February 19

Good Day Traders,

Overview & Highlights for On the Radar: On the Radar is intended to provide a short highlight of stocks and ETFs which show promise for the following week. I will publish the “On the Radar” report for that purpose. Two versions will be posted to the website. One for Premium Members who can access the report on a secure webpage. This version will call out specific stocks or ETFs that are on my radar. The second version will include only a list of stocks that turned up on my review of the IBD 50 over the weekend. This will be posted to the Blog portion of the website on the Homepage.

I hope all members will find this new report valuable to your weekend planning.

Watch for a new Bonus Training Video this week about trading the TSI Tick Up. If you have not seen the video below look and learn how to simplify your process by understanding Seasonality.

See this powerful training at:

https://activetrendtrading.com/how-to-profit-from-market-seasonality/

Upcoming Webinars: At Active Trend Trading we offer three webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, Feb 24th

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/3791291295737251075

Time 11:00 a.m. PDT

Next Training Webinar: Feb 22nd

For Premium Members, our Wednesday evening training is developing some fantastic traders

Topic: Stop Making Dumb Trades

** Friday’s “Final Hour”: Feb 24th **

Time 12:00 p.m. PDT

For Premium Members, provides trades and set ups during the final hour of weekly trading.

On the Radar: I received a great email from a member this weekend asking why we were not more invested in Strategy I: Portfolio Building since the market has been on a tear for most of the year. The main reason is because I wanted to provide training on both Seasonality and the TSI Tick Up entry method so members would have these tools in their kits and understand various entries when the present themselves. Currently, I am 33% invested in Strategy I and will wait for new opportunities to set up going forward. I believe we will have numerous opportunities towards the end of March and early April to fill out the rest of Strategy I. Both the leveraged ETFs and Growth Stock picks tend to bottom for the year during this period and provide higher probability entries.

As you may have observed once the training was in place for the TSI Tick Ups the number of trade alerts did increase. Watch for this trend to continue. But, I will not chase entries just to be in the market. I’m after the exceptional returns using the ETFs and strong Growth stocks.

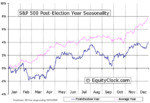

The Seasonality chart is included as a reminder. At this point the Indexes in stronger than what the Post-Election chart forecast. 2017 may be an outlier year and that’s fine. Right now wait for pullbacks in the Index ETFs and watch for the Seasonal moves in Gold, Oil, Financials and Biotech’s.

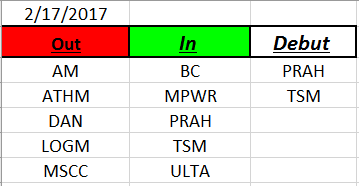

Outs & Ins on the IBD 50: PRAH and TSM make their IBD 50 debut this weekend. Both have been on the list in past years. Both are extended and PRAH has earnings on 2/22 AMC.

My sort for the Strongest Fundamental Stocks from the List turned up two stocks IDCC and THO. IDCC reports earnings on 2/23 BMO. THO may provide a “pre-earnings” run and just broke out above 108.45. I’m waiting for a bounce from the 8 day for a potential entry on THO. Other stock that ranked just below the top two include: MASI, HQY, CGNX, NTES & NVDA.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.