Good Day Traders,

Overview & Highlights: In 4 trading days 2015 will be over. I will review and analyze 2015 performance the first week of 2016 and post a summary report to the website. I want to thank each Active Trend Trading and Early Warning Alert member especially those who hung tough during the first few months of the year in this very trying market! I look forward to how each member will continue to progress in 2016 and have I high expectations for the upcoming year! In 2016 we will continue to focus on our 3 Strategies with the lion share of the focus going to building a successful and manageable portfolio. To all members Happy New Year!

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, Jan 8th

Register Here: https://attendee.gotowebinar.com/register/1834056135396942337

Next Training Webinar: Have a Great Christmas Week, next session Dec 29th

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Part 3: Wealth Building by Portfolio

_____________________________________________________

Managing Existing Trades: Other than a short TSLA put I’m flat the market. I want to establish my Strategy III index ETF position either this week. With only 4 days left to trade for 2015 I will need a very compelling setup to go long any stock position at this point.

Strategy I Portfolio Building: No Open Trades

Strategy II Income Generation: No Open Trades

Strategy III Wealth & Income Generation Trades: If the value of the underlying Long Options plus the premium cleared from selling weekly options approaches 100% on any trade I will close the position and start a new position.

Trade 1: Will open a LEAPS Put and Call position between now and the end of the year in either IWM or SPY. This past year SPY has provided weekly options with higher premium.

Trade 2: Long TSLA Jan17 250C & Long Jan17 220P—will get back into short weekly puts and calls this week. Sold 1 contract of TSLA Dec5 227.5P for $2.85 which is current profitable. Will buy back between 0.50 – 1.00 or protect capital with a stop loss at $1.90 above the entry price.

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/ .

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

_________________________________________________

Pre-Earnings Trade: Will wait for Q4 earnings that start in 2016.

_________________________________________________

Potential Set Ups for this week: The Active Trend Trading System took me out of the market so I was flat most of last week. Given that I was fully engaged in moving my mom last week I’m glad it worked out this way. Managing stocks in a portfolio can be challenging away from ones normal routine. I was able to concentrate on mom knowing that the conditional protective orders would take care of the open positions.

With only 4 days left in 2015 and a suspect market a reason to open any new position must be very compelling!

Upside: TQQQ, UPRO, TNA, NOAH, AOS & AHS

Downside: NFLX (Weakening fundamentals)

On the Radar: TSLA, AVGO, PANW, EPAM, YY, NOW, HAWK, CRM, AKRX, ELLI, WAL, GGAL & VEEV

Leveraged Index ETFs: Sold a portion of TNA for a 10% gain on Friday. Held on 45 shares and will adjust may stop loss up to above breakeven prior to tomorrow morning if a second chance entry sets up I will look to add to the current position or buy UPRO and/or TQQQ.

The Early Warning Alert Service has hit all seven major market trading points this year. See this brief update video for more details: Early Warning Alerts Update Video or at https://youtu.be/aVE9zqbG4MQ

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

General Market Observation: If the Santa Claus rally started on Christmas Eve, it looks like the jolly old elf may have only been carrying half a load! The SPX and NDX finished slightly down for the day while the RUT finished up. Each Index did finish with a weekly Bullish Morning Star like pattern so that’s a positive. We also know that there is an upward bias during holiday periods, so it would not be surprising to see the Index push back up into established resistance areas this week on each Index.

Each of the Tracking Indexes showed a similar Moring Star like pattern as shown on the weekly chart of the SPX below. The current rally could continue and push up into the resistance zone if price action breaks out of the downward sloping trend line that connects the last 4 weeks. On the S&P this would equate to an additional move up from Thursday’s closing price of 1.8% – 3.4%. Each of the other Tracking Indexes show similar potential. If I choose to trade any of the leveraged index ETFs I will wait for an intraday trigger on a one hour chart. Of course just standing aside is also a viable choice given knowing that the underpinnings of the current market are soft!

SPX: Downside Market Short the SPY or SPY Puts. Preferred ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ or QQQ Puts. Preferred ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM or IWM Puts. Preferred ETF’s: IWM and TNA

The Early Warning Alert Service has hit all eight major market trading point this year. See the updated video at: https://activetrendtrading.com/early-warning-alerts-2/

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show Jan 8, 2016

Register Here: https://attendee.gotowebinar.com/register/1834056135396942337

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

_______________________________________________________________

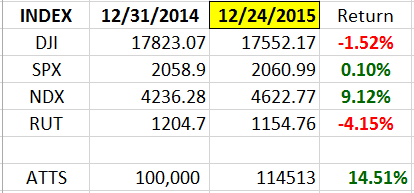

Index Returns YTD 2015

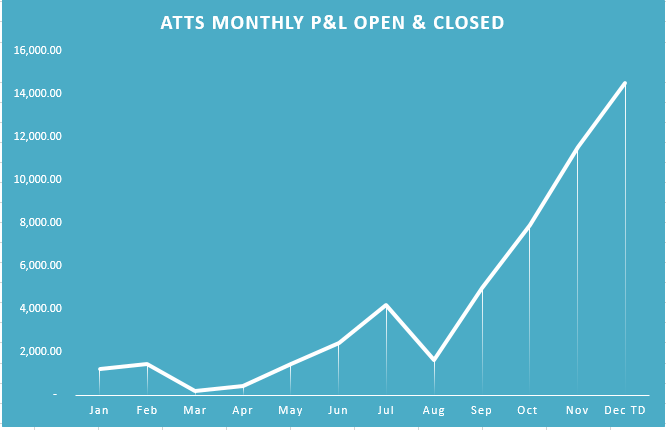

ATTS Returns for 2015 through Dec 24, 2015

6% Invested

Margin Account = +14.5% (Includes profit in open positions). See chart below for monthly tracking.

___________________________________________________________

Early Warning Alerts = 15.6% Partial Positions; 29.22% Full Positions

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

- Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month.

___________________________________________________________

For our all Active Trend Trading Members here’s how we utilize our trading capital

Trading Capital Setup and Position Sizing: Every year we start the year off trading a $100K margin account split up into the three strategies used with the Active Trend Trading System.

- Each trader must define their own trading capital in order to properly size trade positions to meet their own risk tolerance level!

- Strategy I: Capital Growth—70% of capital which equates to $140K at full margin. This strategy trades IBD Quality Growth Stocks and Index ETFs. Growth Target 40% per year.

- Strategy II: Short Term Income or Cash Flow—10% of capital or $10K. This strategy focuses on trading options on stocks and ETF’s identified in Strategy I. The $10K will be divided into $2K units per trade.

- Strategy III: Combination of Growth and Income—20% of capital or $20K. This strategy will use LEAPS options as a foundation to sell weekly option positions with the intent of covering cost of long LEAPS plus growth and income.

- The $70K Strategy I portion of the trade account is split between up to 4 stocks and potentially a leveraged Index ETF. Actual number of shares will vary of course depending on price of the entity traded and amount of margin available. We have found that limiting open positions to only 5 entities greatly reduces the trade management time requirements for members.

- Naked Puts or short term options strategies will be used occasionally for Income Generating Positions

- None of the trade setups are recommendations to trade only notification of planned trades from set ups using the Active Trend Trading System. Each trader is responsible for establishing their own appropriate risk level if they decide to parallel trade.

- The Active Trend Trading System objective is to provide a clear and simple system designed for members who work full time.

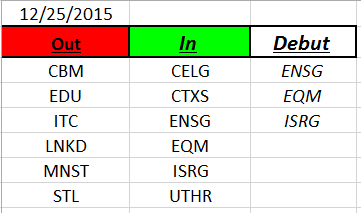

Outs & Ins: ENSG, EQM and ISRG make their debut on the IBD 50 list this weekend. ENSG looks like it should have be assigned to the cut list immediately. EQM is worth keeping our eye on as it may be building a consolidation platform from which to launch. ISRG has been on and off the IBD 50 list for many years. It has been making upward headway back to resistance on less than enthusiastic volume so worth watching but if it gets to the $560 level this may be a chance to go short not long. We shall see.

To date there 220 stocks have been added to the IBD 50 list this year. The list that comes next weekend will serve as the first list for 2016. I have been tracking the first IBD 50/100 list every year since 2007 and have notices an interesting characteristic of the list. During the first 1-3 months of the year stocks on the year tend to move up for nice gains. Then during the next 3-4 months the same stocks tend to sell off and reach their lows of the year between June and August. At that point the stronger stocks tend to rebound back to another high. This second bounce up is when many of the stocks make their largest gain. Please remember these are tendencies and each stock must be traded on its own merits!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.