January 16

Good Day Traders,

Overview & Highlights for On the Radar: On the Radar is intended to provide a short highlight of stocks and ETFs which show promise for the following week. I will publish the “On the Radar” report for that purpose. Two versions will be posted to the website. One for Premium Members who can access the report on a secure webpage. This version will call out specific stocks or ETFs that are on my radar. The second version will include only a list of stocks that turned up on my review of the IBD 50 over the weekend. This will be posted to the Blog portion of the website on the Homepage.

I hope all members will find this new report valuable to your weekend planning.

I have added a new bonus training video for Premium members specifically discussing the Leveraged ETFs on the Active Trend Trading Watch list. Each of the Leveraged ETFs on this list will provide multiple opportunities throughout the year. In addition by becoming intimate with these entities weekly and daily review time will be greatly reduced and simplified for members!

See this powerful training at:

https://activetrendtrading.com/how-to-profit-from-market-seasonality/

Upcoming Webinars: At Active Trend Trading we offer three webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Jan 20th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/8648255267823401987

Time 11:00 a.m. PST

Next Training Webinar: Jan 18th

For Premium Members, our Wednesday evening training is developing some fantastic traders

Topic: The Tick-Up a Simple Object Entry Trigger

** Friday’s “Final Hour”: Jan 20th **

Time 12:00 p.m. PDT

For Premium Members, provides trades and set ups during the final hour of weekly trading

On the Radar: With a focus towards Strategy I-Portfolio building, the stocks and ETF’s highlighted below are either at or approaching price levels of that could result in Trade Alerts being generated this week. Traders who trade options could look at these for option trades on proper triggers if entity has good OI for an option string 4-8 weeks out. Check for earnings before jumping into an overpriced option string.

63% of my trading capital has been dedicated to trade Strategy I. My plan for 2017 is to have no more than 2 Growth Stock positions. This will insure capital is available when the Leveraged ETFs set up. The 3x Leveraged ETFs cannot be bought with margin.

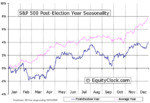

As I write today’s report the futures are down slightly. Will this set the tone for the week through the Inauguration on Friday? We shall see. Here is the SPX seasonality chart that was posted in today’s bonus training. As we can see, the first year of a new presidency

can be very volatile and often decline after the Inauguration. The good news – there will be several opportunities of significant moves during the year. Remember this chart reflects long term tendencies and history repeating itself while probable is not an absolute.

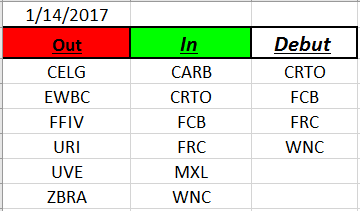

Outs & Ins on the IBD 50: Four stocks made their debut on the IBD 50 this week including: CRTO, FCB, FRC and WNC. None of these floated to the top of my sort which identifies the best of the best Growth Stocks from this week’s IBD 50.

The top stocks from this week’s sort include: IDCC, THO, CPE, NVDA, AMAT and UBNT. IDCC, THO, CPE and NVDA have pulled back from their previous highs and are basing. I’ll be watching these four this week.