July 9, 2018

Good Day Traders,

Tariffs took effect last Friday. It appears the market had already priced in at least the initial round. We shall see what takes place from here! Last week was a truncated week with the Independence Day holiday on Wednesday. Both Thursday and Friday were surprisingly strong as the Indexes bounced into the weekend. Each of the Tracking Indexes are moving up towards a previous resistance ceiling with what appears like waning momentum. It would not be surprising to see the indexes rest a bit this week and even pullback some. The move up towards past highs on Monday would support a pullback into the end of the week. Of course the market will do what it wants. This could include a breakout above the resistance ceiling.

Currently the strongest Indexes are the RUT & NDX. I am building a seasonal gold position in GLD & JNUG. I’m waiting for a pullback in oil to initiate a new seasonal position. The seasonal move on either of these commodities is about 10-14% between now and October. Don’t miss the move!

Trend Trading Tips: Noise! Noise! Noise! After a bull market run of over 9 years many of the prognosticators begin to roll out the fact that bull markets only run for 9 years on average. This is noise that the wise trader will ignore in favor of their own analysis. The data on bull markets show that while the average bull market since 1929 has run 9 years. An additional tidbit of information is that there have been no bull market that lasted 9 years exactly. The data on bull markets is grouped into two clusters. The first cluster contains 4 bull market that lasted 6.4 years down to 2.5 years. The second cluster contains 4 bull markets that lasted between 12.8 years up to 15.1 years. The current bull market just past it’s 9th year and the noise making perma-bears are headlining that the market is about ready to fall out of the sky. Why? Because the current bull has reached the average of 9 years. This is NOISE!

Another way of looking at this data shows that the current bull may last for between 3-6 more years. I reach this conclusion by looking at gap between the high of the first data cluster and the low of the second cluster. This gap is 6.4 years from 6.4 to 12.8 years. If history repeats itself with the current bull market there is a high probability of it reaching 12.8 years. The equate to at least another 3 years. Just because none of the past bull markets last only 9-10 years does not mean it won’t happen. But at this point the market has not shown clues that it may be ready to exit the current bull market. I will stay vigilant for any topping signs in the longer term weekly and monthly charts. At this point the horizon looks clear for more upside.

You will never be an extra-ordinary trader until you are willing to do what the ordinary trader won’t do!

Bounce Zones for Premium Members: If you are a premium member some very powerful conditional order setup information will soon be available to complement the “Go-No Go” Table each week. Chart showing zones where traders can expect prices to bounce due to supply and demand pressures. What does this mean for Premium members? Charts of our ETFs and Core Stocks with define Bounce Zones will empower you to place conditional orders around these areas for both entry and planned exits. This will be one more way Active Trend Trading will help Premium Traders with limit time for market analysis. Stay tuned for more on this beneficial feature!

Remember to register for the After Market Monday and Making Money Trading Stocks and ETFs each week. In these webinars I will provide 10-12 stock set ups per year. All Levels of ATTS members will receive these trade email alerts. The NEW Composite Watch List provides a sort of all stocks that appeared on multiple Premium IBD Watch Lists this week. Often appearing on multiple list is a sign of strength and identifies a strong long term candidate. New Composite List Provided Below!

Register here to not miss the BONUS Trades or the ATTS Webinar Invitation list: https://forms.aweber.com/form/33/1084761733.htm

Running List, Strongest Fundamental stocks on the IBD 50 and the NEW Composite List of Stocks showing up on multiple IBD Watch List on June 30th.

Running List: 144 stocks are on the 2018 Running list. Major swap out this week. Find the list here: Running 7-6

When the new IBD 50 list comes out twice per week I conduct a fundamental sort which results in the top fundamental IBD 50 stocks being identified. The top fundamental stocks for this week are: LGND, VNOM, GRUB, & ABMD This sort is provided at: 7-6 Sorted

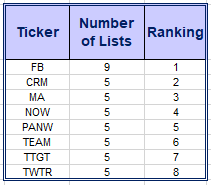

A new addition to the weekly watch lists for Active Trend Traders is a Composite List of IPOs and Growth Stocks appearing on multiple IBD watch list each weekend. When a stock appears on multiple Premium Lists it can potentially be an indication of excellent strength. The stocks on the weekly Composite List may not be at a sound trigger point but may be worth watching for future entries. I will do an analysis of the list looking for price near potential triggers. Stocks near potential triggers will be highlighted. The top stocks appearing on more than one IBD watch list last week are shown in the table below. The Composite List for this week: Composite 7-6