Good Day Traders,

Next week will be real touch and go for me because we’re on call for the arrival of our new grandson, David. When he decides it’s time we’ll be off to take care of his sister at the drop of a hat! I will schedule all webinars as usual with the caveat that the schedule could change quickly.

Performance of trades through the end of April will be posted to the website next weekend.

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. You can either join live or catch the replay on YouTube.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/4419440074949076993

The Mid-Week Market Sanity Check this Wednesday evening.

Our Topic: How to Growing A Small Account

General Market Observation: Next week can probably summed up in two words, ‘AAPL Earnings’! Yes the Bid Dog of the NDX and COMP reports Monday after the close. Unless something devastating happens between then and now the Indexes are likely to be somewhat muted tomorrow. The sentiment for AAPL is high based on Earnings Whispers so if there is anything disappointing then standby. On Friday’s “How to Make Money Trading Stocks” Webinar I highlighted the weighting of AAPL on the NDX. Currently on the NDX AAPL makes up over 11% of its value. When we think about market movers this stock qualifies as one. As we saw with the big gap up on the NDX and COMP on Friday because several heavy weights reported, we will see what the heaviest of the heavies does after Monday. Additionally the next three weeks will see a large number of stocks reporting. 40% of all stocks on the IBD 50 report this week.

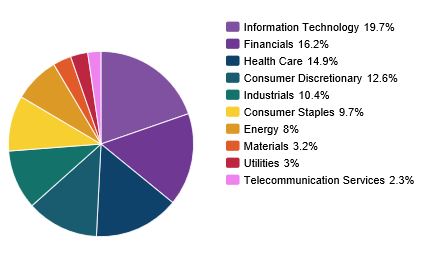

Speaking of weighted Indexes the S&P is also weighted but differently than the NASDAQ. The S&P weighting is in Sectors and this results in the Index reacting differently than how the NASDAQ does when one stock has a huge day. If you are wondering here are the weightings as of the end of March 31, 2015. Oh BTW, AAPL is the heaviest weighted stock in the IT sector.

SPX: The S&P finished Friday just below 2120 which is the top of the resistance zone we’ve been tracking for several weeks. The tone for the week was up from the selloff of Friday two weeks ago. I will be waiting for AAPL’s results Monday before designing any trade on the S&P ETF’s.

Preferred ETF’s: SPY and SPXL

NDX: The NASDAQ 100 and NASDAQ Comp broke out strongly this past week. Old resistance becomes new support so the 4483.97 level becomes support. If we apply traditional technical analysis measurements the upside due to this breakout would be approximately 4682. If the Index demonstrates moves similar to the first of the year price action could reach the 4682 level within a couple of weeks. Once there price would only be 2.8% from the all-time high set back in the year 2000! No trades for now on this index until we get some consolidation.

Preferred ETF’s: QQQ and TQQQ

RUT: As money rotates into the tech index we could actually see the Russell unhinge and underperform. Friday was a down day for the Russell. With strength apparently coming into the NASDAQ the RUT could go into a similar pattern as last year. There were wild tradable swings that were divergent from the other Indexes. We will see if it becomes the underachiever again!

Preferred ETF’s: IWM and TNA

On each of the Index ETF’s if I’m trading to the downside it will be with the non-leveraged ETFs.

If you have not had a chance to check out the research Mike Trager and I have done to start the EWA service you can find a short 10 minute preview at: http://youtu.be/MgC9GMAWh4w

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

Remember if you are a premium or Early Warning Alert member you can receive Text Alerts and Trade Notifications if you send us your mobile phone number. Sent us your number with NO HYPHENS please and we’ll get you on the Text Notification List.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, May 1st

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/4419440074949076993

To get notifications of the newly recorded and posted Market Stock Talk every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

______________________________________________________________

ATTS Returns for 2015 through April 24, 2015

Less than 1% Invested

Margin Account = +1.0%

Early Warning Alerts = +2.7%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated at the beginning of each month.

For our all Active Trend Trading Members here’s how we utilize our trading capital

Trading Capital Setup and Position Sizing: Every year we start the year off trading a $100K margin account make the math really easy for yearly returns.

- Each trader must define their own trading capital in order to properly size trade positions to their own risk tolerance level!

- The $100K account is split between up to 4 stocks and a leveraged Index ETF. Actual number of shares will vary of course depending on price of the entity traded. We have found that limiting open positions to only 5 entities greatly reduces the trade management time requirements for members. This goes back to our goals of providing a system designed for members who work full time.

- Regardless of market conditions no more than 50% of available margin is used at any time.

- Each Trade is split 50-50 between Income Generating & Capital Growth Objectives unless specified in the Order Alert

- Naked Puts or short term options strategies will be used occasionally for Income Generating Positions

- None of the trade setups are a recommendation to trade only notification of planned trades from set ups using the Active Trend Trading System. Each trader is responsible for establishing their own appropriate risk level on every trade.

Managing Existing Trades: A week after opening the YY pre-earnings trade at 60.48 price hit the first target (T1) of 65 on Friday. I sold ½ of my 200 shares and now wait for earnings which are scheduled on 5/5 AMC. I will watch this one close regarding earning because there are two conflicting dates one site says 5/5 the other says 5/4 AMC. The stop on the remaining shares was raised to 61.42 and will stay in place until mid-week. If new highs are hit over the next few days then a trailing 25 cents below the 8 day EMA will be set mid-week adjustment. An alert will go out on the adjustment. If price hits 72.57 prior to earnings then I will sell ½ of the remaining position (50 shares) a move of this magnitude represents a 20% gain from the purchase price.

Pre-Earnings Trade: Many of the stocks on my private list report earnings this week. The notables are AAPL, BIDU and LNKD. BIDU may set the tone for other Chinese stocks this week and we’ve already said enough about AAPL. Stocks worth watching for quick swing trades prior to earnings include: VDSI, VIPS, TSLA, GMCR, BITA and PAYC.

Potential Set Ups for this week: Watch last week’s gappers like SBUX and AMZN. Each of these showed huge buying volume after earnings so a set up may be to test the top of the gap.

Upside: QIHU continues to build a constructive pattern. ALK has rebounded after earnings and may test previous highs. PANW on a retest of breakout or flag pullback.

Downside: SNDK, ALXN, PKG, GBX & BIIB all showing weakness.

Toss Ups: Stocks that could go either way include: UA, AMBA, SWKS (earnings) and FB.

Coming on the Radar: GDDY showed up on MarketSmith IPO list. Go-Daddy may have some potential or at least provide a pre-earnings run from current support. Right now I’m watching it but for a pick it may turn out to be DOA!

Leveraged Index ETFs: Waiting for Reset of EWA. For EWA members remember there can be long time periods of several weeks or months between signals. We’re currently waiting for the reset or some second chance entries.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: I went to a meeting on Friday evening to hear from some gentlemen who were insightful about things happening around the SF Bay Area. Sometime when folks offer what could be considered prophetic about what the future holds, then the hearer must weigh the comments and opinions of the speakers for validity and substance. I agreed with the majority of his point until he said this, “Don’t put your faith in the stock market it’s just gambling!” As I pondered those comments, I wondered are these words truthful or just the words of someone not familiar systems and strategies? Perhaps this statement was both true and false. Is trading in the market gambling? Hmmm?

Here are some of my conclusions. Yes for many the stock market is a gamble because they don’t have a clue what they’re doing and have little understanding of how the markets work. They also have little control over their own emotions and put money in the market based on whims and rumors. In other words they are impulsive in the market, probably much the way they are also impulsive in life. So for those who fit this description then yes, the stock market is gambling.

But thankfully remaining ignorant about the market and how it works is a choice. When one becomes a student and works to understand a system it is the first step towards wisdom. Once it is mastered does it mean that every trade will be successful? Yes. Does it mean that every trade will be profitable? No. Ah, more to ponder!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks!