August 27, 2017

Good Day Traders,

One of my goals for the Active Trend Trading service is to continue refining my processes of providing excellent information to all members. To achieve this objective providing a correct balance of actionable information in both written and video format is important. Moving forward all members will have access to this update that will include editorials from Mike’s Macro Market Musings, the Art and Science of Active Trend Trading Updates (replacing weekly Report).

Actionable Intel, including trigger and alerts will be provided via On the Radar and Final Hour weekly Webinar’s and Videos available to Premium Members. Premium Members will also receive Text and/or Email Alerts on all trade orders used for the 3 Strategies of Active Trend Trading. Plus, mid-week Premium Training on Wednesdays.

Art & Science of Active Trend Trading Update – Waiting for October

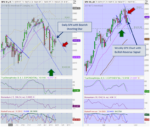

With only 4 more trading days remaining this August, the month has lived up to its historical billing of being the most volatile of the year. The double chart below, showing both a daily and weekly snapshot from August 25th, reveals several areas for focus as price action moves within a downward sloping channel.

First, Friday’s action led to a reversal off the upper channel line which could lead to a slide to the lower channel. Countering the negative Shooting Star signal on the daily chart is a Bullish Piercing Line signal on the weekly chart.

Secondly, notice the lower channel line intersects strong support at the 2400.98 price level. This level was a previous swing high and breakout level. In July price action approached this level 3 times and rebounded.

If this September follows historical norms a weak month can be expected. The good news, is September’s weakness will lead to October’s Bullish setups. Patience, Patience, Patience. Be ready for the move that historically comes around mid-October.

Each of the Tracking Indexes is showing a short-term downtrend and seeking support. Watch for divergence in the momentum oscillators as the seasonal move shapes up. The RUT and NDX typically perform strongest after the October setup. We will be prepared!

Each of the Tracking Indexes is showing a short-term downtrend and seeking support. Watch for divergence in the momentum oscillators as the seasonal move shapes up. The RUT and NDX typically perform strongest after the October setup. We will be prepared!

Running List & Strongest Fundamental stocks on the IBD 50 for August 25th

Look for more earnings excitement next week as other leading growth stock report. Will the market continue to demonstrate a mixed behavior? we shall see!

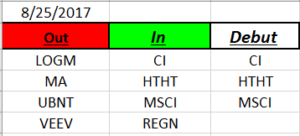

Running List: 173 growth stocks have appeared on the IBD 50 in 2017. CI, HTHT & MSCI were added to the list this week. Each is extended and look prepared to start a pullback. Here is the total Running List, download the full list here: Running List 8-25

Additionally, when the new IBD 50 list comes out twice per week I conduct a fundamental sort which results in the top fundamental IBD 50 stocks being identified. The top fundamental stocks for this week are: BABA, ANET. This sort is provided at: IBD 50 8-25 Sorted

Lastly, to sign up Free Webinars for this week at the GO HERE links below!

After Market Monday Webinar: GO HERE

Making Money Trading Stocks & ETFs Webinar: GO HERE