Good Day Traders,

Overview & Highlights: I’ll be back to the office later this week, but will continue to monitor the market from the road through Wednesday. There was no “On the Radar” Report this weekend because there were no immediate set-ups. On the Radar, will only come out when there are solid potential entries shaping up.

Upcoming Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness. With guest from around the world you get a great Global perspective.

How to Make Money Trading Stocks on Friday, Feb 10th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/7562489734728631809

Time 11:00 a.m. PDT

Next Training Webinar: Feb 15th

For Premium Members, our Wednesday evening training is developing some fantastic traders

Topic: Conditional Orders and Target Shooting Entries

** Friday’s “Final Hour”: Feb 10th **

Time 12:00 p.m. PDT

For Premium Members, provides trades and set ups during the final hour of weekly trading.

Managing Current Trades:

Strategy I Portfolio Building: Long IDCC at 92.30 on 1/25

Stop at 5% or close below 8 day EMA

Profit Target T1 = 7%

Profit Target T2 = 15%-20%

Strategy II Basic Options: No Open Positions

For members wanting to better understand this Strategy there is a very good training video at: https://activetrendtrading.com/basic-option-strategy/

Strategy III Wealth & Income: Foundation positions are open in SPY, TSLA and NUGT. Total capital for Strategy III = 30% or $26.6K.

SPY: Waiting for setup at the upper or lower Keltner Channel on the weekly chart

TSLA: Waiting for setup at the upper or lower Keltner Channel on the weekly chart

NUGT: Waiting for setup at the upper or lower Keltner Channel on the weekly chart

Results from last week:

SPY: Profit = $185

TSLA: Profit = $556

NUGT: Loss = -$138

Tip for Experienced Option Traders: Occasionally after a weekly trade goes against me but the trend appears to be changing I will add one naked contract over and above my foundation position and close this out after it gains at least half of the premium I’ve collected. Doing naked options is not for everyone and I keep my risk small by only doing one contract above my covered limit. In other words, if I can sell 4 contract covered by my long leaps I’ll sell one additional. This helps hedge the losses a bit but it this tactic is not without risk and must maintain a tighter stop than I would normally use with the regular position.

Note: We do our best to get both text alerts and email alerts out in a timely manner, occasionally there will be trades that are missed because of delay in the Text or Email alert applications. Additionally, please double check with your broker to assure they allow spread trades like we do with Strategy III. Some do and some don’t.

Additionally, it is crucial when selling premium against the Long LEAPS position that the premium collected cover the weekly cost of holding the LEAPS plus an additional amount to over this amount as a gain. This is one of the reason I sell premium of weekly options that are close to be “At the Money”. I base my selling on the expected move during the next week. If one is not bringing enough weekly premium this trade will not work out as well and may wind up being a losing trade.

Several members have asked about this strategy and a more detailed explanation is available in this updated video at: https://activetrendtrading.com/wealth-and-income-strategy/

I posted a video about how to choose the weekly options too short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally, some of these trades may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Early Warning Alerts for Leveraged Index ETFs: Last Trigger: 11/4—Waiting new signal or secondary trigger.

EWA Account Return for 2017: 0.09%

The Early Warning Alert Service alerted on all market lows in 2016. See the link below for the new video for 2016 that highlights entry refinements that will provide improved entries even in environment like 2016. In 2016 the entry triggers were challenging because of the number of straight off the bottom moves. Mike and I have analyzed this and have tested adjustments in place going forward.

EWA 2016 Update Video: https://activetrendtrading.com/early-warning-alerts-update-for-2016/

Potential Set Ups for this week: The strongest growth stocks for the week are IDCC, NVDA, UBNT, ESNT and THO. NVDA, ESNT and UBNT have earnings this week and are extended away from proper buy points. Each of these will report on either the 8th or the 9th. IDCC reports on 2/23 so a pre-earnings bump would be excellent and potentially provide a profitable exit for at least a portion of the current open position. I will not hold over earnings unless there is a 10% profit cushion on IDCC. THO is pushing sideways on low volume and holding the 8/20 moving average combo.

