Good Day Traders,

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. Please let others know about this great webinar! You can either join live or catch the replay on YouTube.

Here’s the link for next Friday’s Show:

https://attendee.gotowebinar.com/register/4719387950079237634

Next Training October 7, 2015

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Target Shooting Entries–Objectively

_____________________________________________________

General Market Observation and Highlights from this Edition: The first thing I want to highlight for this edition is encouraging everyone who gets either the Trader’s Report or the Art of Active Trend Trading Free Report to download last Wednesday’s Premium training. This training provides an excellent foundation for trading the Active Trend Trading System. The following link will take you to this valuable training.

Go Here: https://activetrendtrading.com/mid-week-training-back-to-the-8/

Each of the members of our Tracking Index have a positive reversal signal in place. There may be an inclination to think that the markets are heading for a big rebound and this very well may happen. At this point the market cycle it is questionable whether or not all the weakness has been totally wrung out of the market. Mike sent me an article this weekend by Hussman Funds with the following quote which brings some historical perspective into current market expectations.

“If there is a single pertinent lesson from history at present, it is that once obscenely overvalued, overvalued, over bullish market conditions are followed by deterioration in market internals (what we used to call “trend uniformity”), the equity market becomes vulnerable to vertical air-pockets, panics and crashes that don’t limit themselves simply because short-term conditions appear “oversold.””

Later on the article Hussman goes on the say that if we are in a full-fledged secular bear phase that there will be conditions under which a constructive and even aggressive investments stance is appropriate. The key to investing successfully in the current environment is having the discipline that is capable of taking advantage of quickly changing valuations and investor’s risk-preferences. He goes on to state that the real problem is for the passive investor. The passive investor also known as the buy-and-holder will be faced with challenging times ahead. There’s a strong possibility that the high level of volatility will continue and potentially worsen until we reach a more durable support level were valuations will come back into line with longer-term historical values.

Basically the essence of the article supports the concept that trend trading will be a valuable skill to possess for the foreseeable future in the market.

SPX: Friday’s price action on the S&P was very impressive. After an employment report that failed to meet expectations the futures on all indexes were down hard. Shortly after the disappointing employment report came out the Fed started talking about delaying interest rate increases into 2016. At that point the rally was on. It seems like these reactions to bad news which are immediately covered up with some sort of government whitewashing has become a main factor in market direction during 2015. The fact that the economy and the internals of the market are truly weak are just washed away with a few words? This type of knee-jerk market reaction continues to be of concern and serves as a harbinger to a more severe correction, when words stop “making everything all better!”

The chart below reflects of the weekly chart of the S&P. The index finished with a nice Hammer which is a candlestick reversal signal. Additionally price on the daily chart closed at its high above both the 8 and 20 day EMA’s. Overhead resistance remains of both the 50 day EMA and the swing high of 2020 hit on September 17th. Currently it appears the S&P will continue to lend itself to shorter-term trades in both directions based on rebounds from either support or resistance. If volatility remains high 2 to 5% moves over short term time periods will not be surprising. Taking profits at identifiable levels of either support or resistance is appropriate in these market conditions.

Preferred: SPY, UPRO and SPXL

NDX: Price action on the NASDAQ 100 last week was stronger than the other indexes. To get an understanding of why the NDX is stronger than the other indexes observe the slope of the moving averages. On each the downward angle is less severe than the other indexes. This is partly because the NASDAQ hasn’t fallen as far and as hard. Observing the stack, the slope and direction of both the long and short term moving averages provides a strong clue on any entity regarding directional strength.

With the NDX closing above both the 8 and 20 day EMA it appears to be the index most likely to break through the stronger 50, 100 and 200 day moving averages. If price does break above the swing high of September 17th the NASDAQ will be in a new uptrend.

Preferred ETF’s: QQQ and TQQQ

RUT: The Russell closed back above the 8 day EMA for the 1st time in over 2 weeks. The RUT also put in a classic positive divergence showing lower low in price but higher low on the TSI and Momentum oscillators. The RUT also shows an excellent Hammer reversal signal on the weekly chart. Price movement above the 1122 level coincides with the 38.2% Fibonacci retracement from the high on September 17th. Like the other indexes the RUT may be providing a constructive base which will support upside trades.

I’ll be using the 1 hour intraday charts to time potential entries on IWM or TNA in both directions.

Preferred ETF’s: IWM and TNA

_____________________________________________

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, Oct 9th

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/4719387950079237634

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

_________________________

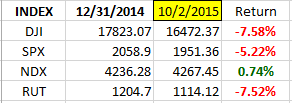

Index Returns YTD 2015

ATTS Returns for 2015 through Sept Oct 2, 2015

20.0% Invested

Margin Account = +8.5% (Includes profit in open positions)

Early Warning Alerts = 6.61%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

- Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

Managing Existing Trades: No Strategy 1 or 2 trades open.

