July 15, 2018

Good Day Traders,

Currently neither Gold or Oil are finding seasonal traction to the upside. Remember that seasonal traits are tendencies which reflect past historical price action. Patterns tend to repeat but vary each year.

This week is monthly option expiration week. There is an upside bias going into the end of the week with Thursday and Friday moving higher in most cases. Add in the beginning of earnings and this could be a very interesting week. NFLX provides an excellent example of what can happen during earnings. We shall see if today’s price action on NFLX turns out to be an good buying opportunity!

Trend Trading Tips: Plan your Trades and Trade your Plan. Easy to say sometimes not so easy to do. This is especially true when a trader fails to have intimate knowledge of their trading plan! Like all relationships a trader must spend time with their plan outside of normal market hours. This time spent practicing and so entries and exits become so ingrained action is crucial to long term trading success. If you are using a mechanical manual system, your responsive action must become highly conditioned skill. If a trader thinks their natural ability needs no refining they are fooling themselves. When they get into the lethal trading environment the success they achieve will most likely only be to serve as just another casualty! Practice, Practice, Practice and then Practice some more!

You will never be an extra-ordinary trader until you are willing to do what the ordinary trader won’t do!

Bounce Zones for Premium Members: If you are a premium member some very powerful conditional order setup information will soon be available to complement the “Go-No Go” Table each week. Chart showing zones where traders can expect prices to bounce due to supply and demand pressures. What does this mean for Premium members? Charts of our ETFs and Core Stocks with define Bounce Zones will empower you to place conditional orders around these areas for both entry and planned exits. This will be one more way Active Trend Trading will help Premium Traders with limit time for market analysis. Stay tuned for more on this beneficial feature!

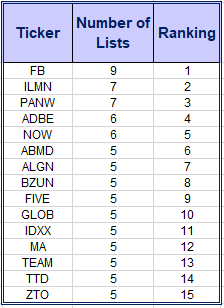

Remember to register for the After Market Monday and Making Money Trading Stocks and ETFs each week. In these webinars I will provide 10-12 stock set ups per year. All Levels of ATTS members will receive these trade email alerts. The NEW Composite Watch List provides a sort of all stocks that appeared on multiple Premium IBD Watch Lists this week. Often appearing on multiple list is a sign of strength and identifies a strong long term candidate. New Composite List Provided Below!

Register here to not miss the BONUS Trades or the ATTS Webinar Invitation list: https://forms.aweber.com/form/33/1084761733.htm

Running List, Strongest Fundamental stocks on the IBD 50 and the NEW Composite List of Stocks showing up on multiple IBD Watch List on June 30th.

Running List: 144 stocks are on the 2018 Running list. Major swap out this week. Find the list here: Running 7-14

When the new IBD 50 list comes out twice per week I conduct a fundamental sort which results in the top fundamental IBD 50 stocks being identified. The top fundamental stocks for this week are: LGND, GRUB, ABMD & PLNT This sort is provided at: 7-14 Sorted

A new addition to the weekly watch lists for Active Trend Traders is a Composite List of IPOs and Growth Stocks appearing on multiple IBD watch list each weekend. When a stock appears on multiple Premium Lists it can potentially be an indication of excellent strength. The stocks on the weekly Composite List may not be at a sound trigger point but may be worth watching for future entries. I will do an analysis of the list looking for price near potential triggers. Stocks near potential triggers will be highlighted. The top stocks appearing on more than one IBD watch list last week are shown in the table below. The Composite List for this week: Composite 7-14