Good Day Traders,

Overview & Highlights: Due to modification on the website by WordPress, spreadsheet files can no longer be uploaded. Moving forward the “Running List” and current “Premium List” will be provided as an attachment in the On the Radar and Trader’s Report weekly.

Tonight, President Trump address Congress and the Senate. We shall see if this provides any catalyst for tomorrow’s market.

I hope all members have seen some of the live Facebook broadcast. If you want notification of when these live market updates take place, please follow Active Trend Trading at: https://www.facebook.com/ActiveTrendTrading/

Upcoming Webinars: At Active Trend Trading we offer three webinars per week to provide training plus trade and market updates. See the schedule below for the next webinars.

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, March 3rd

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/385843200414302723

Time 11:00 a.m. PDT

Next Training Webinar: March 1st

For Premium Members, our Wednesday evening training is developing some fantastic traders

Topic: Early Warning Updates

** Friday’s “Final Hour”: March 3rd **

Time 12:00 p.m. PDT

For Premium Members, provides trades and set ups during the final hour of weekly trading.

General Market Observation: The Dow dropped a bit today after 12 straight days up. While we don’t know if this marks a top or not, each of the Indexes do have something in common. Each Index shows daily TSI that has rolled over and in some cases crossed. This does not mean the top is in but it may mean that upside price action may be muted. For the 3 Tracking Indexes the Russell (RUT) is the weakest of the three. SPX and NDX are both holding up.

As seen on the SPX chart below, the reaction to the last thrust up has been a sideways move over the past 6 days. The uptrend remains intact so waiting for pullbacks would be in order. The most recent TSI rollovers have led to pullbacks resulting in buy opportunities. On should continue to plan to buy pullbacks until they stop working.

NDX similar action to SPX. The RUT is showing the most significant weakness. The breakout above 1392 has now been voided. Today’s price action closed below the 20 day EMA. Today was the largest down day in several months. Above average moves either up or down can telegraph a change in trend.

As I’ve said over the past few weeks, a weakening along the line so the historic post-election seasonality may still happen in March rather than February. If the growth objectives of the new administration appear to be bogging down may be the catalyst for more significant downside.

SPX: Downside Market Short the SPY, SPY Puts or SPXU.

Preferred Long ETF’s: SPY, UPRO and SPXL

NDX: Downside Market Short the QQQ, QQQ Puts or SQQQ.

Preferred Long ETF’s: QQQ and TQQQ

RUT: Downside Market Short the IWM, IWM Puts or TZA.

Preferred Long ETF’s: IWM and TNA

The How to Make Money Trading Stock Show—Free Webinar every Friday at 11:00 a.m. PDT. This weekly live and recorded webinar helped traders find great stocks and ETF’s to trade with excellent timing and helped them stay out of the market during times of weakness.

How to Make Money Trading Stocks on Friday, March 3rd

Register now for the next live webinar at the link below:

Register Here: https://attendee.gotowebinar.com/register/385843200414302723

Time 11:00 a.m. PDT

To get notifications of the newly recorded and posted How to Make Money Trading Stocks every week subscribe at the Market Tech Talk Channel: https://www.youtube.com/c/MarketTechTalk

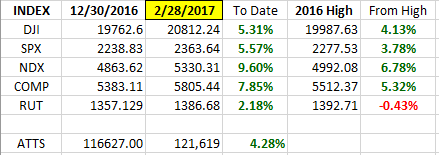

Index Returns 2017 YTD

ATTS Returns for 2017 YTD Closed Trades

Percent invested initial $116.6K account: Strategies I & II invested at 1%; Strategy III invested at 26.6%.

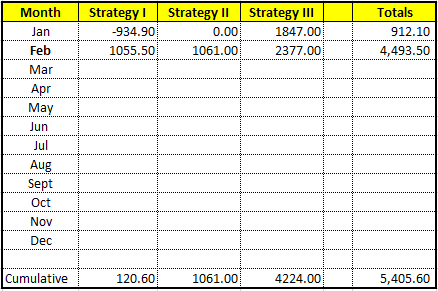

Current Strategy Performance YTD (Closed Trades)

Strategy I: Up $120.60

Strategy II: Up $1061.00

Strategy III: Up $4224.00

Cumulative YTD: 4.6%

Active Trend Trading’s Yearly Objectives:

– Yearly Return of 40%

– 60% Winning Trades

– Early Warning Alert Target Yearly Return = 15% or better

For a complete view of specific trades closed visit the website at: https://activetrendtrading.com/current-positions/

Updated first full week of each month. The next update after first week in March

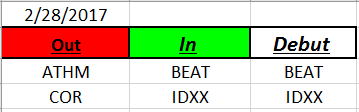

Outs & Ins: BEAT and IDXX make their debut on the IBD 50 mid-week. Only BEAT is in the process of pulling back.

The fundamental sort resulted in AEIS, ESNT and THO on top of the other 50 stocks. Keep an eye on NVDA. While it was hit hard last week it still rates as the 2nd place stock on the IBD 50. We shall see if things turn around!

Share Your Success: Many of you have sent me notes regarding the success you are having with the Active Trend Trading System. Please send your stories to me at dww@activetrendtrading.com or leave a post on the website. Thanks.