Good Day Traders,

Overview & Highlights: Premium members who tuned in to the “Final Hour” webinar during the final trading hour on Friday observed how I set up the Strategy III Income trades. We successfully placed two trades that filled during the final hour. One added feature in this week’s will include sending out the Text Alert for members who were unable to attend. This will give all a chance to trade along with Strategy III if they choose. Feedback from members in attendance was exceptional.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Oct 21st

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/4129966163072750594

11:00 a.m. PDT

Next Training Webinar: Oct 19th

For Premium Members our Wednesday evening training is developing some fantastic traders!

Topic: Building a Strategic Plan—Pulling it all Together Part 2

Managing Existing Trades: Positions open for 2 strategies.

Strategy I Portfolio Building:

Strategy I Weekly Results Week ending 10/14:

JUNO: Loss of $353.40

NUGT: Profit of $262.20

Trade 1: Opened position in JUNO on 10/11 at 28.92

Target 1 = 5%

Target 2 = 15-20%

Stop Loss = move below $28 – 10/12 hit stop loss sold at $28

Loss was $353.40

Trade 2: Opened position in NUGT on 10/12 at 11.50

Target 1 = 10% hit on 10/13 sold ½ position for a profit of $262.20

Target 2 = 25%-35%

Stop Loss = Remaining Shares Break Even

Trade 3: Opened position in GRUB on 10/13 at 40.60 (Pre Earnings Trade)

Target 1 = Fib Retracement at 41.99

Target 2 = 10% or close on 10/25 prior to Market close

Stop Loss = 4% from purchase price

Earnings on 10/26 BMO

Strategy II Income Generation: No Open Position

For members wanting to better understand this Strategy there is a very good training video at: https://activetrendtrading.com/basic-option-strategy/

Strategy III Wealth & Income Generation Trades: Three Foundational Positions are in place to sell weekly options against. The recalculated weekly revenue needed from these foundational positions was forward in an update report earning last week. My objective with this Strategy is to collect enough weekly premium during the life of the LEAPS Strangle on both NUGT, SPY and TSLA to both pay for the capital invested and gain between 50% – 100%. Closed the first TSLA LEAPS Strangle which was opened on 9/28/15 for a 100% profit on 9/2/16.

Strategy III Weekly Results Week ending 10/14:

SPY: Profit of $766.00

TSLA: Profit of $214.00

NUGT: Profit of $310.00

Trade 1: Foundation Position is 4 contracts of SPY Jan17 205C and 4 contracts of SPY Jan17 200P Current Trade—Currently Up 31.6%; Premium Collected since opening trade on 1/4/16 = $8,301

10/14 sold 4 contracts of SPY 21Oct 214P at 1.24; potential profit $460

Trade 2: (Long TSLA Jan17 250C & Long Jan17 220—Closed on 9/2 for 100% gain since 9/29) + New Positions Jan17 210C and 220P: Current Position Total Invested $14,900. Currently Up 87%: Premium Collected since opening trade on 9/28/15 = $15,688.50 + New Positions at $5,750.50 = Total Collected $21,439

Sold 1 contract of 21Oct 195P at 3.20; potential profit $320

Trade 3: Long NUGT Jan18 18.4C + NUGT Jan18 18.4P. 4 contracts each side of the straddle for total investment of $6,720. The required weekly premium to collect each week to achieve a 100% return by Jan 2018 is $191.43 per week.

Sold 3 contracts of 21Oct 11.5P at 0.65; potential profit $195

Tip for Experienced Option Traders: Occasionally after a weekly trade goes against me but the trend appears to be changing I will add one naked contract over and above my foundation position and close this out after it gains at least half of the premium I’ve collected. Doing naked options is not for everyone and I keep my risk small by only doing one contract above my covered limit. In other words, if I can sell 4 contract covered by my long leaps I’ll sell one additional. This helps hedge the losses a bit but it this tactic is not without risk and must maintain a tighter stop than I would normally use with the regular position.

Note: We do our best to get both text alerts and email alerts out in a timely manner, occasionally there will be trades that are missed because of delay in the Text or Email alert applications. Additionally, please double check with your broker to assure they allow spread trades like we do with Strategy III. Some do and some don’t.

Additionally, it is crucial when selling premium against the Long LEAPS position that the premium collected cover the weekly cost of holding the LEAPS plus an additional amount to over this amount as a gain. This is one of the reason I sell premium of weekly options that are close to be “At The Money”. I base my selling on the expected move during the next week. If one is not bringing enough weekly premium this trade will not work out as well and may wind up being a losing trade.

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally, some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Potential Set Ups for this week: My plan for this week is to wait for support and resistance bounces on the Indexes. Secondly I’m not going to rush any trade on Monday and will wait for the stock to complete their current pullbacks or consolidations. There are good candidates pulling back.

I still like NUGT off of identifiable & established levels of support. This is a highly volatile ETF for gold miners. The ideal way to trade it is to know how much it usually runs after a bounce and then plan to take profits during the run not at absolute profit projections. Using this strategy should open the door to profits in the 10%-25% range within a very few days. So we will have to be quick. Mid-week I will provide an in depth analysis of NUGT covering why I think this is a good trading candidate.

Pre-Earnings Trade: The following candidates may provide some Pre-earnings opportunities: GRUB (open position), GIMO, PRAH, CHFC, BIIB, BABA

Upside: GIMO, NVDA, VEEV

Downside: LGIH

On the Radar: Stocks & ETFs that could go either way include: UPRO, SPXU, TQQQ, SQQQ, TNA, TZA & their associated non-leveraged Index ETFs.

Other candidates on the radar include: ACIA, GRUB*, NVDA, ULTA, VEEV, THO, IPHI, WOOF, COR, WYNN and PLNT

Stocks identified by ** that are close to a potential entry point.

Early Warning Alerts for Leveraged Index ETFs: Last Trigger: 9/14. Waiting new signal or secondary trigger.

EWA Account Return to date: 12.09%

The Early Warning Alert Service hit all eight major market trading points in 2015. See this brief update video for more details: Early Warning Alerts Update Video or at https://youtu.be/GJwXCL4Sjl4

If simplifying your life by trading along with us using the index ETF is of interest, you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

General Market Observation: Each of the Indexes finished down last week. It appears that drifting sideways to slightly down may be par for the course until after the next Fed meeting and the Elections on November 8th. Daily Momentum and TSI on each Index continues to drift lower below the ‘zero’ line. Each of the Indexes related ETF provided weekly trade opportunities but directional trades are often completed within a day. The next day prices reverse and eat up the previous day’s move. It has been a good time to sell weekly option premium at support or resistance and hold on. This provides income trades for the week with measured risk.

It still appears that the US Stock Market continues to be the only game in town, but what happens if that stops. The Indexes have been telegraphing their potential negative move when interest rates increase. Instability overseas is also providing bubbles of concern. China, Germany, the EU and other tensions are adding to the weight currently on top of this market. Add to this the outflow of funds that has been going on for a while. The SPDR S&P 500 exchange-traded fund (SPY), one of the most popular ways for investors to play the U.S. equity market, saw more than $1 billion in outflows this week, the most of any ETF, according to FactSet data. Money managers also took last week as an opportunity to lock in profits for the fourth quarter prior. Our best bet at this time is to continue trading what the charts are giving us and right not that is movement between a support and resistance.

The daily chart of the SPX below shows price action is contained within the identified support and resistance. If there is a hiccup towards support price may seek a lower range. I will watch the Indexes most of Monday and then start planning trade once a weekly course is set. SPX remains the weakest of the three Tracking Indexes.

NDX is the strongest of the Tracking Indexes. The 50 day EMA held last week but the 8/20 is close to a negative cross. RUT is close to showing weakness equal to the SPX. Weekly oscillators for each Index show that more downside would not be surprising. Remember current price action can result in quick and deep plunges to lower levels of support. How the Indexes rebound from these plunges will be a good indication of overall Index health.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Oct 21st

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/4129966163072750594

11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

– The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

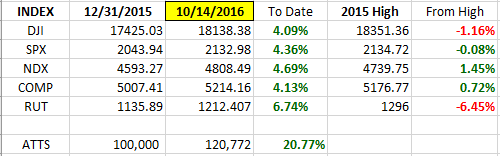

Index Returns YTD 2016

ATTS Returns for 2016 through Oct 7, 2016

Percent invested initial $100K account: Strategies I & II invested at 11.0%; Strategy III invested at 20%.

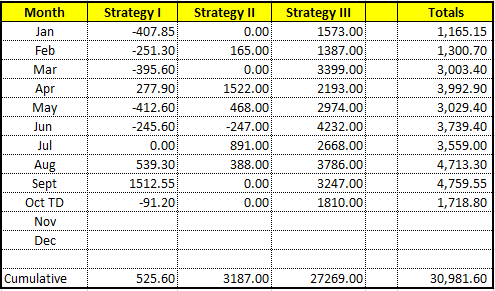

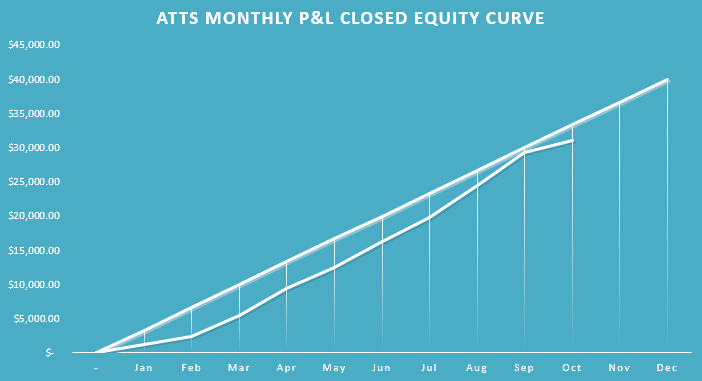

Current Strategy Performance YTD (Closed Trades)

Strategy I: Up $525.60 or +0.75%

Strategy II: Up $3187.00 or +3.18%

Strategy III: Up $27,269.00

Cumulative YTD: 30.98%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

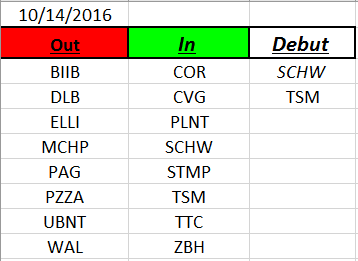

Outs & Ins: SCHW and TSM make their debut on this year’s IBD 50. Both have been on the list in past years so it appears they may have completed a rotation. Schwab has earnings before the opening on 10/17 and has run over 30% since July. TSM just reported a weathered earnings well. Since late June it is up close to 30%. This can be one of the frustrating issues with the IBD 50. Often stocks are added to the list after a big run. There’s a couple ways of working with this reality. First if the stock looks like it will continue to do well added to your list and then simply wait for pullbacks. Secondly, continue to monitor the added stock but look for other stocks that are closer to proper entry points.

Earnings on the IBD 50 cover most of the stocks over the next 2-4 weeks. With weakness in the market several IBD stocks are pulling back into a consolidation. With a favorable market conditions these could rebound quickly. These include: GIMO, GRUB, NVDA, ULTA, THO, VEEV, PRAH, IPHI, WOOF, COR and PLNT.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.