Good Day Traders,

Overview & Highlights: Tonight I’m sitting in Rapid City, South Dakota completing day 8 of our month road trip. Amazing getting to see some of this great Nation in states we’re visiting for the first time. All I can say is the pioneers were a hearty bunch. Distance we cover in a day’s driving would have taken them 30-45 days. I’ll be stationary for a week visiting my mom next week. I’ll schedule both the Friday and Wednesday webinar during the week I’ll be there.

One of the main thing to remember while travelling is to stick to your rules and its OK not to be invested if uncomfortable with Market. Strategy III lends itself well to traveling because selling premium against the long positions takes less actual analysis but still brings in income. I’ll elaborate on other things I’m learning while on the road regarding trading.

Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

How to Make Money Trading Stocks on Friday, Aug 19th—Friday!

Register Here: https://attendee.gotowebinar.com/register/5137505840659157251

11:00 a.m. PDT

Next Training Webinar: Recorded Session will be provided this week by 8-19

For Premium Members our Wednesday evening training is developing some fantastic traders!

Topic: Fixing Bad Trades

Managing Existing Trades: Positions open for 3 strategies.

Strategy I Portfolio Building: Profit/Loss for week ending 8/12 = $247.30

Bought 200 shares of IPHI at 34.70 on 8/2 – Closed 8/8 at 36.12 for a profit of $214.00

Bought 110 shares of WBMD at 60.70 on 8/2 – Closed 8/8 at 58.27 for a loss of -$157.30

Bought 340 shares of PLNT at 20.25 on 8/2 – Closed ½ of position at 21.53 for return of 6.32%, a profit of 217.60

Will hold the remaining ½ position with a profit target between 15%-20% with a trialing stop at 20.90

Strategy II Income Generation: Weekly Profit/Loss for week ending 8/12 = -$515

Trade 1: PYPL 16Aug 40P bought at 3.30 on 8/2—Stop Loss hit at 2.27 for a loss of $515

For members wanting to better understand this Strategy there is a very good training video at: https://activetrendtrading.com/basic-option-strategy/

Strategy III Wealth & Income Generation Trades: Two Foundational Positions are in place to sell weekly options against. The recalculated weekly revenue needed from these foundational positions was forward in an update report earning last week. My objective with this Strategy is to collect enough weekly premium during the life of the LEAPS Strangle on both SPY and TSLA to both pay for the capital invested and gain between 50% – 100%.

Tip for Experienced Option Traders: Occasionally after a weekly trade goes against me but the trend appears to be changing I will add one naked contract over and above my foundation position and close this out after it gains at least half of the premium I’ve collected. Doing naked options is not for everyone and I keep my risk small by only doing one contract above my covered limit. In other words, if I can sell 4 contract covered by my long leaps I’ll sell one additional. This helps hedge the losses a bit but it this tactic is not without risk and must maintain a tighter stop than I would normally use with the regular position.

Note: We do our best to get both text alerts and email alerts out in a timely manner, occasionally there will be trades that are missed because of delay in the Text or Email alert applications. Additionally, please double check with your broker to assure they allow spread trades like we do with Strategy III. Some do and some don’t.

Additionally, it is crucial when selling premium against the Long LEAPS position that the premium collected cover the weekly cost of holding the LEAPS plus an additional amount to over this amount as a gain. This is one of the reason I sell premium of weekly options that are close to be “At The Money”. I base my selling on the expected move during the next week. If one is not bringing enough weekly premium this trade will not work out as well and may wind up being a losing trade.

Strategy III Weekly Results Week ending 8/12:

SPY: Profit = $88

TSLA: Profit = $628

Trade 1: Foundation Position is 4 contracts of SPY Jan17 205C and 4 contracts of SPY Jan17 200P Current Trade—Currently Up 22.78%; Premium Collected since opening trade on 1/4/16 = $5,444.00

Bought back 4 contracts of 12Aug 217.50 at 0.98 for a profit of $88

Waiting for weekly setup for SPY trade

Trade 2: Long TSLA Jan17 250C & Long Jan17 220 + New Positions Jan17 210C and 220P: Current Position Total Invested $14,900.

Currently Up 84.5%: Premium Collected since opening trade on 9/28/15 = $14,887.50 + New Positions at $3,220.50 = Total Collected $18,108

Sold 1 contract of TSLA 12Aug 230C at 3.95 potential profit $395—Bought back at 0.21 for a profit of $374

Sold 1 contract of TSLA 12Aug 230C at 2.75 potential profit $275—Bought back at 0.21 for a profit of $254

Several members have asked about this strategy and a more detailed explanation is available at: https://activetrendtrading.com/wealth-and-income-strategy/

I posted a video about how to choose the weekly options to short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally, some of these trade may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Potential Set Ups for this week: I’ve trimmed several stocks from the On the Radar list. If typical August/September weakness appears many leading stocks may provide pullbacks over the next few weeks and set up for an end of year or at least into November run.

Pre-Earnings Trade: Pre-earnings candidates include: NTES and DG.

See above under Strategy I for the results of pre-earnings trades on WBMD, IPHI and PLNT. The only position remaining open is a ½ position in PLNT.

Pre-earnings trades can be a great supplement to the portfolio building portion of Strategy I. Depending on the stock and technical analysis they tend to be predictable and repeatable. For busy traders focusing on pre-earning opportunities can free one up from the necessity of constantly chasing stocks during other periods of the year. The process repeats four times a year and capturing a 5%-15% return four times a year can compound very nicely!

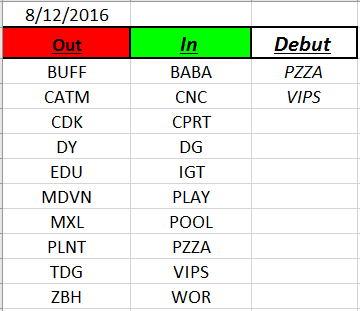

Upside: Waiting for pullbacks on the Index ETF’s, TSLA (formed a symmetrical triangle watch the break), XRS, IPHI (wait pullback), PLNT (wait pullback), PZZA, VIPS, BABA, WOR & ACIA,

Downside: SIX, ALK, WBMD

On the Radar: Stocks & ETFs that could go either way include: UPRO, SPXU, TQQQ, SQQQ, TNA, TZA & their associated non-leveraged Index ETFs. TSLA, BIDU, NFLX, BIDU, WYNN, PAYC, XRS, MBLY, AMBA, AVGO & NTES

Stocks identified by ** that are close to a potential entry point.

Early Warning Alerts for Leveraged Index ETFs: Waiting second chance entry from alert on 6/27

EWA Account Return to date: 5.5%

If simplifying your life by trading along with us using the index ETF is of interest, you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

General Market Observation: While two of the three Tracking Indexes pushed to new highs last week momentum for the current move is waning a bit. No strong sell signals have appeared but after such a swift up move profit taking could be in order for each of the Indexes. How much profit taking is unknown although a healthy 3% – 5% would result in a pullback to around the 38.2% Fib Retracement of the bounce on 6/7. The last head fake from the beginning of August provide a bounce off of either the 8/20 day EMA cluster but was a quick move that relieved an overbought condition.

At this point we must respect the uptrend and plan trades to the long side until enough clues pile up to favor a downside trade. The traditional bias during August and September is down for the Indexes. This year, a perfect storm of investment funds coming in from Global Central Banks and the Fed’s commitment to maintain current stability may come together to counteract this bias. I hate buying slight dips but that may be all the current market provides.

SPX has gone back into a tight trading range with a new high in place. The difference this time is negative divergence on the TSI and low momentum. These are clues that normally would foretell a healthy pullback. I’ll be watching the slope and support capabilities of both the 8/20 daily EMA’s for additional clues if prices fall. If prices push to higher highs without a solid entry signal, then the analysis process will reset.

The NDX stalled some last week. This Index has demonstrated the greatest strength since late June. A solid pullback to either the 8 or 20 day EMAs would be optimal. A pullback into the breakout level around 4741 would split the difference between the two and would potentially be an appropriate entry trigger. Until proven otherwise expect the NDX to be the strongest performer.

The Russell has shown solid gains since 6/7 up just shy of 14% at the high. The RUT also showed signs of stalling last week. A tested level of support at 1200 coincides with the 23.6% Fib Retracement. I’ll use this level as my trigger for upside trades.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Aug 19th—Friday!

Register Here: https://attendee.gotowebinar.com/register/5137505840659157251

11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

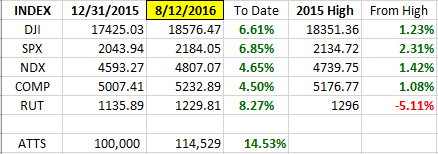

Index Returns YTD 2016

ATTS Returns for 2016 through Aug 12, 2016

Percent invested initial $100K account: Strategies I & II invested at 8.6%; Strategy III invested at 25.98%.

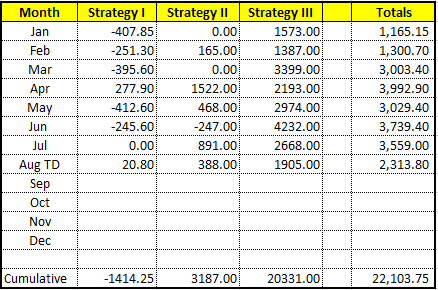

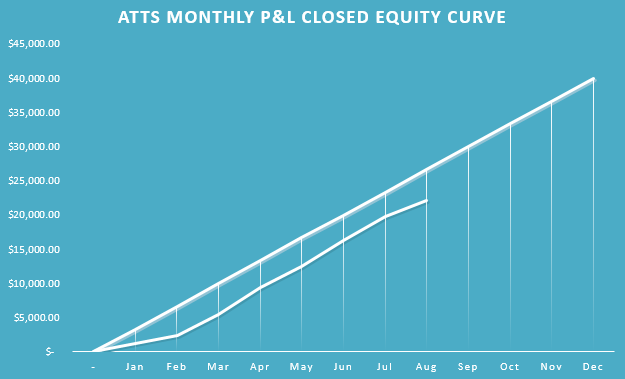

Current Strategy Performance YTD (Closed Trades)

Strategy I: Down -1414.25 or -2.0%

Strategy II: Up $3187.00 or +3.18%

Strategy III: Up $20331 or +74.15%

Cumulative YTD: 22.1%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

The next update August.

Outs & Ins: PZZA and VIPS make their debut on the IBD 50 for this year. Both have been on the list in past years. Both of these entrants appear to be good potential trades. PZZA is in the process of pulling back. VIPS just made a strong move on high volume after earnings. BABA, CNC and WOR round out the list of good looking upside candidates.

DG may provide a pre-earnings trade with earnings scheduled for 8/25.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.