on many of these candidates it that the price action for bear flags has not been orderly. On several of these candidates they are currently testing various moving averages from underneath so if price start to show signs of stalling these may be shorting candidates. From what’s showing up in the pre-market futures market it does look like high volatility and big swings will continue this week. I’m honing down to just a few stocks for the candidate list. With the big swings going on focusing on just a few will enhance the potential of spotting proper entry points without the distraction of volatility noise.

Upside: Most stocks are showing potential for forming a lower high classic failure pattern. Other than looking for a long term entry on TSLA no other stocks jumped out for an immediate long trade.

Downside: I like PANW, DATA, CYBR and BIDU to the downside.

Toss Ups: SWKS, PAYC and CUDA are all showing signs of going either way and basing.

Leveraged Index ETFs: With the increasing volatility buying put options on non-leveraged Index ETFs from good set ups is OK. If we get a set up bounce I will go long the Leveraged Index ETFs not the options.

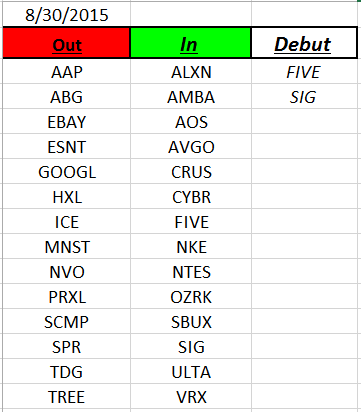

Outs & Ins: FIVE and SIG make their debuts on the IBD 50 this weekend and AMBA reclaims the top spot on the list. AMBA reports earnings on 9/1 AMC. FIVE is a stock worth watching so I’m moving it onto one of premium list.

As can be seen by the wholesale swap out on the IBD 50 this week volatile times tend to do this to the list. Focus in on stocks that are above their 50 day with healthy patterns. Currently 26 out of 50 stocks are above their 50 day moving average.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: “If only I would have!” We traders can get caught up in the “would have’s”, “could have’s” and “should have’s” very easily. We see a big day down and up like last Monday and we get the calculator out and say “If I would have only been ready at the bottom! Look what I could have gained!” While the statement is partially true it is more deception than truthful. The fact is moves like last Monday can neither be anticipated nor captured accepted by pure luck! These large moves down and then up are almost like a tough market laughing at us and mocking us! Depending on where we are in our trading journey we can blow it off or take it personally like we messed up. Those who choose to blow it off understand the function of probabilities. If we continuously do the right thing enough times the action will pay off.

I have a friend who is a straight value investor who thinks technical analysis is worthless. He told me this weekend that he had place buy-stop order several months ago buy certain stocks if price fell. He slept in the day the market plunged and when he got to the market found that many of his orders had filled. He had an exceptional week and I’m glad for him. The funny thing was now that it happened he was pondering about what to do now because he had no exit strategy. Because of his one day success does it mean I’m going to abandon what I do? No way because in the long run I know my system is better than his based on long term performance. My friend average return per year after decades of investing is about 6-8% per year and mine is closer to 27% per year. Like the old adage goes, even the blind rooster occasionally finds the hen house. I’d still rather see where I’m heading than being in the dark relying on what I think something is worth. But that’s just me…

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.