Special Trades: Wealth & Income Generation Strategy 3 Trades: There are 15 weeks until the two long IWM anchor options expire. Since opening this trade on June 18th we are up 26.69%. A mid-course correction to start using the Intraday Charts to time selling premium has resulted in averaging over $263 in premium booked each week during September with no losses. However in order to meet the objective of paying for the underlying anchor position requires a return each week of $630 or 0.45 x 1400 shares or 14 contracts is necessary. I’m at a decision point—Close the overall position and book the 26% or let the trade continue on through Jan 17th? If I hit the average weekly collect per share the return on this trade will be about 41% plus whatever residual remains in the long contracts. I’ll send out an alert to members when I’ve completed my risk/reward calculation on this trade.

Strategy 3: TSLA trade just started last week. I own 2 contracts of the Jan 17 TSLA 250C which require a minimum of $278.54 per week in premium to pay for the anchor position and return 100% by Jan 20, 2017. Last week $465 was booked so the trade is ahead of schedule. TSLA has a projected price of $365 and plenty of weekly volatility to provide good upside potential. I sold 1 contract of the Oct2 255C for $245 last Friday. This option will be closed if prices hits 0.05 – 0.50 or rolled out next Thursday or Friday. I will use the intraday chart to sell the second contract to complete weekly position when a signal appears.

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/ .

I posted a video about how to choose the weekly options to short for this strategy. can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Pre-Earnings Trade: Earnings approaching and kick off on Thursday when AA reports.

_________________________________________________

Potential Set Ups for this week: The watch list is rich this week with many candidates that have corrected with the market and are building a constructive base. As we approach quarterly earnings several of these candidates may go on a pre-earnings runs that will result in upside pops of between 5 to 15%. I have identified several candidates this week to the upside that appear to be early in their rebounds. I will use the techniques identified in last Wednesday night’s training to plan trades for Strategies 1 and 2. As we move into the 4th quarter I am maintaining my 40% portfolio growth objective.

On all potential trades double check for the exact earnings date so we can appropriately plan entries and exits.

Upside: Upside candidates include: TSLA, PANW, NFLX, AFSI, CTSH and HAWK.

Downside: There are no downside candidates based on this weekend’s review.

Toss Ups: candidates to have the potential to go either way include: PAYC, ALK, CRUS, AVGO, FL, NTES, IWM/TNA, SPY/UPRO, QQQ/TQQQ, VDSI, JUNO, YY and BITA.

Leveraged Index ETFs: The Early Warning Alerts triggered last week. I’ll be looking for either new entry points for 2nd chance trades or profit targets to lock in gains.

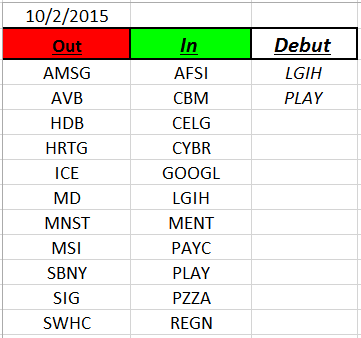

Outs & Ins: Friday’s market action resulted in a wholesale swap out on the IBD 50. Two new players make their debut this week first LGIH a homebuilder that is extended away from its previous breakout. Then there’s Dave and Busters with the ticker PLAY. This is a newer stock that made a strong bounce off the 50 day moving average and would be an interesting buy somewhere around $40.

Of the stocks that came back onto the list AFSI, CYBR and PAYC look to have promise if the market continues to strengthen.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: I always find the reaction of people to new concepts very interesting. I totally understand questioning new concepts as a valid reaction. But those who totally reject a new concept even when the new concept is based on strong factual data may be challenged with biases that dramatically impact their total outlook on life. In turn this can also impact their ability to trade affectively.

Trading requires commitment to a system and a set standard of trading rules but also requires flexibility. It is a lack of flexibility that it opens the door to traders insisting they have to be right! It reminds me of what one of my old mentors used to always ask me. When I would get argumentative about what he was trying to instruct me on he would say, “Do you want to be right or do you want to make money!” Trading like so many other endeavors in life will end in disaster if ego gets in the way.

In trading as in life it is a good idea always challenge your beliefs. If ones initial reaction is to reject without considering there may be a problem. So many of our beliefs are based on perceived truths provided from outside sources. Once these perceptions get ingrained they may blind us to new trails that could lead to success.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.