TSLA reports earnings on the 2/22 AMC. Prices bounced off the 8 day today but didn’t take out the highs at the 258.46 level. Prices may continue to push higher into earnings watch for a pullback and bounce around the 254 level for potential long entry.

The uptrend in NUGT strengthened today and this run may go through the end of February or mid-March. I’ll use the intraday 60-minute chart to time a potential entry to the long side. Keeping an eye on the oil ETF USO for a bounce towards the end of February and TZA if the Indexes soften per historical norms mid-February.

General Market Observation: Will the Post-Election historical weakness show up this week? Since the election, the 3 Tracking Indexes has followed along historical norms and if this continues a healthy pullback should begin soon. This doesn’t mean the market is going to crash because at this point the catalyst for a major failure are not totally in place. However, a pullback lasting through the end of March would tell us that Indexes are following the historical price action and provide healthy long opportunities about 6-8 weeks from now. We shall see.

Today’s action was mixed with only the NDX showing positive price action for the Tracking Indexes. The SPX and RUT were down for the day but showed no signs of a major drop. The SPX continues to work within a trading ranged bracketed between support ant 2260 and resistance at 2300. The Island Top formation is still valid marking the top level of resistance. Because we know the historical price action for a post-election market tends to sell off in February, if price gets near resistance opening a partial bearish position would be reasonable. To maintain a simple approach, I would look to open this position in the Russell inverse leveraged ETF, TZA. If one choose to trade either SPY puts or SPXU that would also allow downside exposure.

NDX continues to be the strongest of the Tracking Indexes has not pushed to any new highs for over a week. The daily Hanging Man reversal candle from 1/27 is still valid and shows resistance at the 5172 level. Daily and Weekly TSI and Momentum indicators are out of sync. These clues provide no current trade setups so waiting for pullbacks is currently appropriate.

The Russell sold off to the 8/20 moving average combo as price action continues in a price range that is drifting lower. Price action on the RUT may lead the way down if the indexes begin to weaken more.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Feb 10th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/7562489734728631809

Time 11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

Index Returns 2017 YTD

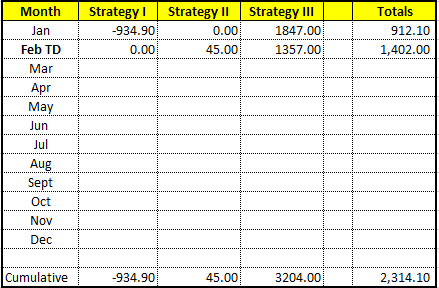

ATTS Returns for 2017 YTD

Percent invested initial $116.6K account: Strategies I & II invested at 13.76%; Strategy III invested at 26.6%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -$934.90

Strategy II: Up $45.00

Strategy III: Up $3204.00

Cumulative YTD: 1.98%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update after first week in February.

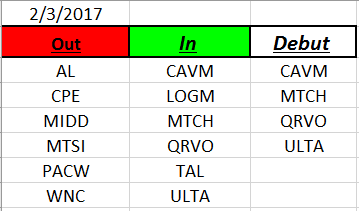

Outs & Ins: CAVM, MTCH, QRVO and ULTA made their debut on this weekend’s IBD 50 list. This is QRVO’s first visit to the list. Each of the inductees are extended at a level of resistance like many of the other stocks on the list.

This week’s sort for the fundamentally strongest stocks resulted in the following list. IDCC, NVDA, UBNT, ESNT and THO. THO is closest to an entry but is not launching off the moving averages. NVDA, UBNT have earnings on the 9th and ESNT following on the 10th. None of these are at a buy point. Watch IDCC for any bounce off the 8/20 moving average combo. IDCC has earnings scheduled 2/23 BMO.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.