June 22, 2014

Good Day Traders,

Wow, where has June gone? I want to thank everyone who’s been involved with the launch of new services and features at Active Trend Trading. Most of the pieces are in place for the July 1st launch!

If you are a new subscriber to Active Trend Trading, watch for an invitation to the Mid-Week Review Webinar for paid subscribers it will come out Sunday, June 22th.

If there is ever a question about a potential set-up email me at dww@activetrendtrading.com or call me at 808-366-0397 and get clarification!

Remember every Friday at 1:30 p.m. PDT, the Active Trend Traders co-host the free “Market Stock Talk” Webinar. I want to invite you to attend register here: https://attendee.gotowebinar.com/register/4120253058594959106

General Market Observation: The Indexes continue in a Confirmed Uptrend with 2 Distribution Days for the S&P and 1 for the Nasdaq. Things looked pretty good, so nothing to worry about right? Well each of the indexes are extended well above their 50 day moving averages and have started showing some negative divergence in their momentum. This decrease in positive momentum is associated with each Index approaching resistance levels. This observation is very noticeable on the Nasdaq which is back to this year’s highs (see chart below). Additionally Friday’s formation of a Bearish Hanging Man Candlestick patter is providing a clue that momentum is waning.

The Russell has been playing catch up with the other main Indexes over the past few weeks. Notice how price action on this Index has moved in a cycle of 4-5 days up then consolidate or pullback 4-5 days. Friday marked the fifth day up. It may be time to rest and move sideways of pullback to the moving averages.

Next week it would not be surprising to see profit taking at the slightest event that could be perceived as negative for the Market. So far pullbacks have been profit taking opportunities. Whether the next pull back will be the start of the Summer Slump or just a another brief pullback to digest gains remains to be seen.

Summary of Closed Trades: For the month of June we have closed 9 trades. 8 trades have been profitable and 1 trade lost 1.43%. The 8 profitable trades were a combination of both Income Generating Trades and Capital Growth Trades. Working with a margin account of $100K in trading capital the following actual profits have been achieved through the end of the 3rd week in June.

Profit/Loss from Closed June Trades as of June 20th

Income Generating Trades Closed = + $ 3,039

Capital Growth Trades Closed = + $ 1,070

Total Profit/Loss Month To Date = + $ 4,109

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

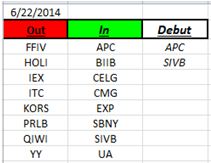

Outs & Ins: APC & SIVB make their debut this weekend to this elite watch list. APC is already well extended so it moves immediately to the “Wait for a Set-Up List”. SIVB is starting up the right hand of a cup formation and a move of approximately 12% is required to reach the past high. It’s early in the move from the bottom of the cup, so one could choose an alternative entry based on a Bull Flag Set-up when one appears or wait for a more a Cup or Cup and Handle Breakout pattern to show up.

Here’s a quick Tech Tip: If a trader is going to trade breakouts, go through the IBD 50 on Wednesday & Monday’s edition look at each of the thumbnail charts and in the comments it list a Buy Point if there is one. Just making this part of your review will make your review quicker and more efficient. A few stocks that were listed this weekend include GILD, MANH, PKG & ALXN.

As I’ve often said that I often find the stocks that are moved out of the IBD 50 more interesting than the stocks that are added to the list each week—thus reason for establishing the Running List each year. By doing a quick sort of the Running List weekly I’ve found many forgotten leaders that were great stocks like DDD last year when it bounced off the 200 day SMA and then went on for a 200%+ run by the end of the year. DDD didn’t make it back on the IBD 50 for about 6 weeks after alternative entry presented itself. When DDD came back on the radar for the List, price had run up over 50% from the alternative entry point of $31.46. Now this type of thing doesn’t happen every time but it does happen all the time.

One of the stocks that exited the IBD 50 this week that looks very interesting is YY. This was on my private watch list and I’ve been waiting for an opportunity to buy. CELG that comes back on the list this weekend is a great example of the power of alternative entries. The paper says “Nearly 5% past 163.60 later-stage cup with handle entry.” This Buy Point is 10% above the alternative entry Action Point when CELG retested the 50 day SMA on 5/19/14 a month ago. A Capital Growth trade initiated at the alternative entry would be up about 16% as of yesterday.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: As I write this week’s Art & Science edition I was reviewing the very first presentation of the year for the Bay Area Money Makers and came across a great quote from Gary Ryan Blair. Now in reality I don’t have a clue who Gary Ryan Blair is other than I know I really related with his quote!

Rediscovering this quote from the beginning of the year seems very timely considering all we’ve been doing to enhance the Active Trend Traders. At the beginning of the year I had no clue that 6 months later Active Trend Trading would be doing what it’s doing today. I thought it would be a nice add-on to the Bay Area Money Makers—but it has turned out to be so much more. Personally I’ve learned a lot about how to code websites, about how to use many tools that I never knew exited a few months ago. Made new providential business collaborators and gained a whole lot of new friends.

While the level of effort is comparable to the work I did in Grad School when I completed two degrees in a brief 21 months stay at Cal, hearing the great stories of how our efforts have positively impacted so many of my friends makes the late nights and early hours more than worth the effort.

So what was the quote from Gary Ryan Blair that seems so perfect for today? It’s this:

“Do more than is required. What is the distance between someone who achieves their goals consistently and those who spend their lives and careers merely following? The Extra Mile

And yes, this also applies to becoming a Master Trader. Remember we’re in it together!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks!