Good Day Traders,

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. Please let others know about this great webinar! You can either join live or catch the replay on YouTube.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/3119307160590094849

Next Training September 16, 2015

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Pinpoint Entries

_____________________________________________________

General Market Observation: To raise or not to raise, tis the question! On September 17th the FED provides their decision on raising interest rates by ¼ of a point. The opinions on what will happen with the indexes is split just and the opinions of whether they will raise rates are split-about 50-50 currently. Regardless of what the decision the fact remains that the character of the tracking indexes has changed and the long term trend has been broken. Since nothing has really changed with weakness worldwide and government’s attempts to prop up their own markets having nominal effects, will down provide the path of least resistance? While there may be more up prior to more down it will be an interesting week! We will seek light exposure in both direction and will maintain a cautious approach waiting for the FED.

Just in case a “Sucker’s Rally” is in the cards, I wanted to highlight a chart with one variation of a Bull Trap. This is an excellent pattern to be watching for because it is applicable to the indexes and many growth stocks when breakouts fail. Another form a Bull Trap is where price breaks below and established uptrend line and then bounces back towards it and then fails. These related price patterns need to be part of each trader’s pattern portfolio.

The flip side of the Bull Trap is the Bear Trap. The chart below provides one version of this type of pattern. One thing to remember for this pattern is that a Bear Trap takes place after a sustained downtrend and not after the first plunge down. Bear Traps try to trap the Bears before the beginning of a new uptrend, just like Bull Traps try to trap the Bulls before the fall.

SPY: The S&P is stuck between resistance at 1993 and support at the 1866 level. The chart below shows that the big Hammer Reversal signal is still valid but not yet confirmed. The three dashed lines show level of resistance that may thwart a price advance. These dashed lines are not the expected trajectory. If recent wide price ranges continue to be the daily and weekly character each of these levels could be reached quickly. So placing an alert that also sends out an email is a wise preparatory action. This action will ensure a traders are ready to take action if prices start to stall at any of these significant levels of resistance. Follow this same technique to identify support where potential bounces may occur.

SPX: Preferred ETF’s: SPY and SPXL

NDX: The Nasdaq 100 has also broken its long-term uptrend line and is bouncing and stalling at current levels. Take similar actions to what was done with the S&P. Identify levels of both support and resistance and if those levels are reached watch for indecisive or reversal candles. The first level of resistance is at 4343 with the next on being just above the 200 day moving average at 4385. The NDX is the strongest of the three Tracking Indexes.

From a moving average view prices are currently showing what will be either a bearish squeeze which will lead to more downside or the first attempts at a basing pattern which may lead to a renewed uptrend. The path of least resistance at this point is still down even after a relief rally.

NDX: Preferred ETF’s: QQQ and TQQQ

RUT: The Russell is still down over 10% from the highs of the year. If the current attempted rally continues the next levels of resistance are at 1169 and then 1188. The weekly chart shows that TSI has had a positive cross from an oversold condition. In an ideal trading environment price would put in a controlled move up forming a Bearish Flag. Unfortunately this has not been the character of this index recently. Until order returns identify the support and resistance levels and plan trades at those levels. The 1 hour Intraday charts may be one’s best chart to actually plan the trade. The key wait for the reversal signals and resist over anticipating the reversals. Keep stops close and profit projections realistic.

RUT: Preferred ETF’s: IWM and TNA

_____________________________________________

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, Sept 18th

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/3119307160590094849

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

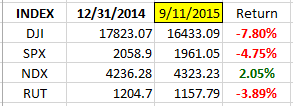

Index Returns YTD 2015

ATTS Returns for 2015 through Sept 11, 2015

10.0% Invested

Margin Account = +3.4% (Includes profit in open positions)

Early Warning Alerts = -0.78%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

Managing Existing Trades: No Strategy 1 or 2 trades open.

Special Trades: Wealth & Income Generation Strategy 3 Trades: This strategy provides trading and profit opportunities when the market is not providing a significant number of trades in Strategy’s 1 & 2. This past week we booked $270 in profit and have established a position on the Call leg for next week. For next week I am short 5 contracts of the IWM Sep 116.5C which was sold at 0.76 cents. Through Thursday the volatility may increase awaiting the Fed outcome so I’ll will let this trader run within reason. Additionally I will look for a set up to sell Puts prior to Thursday.

My objective is to collect $814 per week to achieve a 50% return on this trade by expiration of the long LEAPS in January 2016.

I have also been running a test run of Strategy 3 with TSLA. Great results so far so I will buy a Jan 2017 Call LEAPs and then sell weekly premium. I will send out an alert on both buying and selling the TSLA position.

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/ .

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: No Pre-Earnings Trades

_________________________________________________

Potential Set Ups for this week: Some say the market has already priced in whatever the Fed decision is this week. Those who believe this forecast that this Fed meeting will be a non-event. My opinion is that if the Fed doesn’t raise rates there will be a more significant rally. Regardless with the current uptrend suspect not opening any large position may be the best course. Hone in stocks that are either showing strong consolidations after a big downtrend or focus on entities that are still above their 50 day EMA’s that have pulled back and ready to bounce.

Upside: Still looking for an entry on TSLA and may trade TSLA with all three strategies. FB, SHAK and TSEM round out the upside candidates. If the momentum in SHAK is waking up this stock is a mover.

Downside: NFLX, BIDU and BABA look weak and just need a set up for a downside trade.

Toss Ups: PANW had a great earnings report and gapped back above the 50 day moving average. If it maintains the momentum this could be a good mover. The other candidates are: CAVM, HAWK and JUNO.

Leveraged Index ETFs: Waiting for set ups for the Early Warning Alerts.

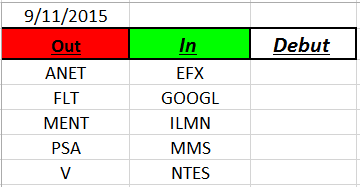

Outs & Ins: No new additions to the IBD 50 list this weekend. I will be watching the following stocks for upside setups: CBM, MANH and FB. Toss-up stocks include: PAYC, HAWK, ULTA, UHS and TSO. To the downside VRX looks most promising.

With the uptrend under pressure having good candidates that could go either way is a wise idea. Up until the FED announcement on Thursday trade duration may be short lived.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: I’m reading a very interesting book called The Bait of Satan, by John Bevere. The book covers some interesting aspects about the epidemic of “being offended”. Doesn’t it seem like everyone wears their feelings/beliefs on their sleeve and become quickly offended by anything that goes against what they feel is correct or what they believe they are due? Gone are the days when the old adage of “sticks and stones my break my bones, but words will never hurt me” was a motto to live by. In fact words are can be seen as weapons to kill, steal and destroy. Typically how we react to words is the result of how we see ourselves. Said a more directly it may be the result of how we let others define how we see ourselves. We seem to have lost the ability to listen to what someone says about us or about one of our beliefs and then decide the veracity of what was said. Instead our often distorted self-image jumps to the conclusion that we only believe the truth. This in turn sets us up to be offended again and again. See the chance to be offended is the bait on the trap. If we take the bait then we actually lose control, because once offended emotions get involved. Once offended we tend to strike out, become even more self-absorbed and accept a victims mentality. The fruits of being offended include other feelings and actions like, hurt, anger, outrage jealousy, strife, bitterness, hatred and envy to name a few. Then we tend to strike back trying to offend the one who offended us. This cycle doesn’t sound like it leads to a very healthy life does it?

The author went on to explain that we have choices and we do not have to live with the fruit of offense. To be offended we personally have to pick up the bait in the trap. If we do get suckered into picking up the bait and letting the offense process start in our lives the best remedy is to recognize that we’ve been offended and then forgive the person who did the offending. These action make it less likely that vile fruit of offense will grow and control our lives. Here’s a hint if your struggle with any of the fruit named it may be evidence that you’re letting yourself be a victim to real or perceived offense.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.