Good Day Traders,

Thanks for all the great comments about the ATTS service and the “How to Make Money Trading Stocks” webinar that blast out every Friday at 10 a.m. Pacific. Please let others know about this great webinar! You can either join live or catch the replay on YouTube.

Here’s the link for next Friday’s Show: https://attendee.gotowebinar.com/register/761897053742825474

For Premium Members our Wednesday evening training is developing some fantastic traders!

Mid-Week Market Sanity Check Topic: Refining Your Routine

_____________________________________________________

General Market Observation: I read a very interesting piece this weekend from David Stockman about the current market bubble. The essence of the article was that the market is being pushed higher on false hope and that eventually the reality of an overpriced market will hit and the drop will be substantial. Last week’s market action was weak but still within simple pullback criteria for an up trending market. Many are still touting the buy the dip strategy and this will continue to work until it doesn’t. Have you noticed that magnitude of the runs after the dips are getting smaller? I believe the charts are telling us to look more towards a buy support sell resistance strategy if you choose to play in these swirling waters.

SPX: The S&P looked a bit like a yo-yo last week as support at the 50 day EMA was tested and then a rebound to test the down trending resistance (flag) line took place. Price action on Friday was down but still within the big selloff candle from Tuesday. This index did not seem as resilient to the bad news of shrinking GDP and other weakening economic indicators as it has demonstrated in the past few months.

In one of my accounts I have bought the Jan 2017 SPY 210P leap with the expectation that sometime within the next 19 months there will be a significant correction. In the interim I’m selling weekly put premium against this position paying down the cost basis. I’ll be introducing this trade to Premium members this week.

Preferred ETF’s: SPY and SPXL

NDX: Price action on the NASDAQ 100 looks like a potential double top like pattern. With a successful test of resistance at 4550 and drop, this level becomes the line of demarcation for continuing the uptrend. While the moving averages on the daily chart are aligned for more upside, the weekly chart continues to weaken. Trade support and resistance bounces as the battle between the bulls and bears plays out.

Preferred ETF’s: QQQ and TQQQ

RUT: If we consider the Russell as the purest of the indexes for actually showing true market sentiment then the week has added credence that more downside is coming. Price appears to now be working with in a down trending channel and if it fulfills to the downside could see a slip in price to below the 1200 level. It appears that the 50 day EMA and 100 day moving averages will serve as support but if a significant negative catalyst appears these levels could be broken quickly down to the 1211 level.

The weekly chart provided a long legged bearish harami just at the 8 week EMA. While these RUT charts are continuing to grow in weakness, I would be remiss not to mention that thus far any downside momentum has met with buyers. The current situation could be just another repeat. As said earlier the strategy of buying the dips remains in effect until it doesn’t work!

Preferred ETF’s: IWM and TNA

_____________________________________________

The Early Warning Alert Service has hit all three major market trading point this year. See this brief update video for more details: https://youtu.be/PRLmPQLHjiI

If simplifying your life by trading along with us using the index ETF is of interest you can get the full background video at: https://activetrendtrading.com/etf-early-warning-alerts-video/

The How to Make Money Trading Stock Show—Free Webinar every Friday at 10 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

The “How to Make Money Trading Stocks” Show is back this Friday, June 5th

Ensure you get a seat by registering now at:

https://attendee.gotowebinar.com/register/761897053742825474

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/channel/UCLK-GdCSCGTo5IN2hvuDP0w

The Active Trend Trader Affiliate Program is ready. For more information or to become an Affiliate please register here: https://activetrendtrading.com/affiliates-sign-up-and-login/

______________________________________________________________

ATTS Returns for 2015 through May 31, 2015

Margin Account: 38.5% Invested

Margin Account = +2.5% (Open and Closed Positions)

Early Warning Alerts = +5.32%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated at the beginning of each month.

___________________________________________________________

For our all Active Trend Trading Members here’s how we utilize our trading capital

Trading Capital Setup and Position Sizing: Every year we start the year off trading a $100K margin account make the math really easy for yearly returns.

- Each trader must define their own trading capital in order to properly size trade positions to their own risk tolerance level!

- The $100K account is split between up to 4 stocks and a leveraged Index ETF. Actual number of shares will vary of course depending on price of the entity traded. We have found that limiting open positions to only 5 entities greatly reduces the trade management time requirements for members. This goes back to our goals of providing a system designed for members who work full time.

- Regardless of market conditions no more than 50% of available margin is used at any time.

- Each Trade is split 50-50 between Income Generating & Capital Growth Objectives unless specified in the Order Alert

- Naked Puts or short term options strategies will be used occasionally for Income Generating Positions

- None of the trade setups are a recommendation to trade only notification of planned trades from set ups using the Active Trend Trading System. Each trader is responsible for establishing their own appropriate risk level on every trade.

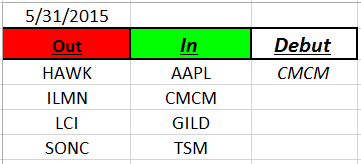

Outs & Ins: Not much shake up in the IBD 50 this weekend. CMCM makes its debut and actually may be in the process of pulling back for a potential entry action point.

The big news for the week will be AMBA reporting earnings on June 2 AMC. Will AMBA’s winning ways continue? Price is extended so any disappointment from the earnings report may lead to a drop in this strong stock.

Comments and opinions written below this line of text may be provocative and only obliquely related to trading. Some may find these “Off the Wall” comments challenging to their outlook on life. I will not post any comments made on subject matter below this line, so if you disagree blast away.

OFF THE WALL

Off the Wall: Searching, searching, searching! Often when we start to trade stocks we get stuck in a rut of constantly searching for the perfect system. It is almost as if the search is more important than learning to trade well. There is no perfect system. Each system has its pros and cons. But if it has an acceptable track record then learning the ends and outs of the system is important. I whole heartedly support and practice refining a system along with continuing to learn trading. The one reason I believe many would be great traders repeatedly throw the baby out with the bath water regarding trading systems is that each system requires work to learn the system. I’ve seen too many traders get to the verge of success and bail out. Then there’s the diligence and discipline required to hang tough learning to let the system works. If a system is based on solid rules then over time it will be successful.

There is an additional aspect that many fledgling traders are not aware of and that has to do with how trading actually pays a traders. It’s more like how a commission salesperson gets paid. Some months are great and the paycheck is big and other months the paycheck is non-existent. For a given year a trader will typically have a few great months coupled with months may even loose a little. This is primarily a factor in just trading straight long positions.

Some traders have learned other strategies that help maintain a more stable monthly income but that takes additional learning and diligence. In the month of June Active Trend Trading will allocate a small portion of our trading capital to this type of trade and will share the how’s with members who are interested.

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks!