Good Day Traders,

Overview & Highlights: Well the first day of the new trading campaign kicked off today to the upside. I’m looking forward to how both the Active Trend Trading and Early Warning Alert Systems will benefit from the in-depth analysis we conducted during the month of November and December. The yearend summary of how the system and strategies performed in 2016 will be posted to the website this weekend. The optimizations we have implemented from a refined Premium Watch List which includes strong growth stocks and top-notch leveraged ETFs will simplify after-hour analysis and allow members to mainly wait for proper entry triggers.

Additionally, there is some excellent training planned for 2017 which will help each member continue to sharpen their trading skills.

Mike’s Macro Market Musings has really gone to the dogs, I believe you will enjoy tonight’s post.

Lastly, I will be sending out a video defining exactly how I’m dividing up my trading capital for 2017. Strategy III: Wealth Building will have about 10% more capital allocated. This will allow me to have at least 2 contracts active on each side of the LEAPS Straddle or Strangle we set up this Friday.

Upcoming Webinars: At Active Trend Trading we offer two webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Jan 6th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/5715988598121619970

Time 11:00 a.m. PDT

Next Training Webinar: Jan 4th

For Premium Members, our Wednesday evening training is developing some fantastic traders

Topic: Seasonality—Wait for It

Managing Current Trades: Carried forward from 2016.

Strategy I Portfolio Building: 2 positions open

12/16: Bought 600 of SQQQ at 12.72

T1 = Sell ½ Position at 5-10%

T2 = Sell second ½ position at 15-20%

Stop Loss at 5% or 50 cents below swing low, if T1 hit move to breakeven

12/16: Bought 390 shares of TZA at 19.74

T1 = Sell ½ position at 5-10%

T2 = Sell ½ position at 15-20%

Stop Loss at 5% or 50 cents below swing low, if T1 hit move to breakeven

Strategy II Basic Options: No Open Positions

For members wanting to better understand this Strategy there is a very good training video at: https://activetrendtrading.com/basic-option-strategy/

Strategy III Wealth & Income: 1 Open Position. I will open a TSLA and SPY Straddle or Strangle on Friday Jan 6, 2017. I want to allocate more capital to Strategy III in 2017 so each position will have at least 2 LEAPS contracts on each side. Total capital for Strategy III = 30% or $30K.

Last year we closed out three Strategy III Positions including:

First TSLA LEAPS Strangle which was opened on 9/28/15 for a 100% profit on 9/2/16

SPY Strangle Closed for a 34% Gain from January 2016

Second TSLA Strangle closed for a profit of 53% from June of 2016

Strategy III Weekly Results Week ending 12/16:

NUGT: No Position

Trade 1: Long NUGT Jan18 18.4C + NUGT Jan18 18.4P opened 9/. 4 contracts each side of the straddle for total investment of $6,720. The required weekly premium to collect each week to achieve a 100% return by Jan 2018 is $191.43 per week.

Waiting for Weekly Set up

Tip for Experienced Option Traders: Occasionally after a weekly trade goes against me but the trend appears to be changing I will add one naked contract over and above my foundation position and close this out after it gains at least half of the premium I’ve collected. Doing naked options is not for everyone and I keep my risk small by only doing one contract above my covered limit. In other words, if I can sell 4 contract covered by my long leaps I’ll sell one additional. This helps hedge the losses a bit but it this tactic is not without risk and must maintain a tighter stop than I would normally use with the regular position.

Note: We do our best to get both text alerts and email alerts out in a timely manner, occasionally there will be trades that are missed because of delay in the Text or Email alert applications. Additionally, please double check with your broker to assure they allow spread trades like we do with Strategy III. Some do and some don’t.

Additionally, it is crucial when selling premium against the Long LEAPS position that the premium collected cover the weekly cost of holding the LEAPS plus an additional amount to over this amount as a gain. This is one of the reason I sell premium of weekly options that are close to be “At the Money”. I base my selling on the expected move during the next week. If one is not bringing enough weekly premium this trade will not work out as well and may wind up being a losing trade.

Several members have asked about this strategy and a more detailed explanation is available in this updated video at: https://activetrendtrading.com/wealth-and-income-strategy/

I posted a video about how to choose the weekly options too short for this strategy. It can be viewed at: https://activetrendtrading.com/videos/

Additionally, some of these trades may be selling weekly puts on up trending stocks. If you are interested in parallel trading this strategy register at this link: http://forms.aweber.com/form/99/1278533099.htm

Early Warning Alerts for Leveraged Index ETFs: Last Trigger: 11/4—Waiting new signal or secondary trigger.

EWA Account Return for 2017: 0.0%

The Early Warning Alert Service alerted on all market lows in 2016. See the link below for the new video for 2016 that highlights entry refinements that will provide improved entries even in environment like 2016. In 2016 the entry triggers were challenging because of the number of straight off the bottom moves. Mike and I have analyzed this and have tested adjustments in place going forward.

EWA 2016 Update Video: https://activetrendtrading.com/early-warning-alerts-update-for-2016/

Potential Set Ups for this week: Several of members of our Premium Watch List are on our radar as the market proceeds through the first week of 2017. NUGT continues to base in what looks like preparation for gold’s seasonal run in January and February. This ETF becomes interesting on a pullback into the 8-20 day EMA combo. The longer term weekly TSI and Momentum is turning positive so now I will wait for the proper entry. I must keep in mind that a rally in gold may be muted due to the Fed’s last decision which raised interest rates. Remember this ETF is very volatile and moves fast in both directions. Position sizing will be crucial.

TSLA appears to be setting up for a pullback or more. News out today indicated there is concern with meeting production quotas. In addition to Strategy III, TSLA may provide either a short or put option trade in the near term.

Lastly, in the review of the IBD 50 this weekend several of the fundamentally strongest stocks are pulling back to support. Stocks pulling back include THO, CPE and ESNT. CPE appears closest to firing a buy signal in the near term as it rebounds from the 50 day EMA. A text and email alert will be issued if a confirmed buy signal fires.

Mike’s Macro Market Musings: Misha’s Market Musings

Anyone who lives with an animal companion knows very well that they constantly communicate with us in ways that can be both surprising and revelatory and that they are extremely observant and sensitive to our emotions and moods. Our 4-year-old Goldendoodle, Misha, is a constant companion and has no difficulty letting me know what she thinks and feels in between her multiple daily naps. She is often at my side or my feet as I sit at the computer monitors observing the price action of the markets. Following is a distillation of recent exchanges between her and I on the current state of the equity markets, the history of boom and bust cycles in the economy and the markets, and the similarities between events in her life and what the charts are currently showing us. Her insight borders on the uncanny.

The conversation starts as Misha observes me looking at the charts on the monitors and shaking my head in disbelief:

MISHA – Dad, what’s wrong? Why are you shaking your head like that? Can I have a treat?

ME: No, you can’t have a treat. You just ate breakfast. Do you want to get fat like your friend Rosie? I’m shaking my head because I can’t believe these stock charts.

MISHA: Why? What’s wrong with them? I don’t mind getting fat. Rosie’s cute and fun to chase and easy to catch

ME: They’re going up too much and too fast and I’m afraid of what might happen next.

MISHA: You mean like when I eat too much and too fast and then I have to throw up later?

ME: Yes, something like that

MISHA: OK. Can I have a treat now?

ME: No.

MISHA: I’m not talking to you anymore until I get a treat

ME: Come on, you just ate

MISHA: (Silence)

ME: Geez. OK. Here’s a cookie. Don’t tell Mom. She’s always yelling at me that I feed you too much

MISHA: OK. Don’t worry. I won’t tell. If I eat too much I’ll just throw up on the oriental rug in the living room like I always do.

ME: Then what?

MISHA: Then you’ll bail me out and clean up the mess like you always do. Thanks for the cookie, it was delicious. (licks her lips). Are the people in the stock market eating too much?

ME: Yes, that’s what I’m afraid of

MISHA: Do they throw up after they eat too much like I do? Can I have another treat, please?

ME: Yes. And no.

MISHA: (Silence, and a long direct look)

ME: What?

MISHA: No treat, no trick. It’s not Halloween anymore.

ME: Sheesh! OK, here’s a small piece of cookie. DON’T TELL MOM!!

MISHA: Thanks, Dad. (Licks the back of my hand) So when the humans in the stock market eat too much and too fast and then they throw up, do they get bailed out and cleaned up afterwards like I do?

ME: Well, yes, at least some of them do. Remember that time in the park you found a piece of a dead squirrel and ate it?

MISHA: Yes. That was delicious! Can we do that again? Where’s my treat?

ME: Remember what happened after that?

MISHA: I felt sick. Another cookie, please

ME: Forget it. No more treats right now. Remember I had to take you to the doctor and what happened then?

MISHA: Oh, yeah, now I remember. The doctor gave me a shot and I had to throw up and then I felt better and I was ready to eat again. What do you mean, no more treats? You know, you look like you’ve been eating too many treats yourself

ME: (Silence)

MISHA: (Silence)

ME: All right, last cookie. Now what?

MISHA: (Licks her lips) So when the humans in the stock market eat too much and get sick and then throw up, why do they eat too much again next time?

ME: They forget how sick they got and only remember how good it felt while they were eating. Why do you?

MISHA: I’m a dog. It’s what I do, part of the job. Just like it’s the master’s job to feed us too much and then clean up the mess when we get sick and throw up. I know you said that was my last treat, but when do I get another one?

ME: Later. Let’s go to the park.

MISHA: Wait. I don’t feel so good (throws up on the oriental rug in the living room)

ME: Oh well, now I have to bail you out and clean up the mess before Mom gets home

MISHA: That’s what masters do. Thanks, Dad. I feel better now. Can I have a treat when we get back from the park?

ME: We’ll see.

MISHA: I love you, Dad

ME: I love you, too. DON’T TELL MOM!!

MISHA: OK, I promise I won’t tell if you promise to keep feeding me. Otherwise, I’m going to tell her everything, and you’ll be sorry you didn’t give me another cookie.

Misha has asked me to wish you all a very Happy New Year and an excellent 2017 Trading Season!

General Market Observation: Each of the 3 Tracking Indexes finished up for the first trading day of 2017. This is positive for the current uptrend that started just before the election in November. But, today’s price action took place within the bearish price action from last week. Each Index has solid levels of support and resistance and with bearish reversal candlesticks in place either on a weekly or daily chart. Neither the SPX, NDX nor RUT have totally let go to the downside, so at this point today’s action must be considered pullback action within an uptrend.

The TSI and Momentum indicators between the weekly and daily charts are not in synch. Daily oscillators look ready for a bounce while the weekly oscillators look ready to continue their rollover. The price action for each Index finished midway between support and resistance in no man’s land. At this point no trade for the indexes in either direction.

As the daily chart of the SPX shows below, today’s action may be just a bounce into the resistance from last week’s bearish action. The down slanted resistance line may provide an upside ceiling where selling could begin again. The long wicks both above and below the body of today’s candle show exactly where buyers and sellers came in to support their convictions. I’ll place an alert at 2269 to let me know when the Resistance line is approached. Again, due to the weekly and daily charts being out of synch, I would favor the longer term weekly charts which look to favor a downside move.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Jan 6th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/5715988598121619970

Time 11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

– The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

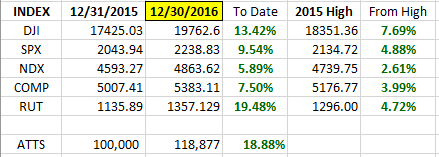

Index Returns 2016

ATTS Returns for 2016

Percent invested initial $100K account: Strategies I & II invested at 15%; Strategy III invested at 8%.

Current Strategy Performance YTD (Closed Trades)

Strategy I: Up $896.15 or +1.28%

Strategy II: Up $1,371.00 or +13.7%

Strategy III: Up $28,869.00

Cumulative YTD: 31.14%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update after first week in January.

Outs & Ins: The first IBD 50 of the year came out this past weekend. The stocks with the strongest fundamentals include: IDCC, THO, CPE, NVDA, UBNT & ESNT.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.