Good Day Traders,

Had a great time at the MoneyShow Friday and Saturday. Many folks turned out for the presentation for Wealth and Income Generation using Index ETFs Saturday morning. For current members who came out thanks for your support. Attended several presentations—even one by a fundamental analysis advisor! I won’t say who it was but a fairly well-known talking head. When he talked about all the stuff he has to do to evaluate a company before he invest and then top that off with a total return of less than 14% in 2014 it reinforced greatly my belief in the Active Trend Trading Systems. Let IBD do the fundamentals which leaves us free to analyze the technicals on the best growth stocks!

_____________________________________________________

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. Please let others know about this great webinar! You can either join live or catch the replay on YouTube.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/6336760756741947905

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Candlesticks Part 3

_____________________________________________________

General Market Observation: Friday painted a picture of three different Indexes. One had a strong tailwind while the others were treading water. We finished with a mixed market with the SPX up a little, The RUT down a little and the NDX gapping to new highs! Remember last year the RUT danced to its own music throughout the year providing several great trading opportunities but providing a poor buy-and-hold performance. During this time both the SPX and NDX were rolling higher and higher. If the NDX is decoupling from the other indexes it could lead to some exciting times through the end of the year.

Last week there was positive response to Greece voting to approve the new bailout deal, but it merely kicks the can down the road for a few years. China was quiet but the government manipulation and trading stoppage is not over and earnings rewarded the indexes heavily weighted in the NFLX and GOOGL. But under the hood what really changed? Nothing. The markets are still operating with the highest margin debt in history, companies are buying back their own shares on borrowed money and the government is still reporting a better economic numbers than what’s really happening—like inflation and employment. The FED is locked into a rate hike this year to save face. So there are a lot of moving pieces on the table which could result in a very interesting second half of 2015. Hang On!

SPX: The S&P finished with a Dragon Fly Doji at a resistance zone. This is a bearish reversal signal at a level where a pullback could begin. There has been no breakdown in the indicators yet but price is overextended. On the weekly charts Momentum is below the zero line and TSI has crossed into positive territory. At this point more clues need to come together for trading decisions to be made. So we wait.

Preferred ETF’s: SPY and SPXL

NDX: Friday’s close leaves about 3.3% to the all-time high hit back in 2000. Price moves this week will be tied to the big names reporting in this index like AAPL. Any resistance between the current price and 4816.35 is old and less of an influence. The move over the past six days has been very impressive but this type of ascent cannot be maintained long-term and at some point a consolidation of gains or flat out profit taking will start to appear. When? We shall see.

Preferred ETF’s: QQQ and TQQQ

RUT: The daily action on the Russell resulted in a pattern very similar to an evening star. Plus Friday’s candle engulfed Thursday’s Bearish Harami. Could it be that the RUT is uncoupling from the other indexes or vice versa? I like the RUT because it’s levels of support and resistance are very well defined and trades can be planned at these. If price action turns weak on the other market RUT may fall further and faster so watch support at the 50 day EMA down to 1226. A retest up in the 1275 level might provide a downside trade set up with corresponding reversal candles on the intraday hourly chart or the daily charts. If buyers come in at the 50 day this may provide upside opportunities at least back to 1275. Over all this index is the weakest link.

Preferred ETF’s: IWM and TNA

_____________________________________________

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, July 24th

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/6336760756741947905

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

- The Active Trend Trader Referral Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

_______________________________________________________________

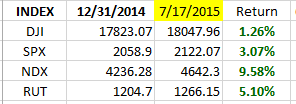

Index Returns YTD 2015

ATTS Returns for 2015 through July 17, 2015

Less than 1.1 % Invested

Margin Account = +2.7 % (Includes profit in open positions)

Early Warning Alerts = +3.08%

Active Trend Trading’s Yearly Objectives:

- Yearly Return of 40%

- 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated at the beginning of each month.

Outs & Ins: No new debuts to the IBD 50 this weekend. Between now and the end of July 56% of the current IBD 50 will report earnings. As we seen so far there have been some impressive earnings fireworks going in both direction so far this season. If you are in any of the IBD 50 stocks and do not have a significant profit margin of 10% or more think about taking some profits off the table or hedging with an option strategy like a covered call if you choose to hold over earnings!

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: It sure seems like the world is getting crazier and crazier! This past week I read a story about a man in Canada who was arrested and facing charges because he disagreed with a person’s point of view on a social media site. He didn’t call the person any derogatory names or threaten them with bodily harm, he just disagreed with their point of view. Apparently there is a law in this particular province that says if one person feels threatened by what another person says then a formal legal complaint can be filed and the person who disagrees arrested. What’s said doesn’t have to be a verbal threat just an opposite view of life that can wind a person up in the slammer. Perhaps I’m too much of a traditionalist who believes that learning from opposing views is a good thing and that folks should be free to have opposing view. Differences of view in the past added fabulous texture to life. There are lots of folks who don’t agree with me but I’m not going to feel threatened by a disagreeing views unless they say they’re going to take action to harm me or my family.

Perhaps we place too much energy into our self-absorbed points of view and not enough energy into giving others space to agree or disagree. I want to truly understand other points of view—it adds to the texture of my life! May not agree but I will be richer for it.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.