Positions and Performance Will be Updated first full week of each Month

Results for 2015

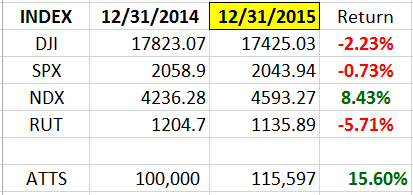

2015 represents the 4th year in a row that the Active Trend Trading System achieved a double digit return. The average return over the past 4 years is 29.09% which provides a compounding effect of 174.3%. Based on our progress enhancements made during 2015 I look forward to strong results fro 2015.

Trading funds used for the Active Trend Trading System are divided between 3 Strategies. A breakdown of the Strategies follows:

Strategy 1: 70% of trading funds dedicated to trading individual stocks and Index ETFs

Strategy 2: 10% of trading funds dedicated to simple directional option trades. Up to 5 different option positions can be open at one time. Trading funds will be divided equally between the 5 positions

Strategy 3: 20% of trading funds dedicated to Wealth and Income Generation using LEAP options on one of the Index ETFs non-leveraged. Then selling weekly options against both a call and put position

In 2016 performance will be broken into the 3 Strategies for tracking purposes

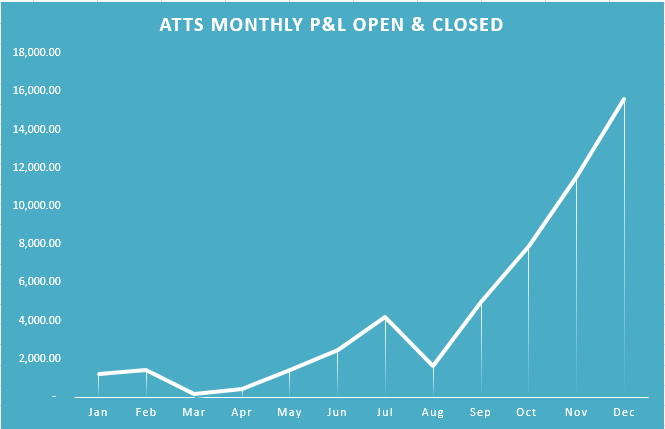

Remember Trading is much like a commission job. Some months are lean and others are amazing–we’ve seen the lean now looking for the amazing! Oct-Nov has yielded almost 4% on the Margin account based on very short timeframe trades in Strategy 1 and Strategy 3. The power of the 8 period moving average as a trade trigger on multiple timeframes will be the mainstay of trades for all 3 Strategies.

These results are not a claim that similar results will be achieved by all traders. No system can ever totally incorporate all the variables present in the Market and human factors in following trading rules.

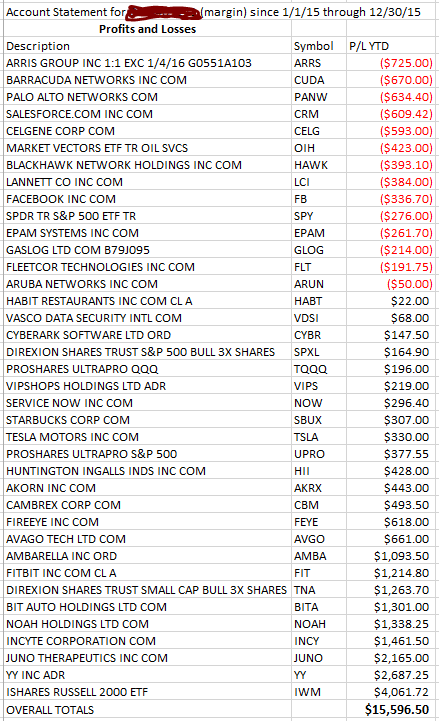

Profit/Loss Since Jan 1, 2015

Through Dec 31, 2015

End of Nov Closing Balance $12,380.02